About Schedule a Form 1040 or 1040 SR, Itemized 2020

Overview of Schedule A Form 1040

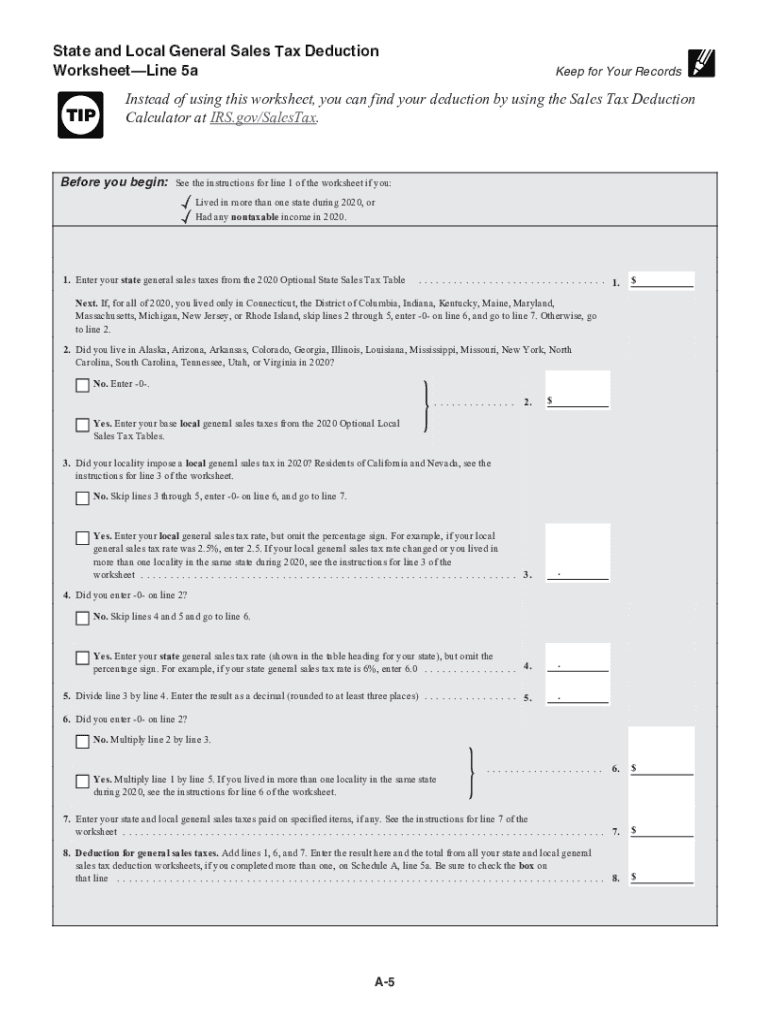

The Schedule A Form 1040, also known as the Itemized Deductions form, allows taxpayers to detail their eligible deductions to potentially reduce their taxable income. This form is essential for individuals who choose to itemize rather than take the standard deduction. Common deductions include mortgage interest, state and local taxes, medical expenses, and charitable contributions. Understanding the components of this form is crucial for maximizing tax benefits.

Steps to Complete Schedule A Form 1040

Completing the Schedule A Form 1040 involves several key steps:

- Gather all necessary documentation, including receipts and records for deductible expenses.

- Fill in your personal information at the top of the form, including your name and Social Security number.

- Enter the amounts for each category of deduction, ensuring that you adhere to IRS guidelines for eligibility.

- Calculate the total of your itemized deductions and transfer this amount to your Form 1040.

Each section of the form requires careful attention to detail to ensure accuracy and compliance with IRS regulations.

IRS Guidelines for Schedule A Form 1040

The IRS provides specific guidelines for completing the Schedule A Form 1040. Taxpayers should refer to the latest IRS instructions for detailed information on what qualifies as a deductible expense. It is important to keep thorough records of all expenses claimed, as the IRS may require documentation to substantiate deductions. Additionally, certain limitations may apply based on income levels and filing status.

Required Documents for Schedule A Form 1040

To complete the Schedule A Form 1040 accurately, taxpayers need to gather various documents, including:

- Receipts for medical and dental expenses.

- Records of mortgage interest paid.

- Documentation of state and local taxes.

- Proof of charitable contributions.

- Any other relevant financial statements that support itemized deductions.

Having these documents organized will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Filing Deadlines for Schedule A Form 1040

Taxpayers must adhere to specific filing deadlines when submitting the Schedule A Form 1040. The standard deadline for individual tax returns is typically April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates regarding filing deadlines, especially for extensions or changes in tax law.

