Instructions 1040 a Form 2016

What is the Instructions 1040 A Form

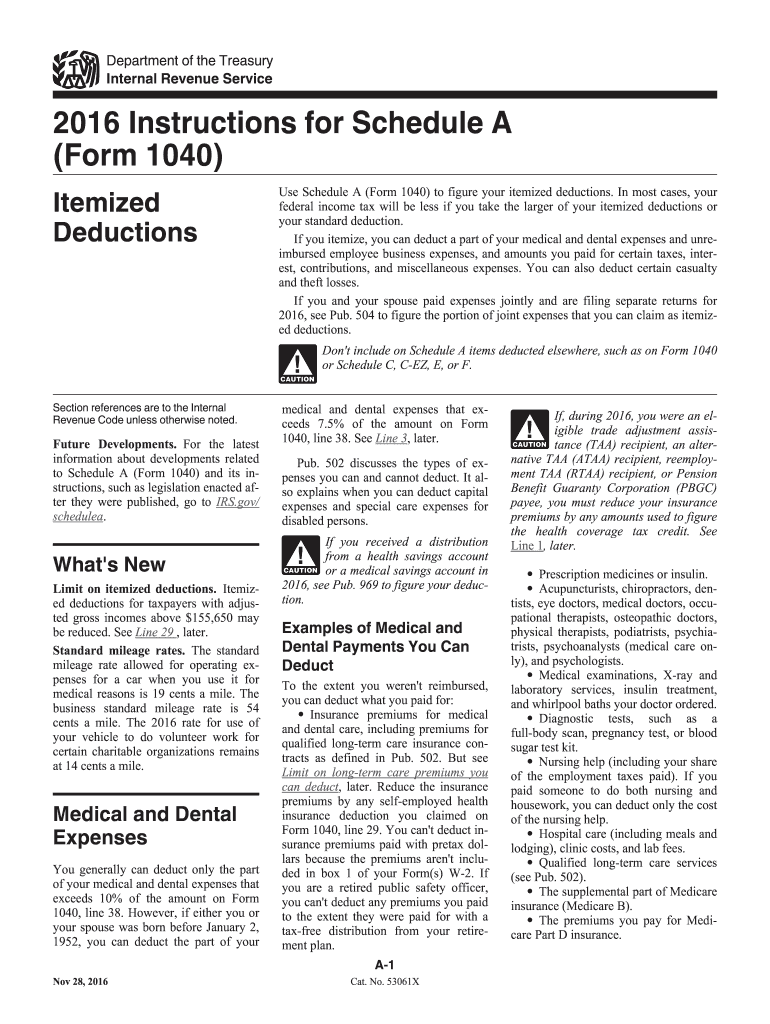

The Instructions 1040 A Form is a simplified guide provided by the Internal Revenue Service (IRS) for individuals filing their federal income tax returns using the 1040 A form. This form is designed for taxpayers with straightforward tax situations, allowing them to report income, claim deductions, and calculate their tax liability in a more streamlined manner than the standard 1040 form. The 1040 A form is typically used by those who do not itemize deductions and meet specific eligibility criteria, such as income limits and filing statuses.

How to use the Instructions 1040 A Form

Using the Instructions 1040 A Form involves several steps to ensure accurate completion of your tax return. First, review the eligibility criteria to confirm that you qualify to use the 1040 A form. Next, gather all necessary documents, including W-2s, 1099s, and any other income statements. Follow the instructions carefully, filling out each section of the form as directed. It is essential to double-check your entries for accuracy and completeness before submission. If you are claiming any credits or deductions, ensure you have the required documentation to support your claims.

Steps to complete the Instructions 1040 A Form

Completing the Instructions 1040 A Form involves a systematic approach:

- Step one: Gather all relevant financial documents, including income statements and records of any deductions.

- Step two: Review the instructions thoroughly to understand the requirements and eligibility.

- Step three: Fill out the form, starting with personal information such as your name, address, and Social Security number.

- Step four: Report your income, including wages, interest, and dividends, in the appropriate sections.

- Step five: Claim any deductions and credits you qualify for, ensuring you have the necessary documentation.

- Step six: Review the completed form for accuracy and sign it before submission.

Legal use of the Instructions 1040 A Form

The Instructions 1040 A Form is legally binding when completed and submitted in accordance with IRS regulations. It is essential to provide accurate information, as any discrepancies may lead to penalties or audits. The form must be signed and dated by the taxpayer, affirming that the information provided is true and correct to the best of their knowledge. Electronic filing options are available, which also comply with legal standards for electronic signatures, ensuring that your submission is both secure and valid.

Filing Deadlines / Important Dates

Taxpayers must adhere to specific deadlines when filing the Instructions 1040 A Form. The standard deadline for submitting your federal income tax return is typically April 15 each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers who require more time can file for an extension, which allows for an additional six months to submit the return, although any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the Instructions 1040 A Form accurately, several documents are required. These typically include:

- W-2 forms from employers, detailing wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of deductible expenses, such as mortgage interest or educational expenses.

- Social Security numbers for all dependents claimed on the return.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS regulations.

Quick guide on how to complete 2016 instructions 1040 a form

Effortlessly Prepare Instructions 1040 A Form on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Instructions 1040 A Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Instructions 1040 A Form Without Stress

- Locate Instructions 1040 A Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign function, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions 1040 A Form and ensure exceptional communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 instructions 1040 a form

Create this form in 5 minutes!

How to create an eSignature for the 2016 instructions 1040 a form

How to generate an electronic signature for the 2016 Instructions 1040 A Form online

How to make an eSignature for your 2016 Instructions 1040 A Form in Google Chrome

How to generate an electronic signature for putting it on the 2016 Instructions 1040 A Form in Gmail

How to create an electronic signature for the 2016 Instructions 1040 A Form straight from your smartphone

How to make an electronic signature for the 2016 Instructions 1040 A Form on iOS

How to generate an eSignature for the 2016 Instructions 1040 A Form on Android devices

People also ask

-

What are the Instructions 1040 A Form for tax filing?

The Instructions 1040 A Form provide detailed guidance on how to fill out the simplified tax return form for individuals. This document outlines eligibility requirements, necessary schedules, and step-by-step processes to ensure accurate tax reporting. By following the Instructions 1040 A Form, taxpayers can maximize their deductions and credits.

-

How can airSlate SignNow assist with filling out the Instructions 1040 A Form?

AirSlate SignNow offers an intuitive platform that allows users to fill out and eSign the Instructions 1040 A Form easily. With our user-friendly interface, you can complete your tax documents online, ensuring accuracy and compliance. This makes tax season stress-free and efficient.

-

Are there any costs associated with using airSlate SignNow for the Instructions 1040 A Form?

Yes, airSlate SignNow offers various pricing plans to cater to your needs, starting with a free trial for new users. Depending on the plan you choose, you can access features specifically designed for preparing and signing the Instructions 1040 A Form. Our cost-effective solution ensures that you get the best value for your document management needs.

-

What features does airSlate SignNow offer for the Instructions 1040 A Form?

AirSlate SignNow includes features like eSignatures, document templates, and secure cloud storage, making it ideal for completing the Instructions 1040 A Form. You can easily collaborate with tax professionals, track document status, and ensure compliance with IRS regulations. These features streamline the tax preparation process.

-

Can I integrate airSlate SignNow with other software for the Instructions 1040 A Form?

Yes, airSlate SignNow seamlessly integrates with popular software such as Google Drive, Dropbox, and various accounting tools. This allows you to access your documents and the Instructions 1040 A Form from multiple platforms, enhancing your workflow. Integration ensures that all your tax-related documents are organized and easily accessible.

-

Is airSlate SignNow secure for handling the Instructions 1040 A Form?

Absolutely! AirSlate SignNow uses advanced encryption and security protocols to protect your sensitive information when handling the Instructions 1040 A Form. Our platform complies with industry standards to ensure your data remains confidential and secure throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for the Instructions 1040 A Form?

Using airSlate SignNow for the Instructions 1040 A Form simplifies the tax filing process by providing an efficient, secure, and user-friendly platform. The ability to eSign documents electronically saves time and reduces paperwork. Additionally, our solution helps you stay organized and compliant with tax regulations.

Get more for Instructions 1040 A Form

- Nc vehicle bill form

- Utah residential real estate sales disclosure statement form

- Land agreement form kenya pdf

- Kansas residential real estate sales disclosure statement form

- Maryland legal last will and testament form for divorced person not remarried with adult children

- Promissory note format pdf

- North carolina articles of organization for domestic limited liability company llc form

- Bill of sale tulsa ok form

Find out other Instructions 1040 A Form

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement