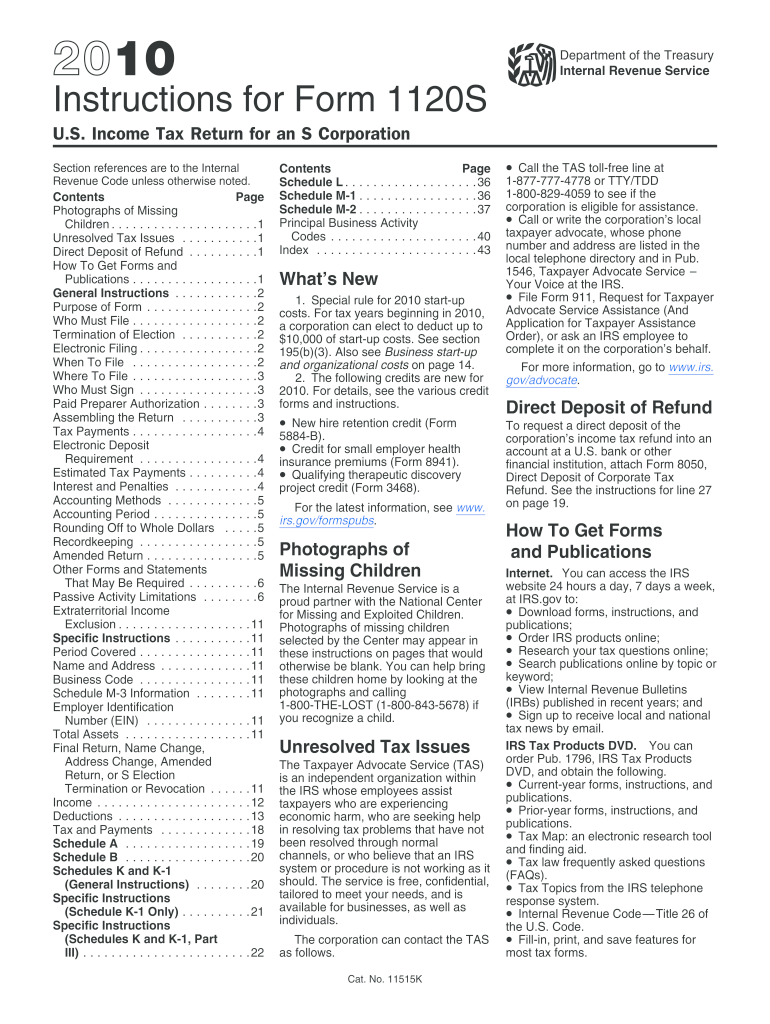

I1120s Form 2010

What is the I1120s Form

The I1120s Form is a tax document used by S corporations in the United States to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for S corporations, as it allows them to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The I1120s Form is typically filed annually and is crucial for maintaining compliance with tax regulations.

How to use the I1120s Form

Using the I1120s Form involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial records, including income statements, expense reports, and any relevant documentation. Next, complete the form by entering your corporation's income, deductions, and credits in the appropriate sections. It is important to ensure that all figures are accurate and reflect your corporation's financial status for the tax year. Finally, submit the completed form to the IRS by the designated deadline, ensuring that you retain copies for your records.

Steps to complete the I1120s Form

Completing the I1120s Form involves a systematic approach:

- Gather financial documents: Collect all necessary financial records, including profit and loss statements, balance sheets, and any other relevant documentation.

- Fill out the form: Begin entering your corporation's income, deductions, and credits in the designated sections of the form.

- Review for accuracy: Double-check all entries to ensure that they are accurate and reflect your corporation's financial situation.

- Sign and date: Ensure that the form is signed by an authorized officer of the corporation and dated appropriately.

- Submit the form: File the completed form with the IRS by the deadline, either electronically or via mail.

Filing Deadlines / Important Dates

The filing deadline for the I1120s Form typically falls on the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is important for S corporations to be aware of these deadlines to avoid penalties and ensure compliance with tax regulations.

Legal use of the I1120s Form

The I1120s Form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all income, deductions, and credits, as well as adhering to the specific requirements for S corporations. Failure to comply with these regulations can result in penalties, including fines and potential loss of S corporation status. It is advisable for corporations to consult with a tax professional to ensure that they are using the form correctly and in compliance with all applicable laws.

Required Documents

To complete the I1120s Form, several documents are typically required, including:

- Income statements: Detailed records of all income received by the corporation during the tax year.

- Expense reports: Documentation of all business expenses incurred, including operating costs, salaries, and other deductions.

- Shareholder information: Records of all shareholders, including their ownership percentages and any distributions made during the year.

- Prior year tax returns: Previous I1120s Forms and any supporting documentation for reference.

Quick guide on how to complete 2010 i1120s form

Create I1120s Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage I1120s Form across any platform with airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to modify and eSign I1120s Form with ease

- Find I1120s Form and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Mark signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign I1120s Form to ensure outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 i1120s form

Create this form in 5 minutes!

How to create an eSignature for the 2010 i1120s form

The way to make an electronic signature for your PDF file in the online mode

The way to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is the I1120s Form and why is it important?

The I1120s Form is a tax return specifically designed for S corporations in the United States. It is crucial for reporting income, deductions, and credits, ensuring compliance with IRS regulations. Completing the I1120s Form accurately helps businesses maximize tax benefits and minimize liabilities.

-

How does airSlate SignNow help with the I1120s Form?

airSlate SignNow streamlines the process of completing and eSigning the I1120s Form, providing an intuitive and user-friendly interface. Our platform enables secure document sharing and eSigning, reducing the time spent on paperwork. This efficiency ensures that your I1120s Form is submitted promptly and accurately.

-

Does airSlate SignNow integrate with accounting software for managing the I1120s Form?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, allowing you to manage the I1120s Form efficiently. With these integrations, you can easily import data and electronic signatures directly into your tax documents. This connection simplifies the filing process, ensuring accuracy and compliance.

-

What are the pricing options for using airSlate SignNow to manage the I1120s Form?

airSlate SignNow offers competitive pricing plans tailored to different business needs when managing the I1120s Form. Our plans are designed to be cost-effective while providing you with essential features such as eSigning and document management. Check our pricing page for detailed information on the best plan for your requirements.

-

Can I use airSlate SignNow on mobile devices for the I1120s Form?

Absolutely! airSlate SignNow is fully optimized for mobile devices, allowing you to manage your I1120s Form on the go. Whether you're using a smartphone or tablet, you can easily access, complete, and eSign your documents with just a few taps. This mobility enhances productivity, especially during tax season.

-

Is it secure to eSign the I1120s Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the I1120s Form. The platform employs advanced encryption and security protocols to protect sensitive information during transmission and storage. You can confidently eSign your documents knowing they are secure and compliant with industry standards.

-

What customer support options are available for I1120s Form queries?

airSlate SignNow provides comprehensive customer support for any questions related to the I1120s Form. Our support team is available through various channels, including email, live chat, and phone. We aim to assist you promptly, ensuring that you can navigate the eSigning process with ease.

Get more for I1120s Form

- Legal last will form for a widow or widower with no children iowa

- Legal last will and testament form for a widow or widower with adult and minor children iowa

- Legal last will and testament form for divorced and remarried person with mine yours and ours children iowa

- Legal last will and testament form with all property to trust called a pour over will iowa

- Written revocation of will iowa form

- Last will and testament for other persons iowa form

- Notice to beneficiaries of being named in will iowa form

- Estate planning questionnaire and worksheets iowa form

Find out other I1120s Form

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online