Digital vs. Paper Version of Schedule A Form 1040

Taxpayers can choose between filing the Schedule A Form 1040 digitally or submitting a paper version. Filing electronically often streamlines the process, reduces errors, and allows for quicker refunds. Many tax preparation software programs, including those compatible with Schedule A, provide guided assistance. On the other hand, some individuals may prefer the traditional paper method, which requires mailing the completed form to the IRS.

Common Scenarios for Using Schedule A Form 1040

Different taxpayer scenarios may influence the decision to use the Schedule A Form 1040. For instance:

- Self-employed individuals may have additional business-related deductions.

- Homeowners often benefit from mortgage interest deductions.

- Individuals with significant medical expenses may find itemizing advantageous.

Understanding how personal circumstances affect eligibility for deductions can help taxpayers make informed decisions about their filing options.

Quick guide on how to complete about schedule a form 1040 or 1040 sr itemized

Finish About Schedule A Form 1040 Or 1040 SR, Itemized effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle About Schedule A Form 1040 Or 1040 SR, Itemized on any platform using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to edit and eSign About Schedule A Form 1040 Or 1040 SR, Itemized with ease

- Find About Schedule A Form 1040 Or 1040 SR, Itemized and click on Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign About Schedule A Form 1040 Or 1040 SR, Itemized and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule a form 1040 or 1040 sr itemized

Create this form in 5 minutes!

How to create an eSignature for the about schedule a form 1040 or 1040 sr itemized

The best way to generate an electronic signature for a PDF online

The best way to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your smartphone

The way to make an eSignature for a PDF on iOS

How to make an eSignature for a PDF document on Android

People also ask

-

What are the basic instructions 1040 schedule requirements?

The instructions 1040 schedule provide guidelines for reporting various types of income and deductions on your tax return. It includes information on how to fill out the appropriate forms, including necessary schedules based on your financial activities. Understanding these instructions is essential for accurate tax filing.

-

How can I access the instructions 1040 schedule using airSlate SignNow?

You can easily access the instructions 1040 schedule documents through airSlate SignNow's user-friendly platform. Simply upload your tax forms and our system will guide you through the signing and e-signing process. This ensures you have the latest forms and instructions at your fingertips.

-

What is the pricing model for using airSlate SignNow for electronic signatures?

airSlate SignNow offers competitive pricing plans that cater to individual users and businesses. Our plans include features that simplify accessing instructions 1040 schedule and other documents. Consider trying our free trial to see how effective and cost-efficient our solution can be for your tax documentation needs.

-

Can I integrate airSlate SignNow with other tax software to access instructions 1040 schedule?

Yes, airSlate SignNow supports integrations with various tax software platforms, allowing you to access instructions 1040 schedule seamlessly. This means you can eSign documents while staying within your preferred tax software system, making the filing process much smoother and more efficient.

-

What benefits does airSlate SignNow offer for handling instructions 1040 schedule?

Using airSlate SignNow for your instructions 1040 schedule provides numerous benefits, including the ability to eSign documents securely and promptly. Our platform also helps manage your paperwork efficiently, minimizing errors and ensuring compliance with IRS requirements. This can save you valuable time during tax season.

-

Is airSlate SignNow secure for handling tax-related documents like instructions 1040 schedule?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the instructions 1040 schedule. We employ advanced encryption and security protocols to ensure that your sensitive tax information remains confidential and protected.

-

What types of documents can I sign related to instructions 1040 schedule?

With airSlate SignNow, you can sign a variety of documents related to instructions 1040 schedule including tax return forms, schedules, and any supporting documents required by the IRS. Our platform provides templates and guidance to ensure you can complete your filing accurately and efficiently.

Get more for About Schedule A Form 1040 Or 1040 SR, Itemized

- Discovery interrogatories from defendant to plaintiff with production requests wyoming form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant wyoming form

- Quitclaim deed two individuals or husband and wife to limited partnership wyoming form

- Quitclaim deed trust as grantor to husband and wife as grantees wyoming form

- Quitclaim deed from husband and wife to a trust wyoming form

- Quitclaim deed two individuals to one individual wyoming form

- Quitclaim deed from three 3 individuals to an llc wyoming form

- Wyoming disabled form

Find out other About Schedule A Form 1040 Or 1040 SR, Itemized

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy