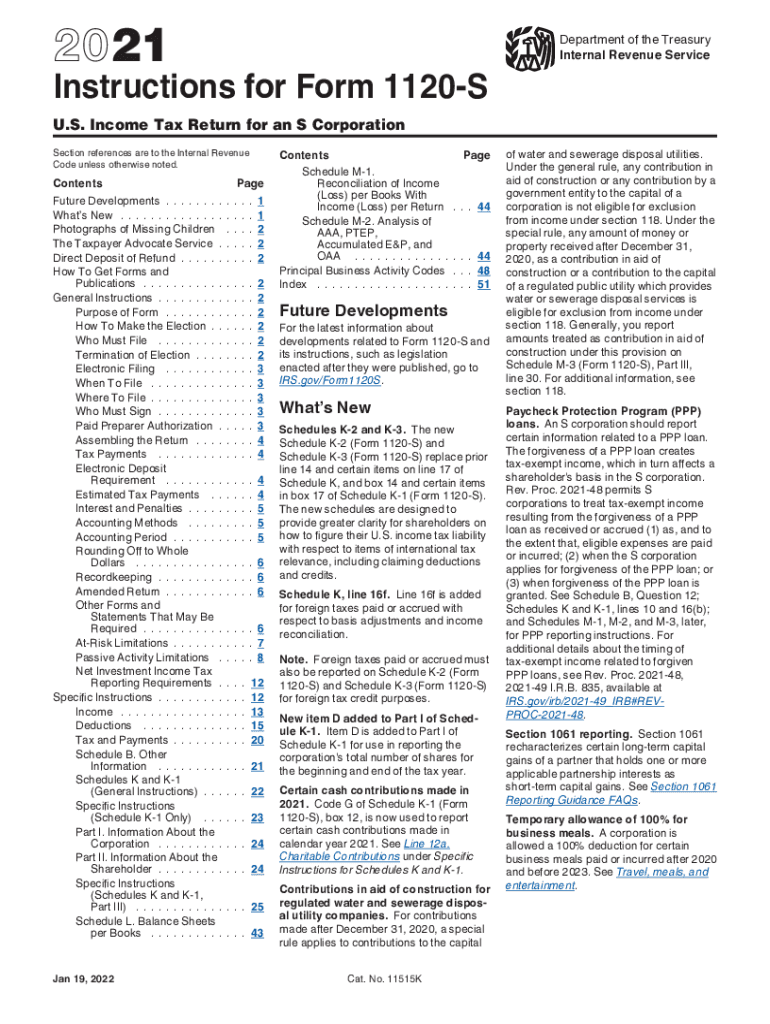

1120S FORM PDF 1120 S Form Department of the Treasury 2021

What is the 1120S Form?

The 1120S form, officially known as the U.S. Income Tax Return for an S Corporation, is a tax document used by S corporations to report income, gains, losses, deductions, and credits. This form is essential for S corporations, which are special types of corporations that pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The form is filed annually with the Internal Revenue Service (IRS) and is crucial for ensuring compliance with federal tax regulations.

Steps to Complete the 1120S Form

Filling out the 1120S form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and any relevant deductions. Next, follow these steps:

- Provide basic information about the S corporation, including its name, address, and Employer Identification Number (EIN).

- Report income and deductions on the appropriate lines, ensuring all figures are accurate and correspond to your financial records.

- Calculate the corporation's taxable income and any applicable tax credits.

- Complete the signature section, ensuring that an authorized officer of the corporation signs the form.

After completing the form, review it thoroughly for any errors before submission.

Filing Deadlines for the 1120S Form

The deadline for filing the 1120S form is typically March 15 of the year following the tax year in question. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for S corporations to adhere to this deadline to avoid penalties and ensure timely processing of their tax returns. Additionally, if an extension is needed, Form 7004 can be filed to request an automatic six-month extension.

Required Documents for the 1120S Form

To complete the 1120S form accurately, several documents are required. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income received during the tax year.

- Documentation for any deductions claimed, such as receipts and invoices.

- Previous year’s tax return for reference.

Having these documents organized and readily available can streamline the completion of the form and help ensure compliance with IRS regulations.

Legal Use of the 1120S Form

The 1120S form must be used in accordance with IRS guidelines to ensure its legal validity. This includes accurately reporting all income and deductions and ensuring that the form is signed by an authorized representative of the S corporation. Filing the form correctly helps maintain the S corporation's status and avoids potential penalties or loss of tax benefits. Compliance with all applicable tax laws and regulations is essential for the legal standing of the S corporation.

Digital vs. Paper Version of the 1120S Form

Filing the 1120S form can be done either digitally or via paper submission. The digital version, often filed through tax software, offers benefits such as automatic calculations and easier error checking. Additionally, electronic filing can expedite processing times and provide immediate confirmation of receipt. On the other hand, paper submissions may take longer to process and require careful attention to detail to avoid errors. Choosing between digital and paper filing depends on the corporation's preferences and capabilities.

Quick guide on how to complete 1120s formpdf 1120 s form department of the treasury

Complete 1120S FORM PDF 1120 S Form Department Of The Treasury effortlessly on any gadget

Digital document management has become favored among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources needed to generate, modify, and eSign your documents swiftly without any holdups. Manage 1120S FORM PDF 1120 S Form Department Of The Treasury on any gadget using airSlate SignNow’s Android or iOS applications and simplify any document-related workflow today.

How to modify and eSign 1120S FORM PDF 1120 S Form Department Of The Treasury effortlessly

- Locate 1120S FORM PDF 1120 S Form Department Of The Treasury and then click Get Form to begin.

- Leverage the resources we provide to complete your document.

- Emphasize important segments of your documents or obscure sensitive data with tools that airSlate SignNow specially offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device you choose. Modify and eSign 1120S FORM PDF 1120 S Form Department Of The Treasury and guarantee top-notch communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1120s formpdf 1120 s form department of the treasury

Create this form in 5 minutes!

How to create an eSignature for the 1120s formpdf 1120 s form department of the treasury

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an e-signature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What are the form 1120s 2019 instructions for filing?

The form 1120S 2019 instructions detail how S corporations should report their income, deductions, and credits. It's important to accurately follow these instructions to avoid penalties and ensure compliance with tax regulations. This includes information on necessary schedules and required supporting documentation.

-

How can airSlate SignNow help with form 1120s 2019 instructions?

airSlate SignNow simplifies the process of eSigning and sending documents related to form 1120S 2019 instructions. By using our platform, you can streamline the workflow for collecting signatures, ensuring faster submissions. This enhances your efficiency, making tax season less stressful.

-

Are there any fees associated with using airSlate SignNow for form 1120s 2019 instructions?

airSlate SignNow offers competitive pricing plans tailored to different business needs. You can choose from various subscription tiers, all designed to provide value when handling documents related to form 1120S 2019 instructions. A free trial is often available, allowing you to test features before committing.

-

What features does airSlate SignNow offer for managing form 1120s 2019 instructions?

airSlate SignNow provides features like document templates, team collaboration tools, and secure cloud storage to effectively manage form 1120S 2019 instructions. These tools help ensure that all necessary paperwork is organized and readily accessible. Additionally, real-time tracking of document status enhances accountability.

-

Can I integrate airSlate SignNow with other software for form 1120s 2019 instructions?

Yes, airSlate SignNow integrates seamlessly with various software tools commonly used for tax preparation and accounting. This integration supports the efficient handling of form 1120S 2019 instructions, allowing you to connect with existing workflows. You can easily synchronize data and keep everything organized.

-

What benefits does using airSlate SignNow provide when handling form 1120s 2019 instructions?

Using airSlate SignNow for form 1120S 2019 instructions offers signNow benefits like improved efficiency, reduced turnaround time for signatures, and enhanced document security. The user-friendly interface makes it easy to create, send, and sign necessary paperwork. This ultimately helps your business save time and money.

-

Is airSlate SignNow secure for sending documents related to form 1120s 2019 instructions?

Absolutely, airSlate SignNow employs advanced security protocols to safeguard documents, including those related to form 1120S 2019 instructions. Our platform uses encryption and secure cloud storage to protect sensitive information. You can trust that your documents are handled with the utmost care.

Get more for 1120S FORM PDF 1120 S Form Department Of The Treasury

- Motion in municipal court for continuance of a trial regarding a misdemeanor mississippi form

- Motion drug testing form

- Mississippi guardian form

- Bill of sale of automobile and odometer statement mississippi form

- Bill of sale for automobile or vehicle including odometer statement and promissory note mississippi form

- Promissory note in connection with sale of vehicle or automobile mississippi form

- Bill of sale for watercraft or boat mississippi form

- Bill of sale of automobile and odometer statement for as is sale mississippi form

Find out other 1120S FORM PDF 1120 S Form Department Of The Treasury

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter