Irs Instructions Form 1120s 2017

What is the Irs Instructions Form 1120s

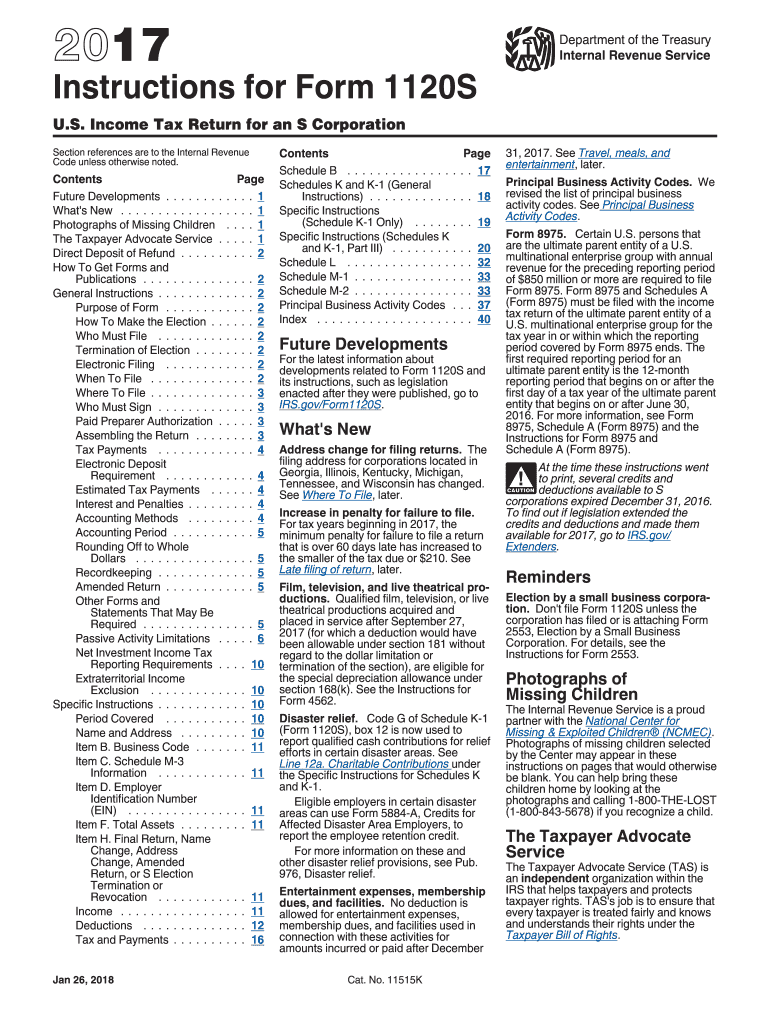

The Irs Instructions Form 1120S provides guidance for S corporations in the United States on how to complete Form 1120S, which is the U.S. Income Tax Return for an S Corporation. This form is essential for S corporations to report their income, deductions, and credits to the Internal Revenue Service (IRS). The instructions detail the necessary steps and requirements for accurately filing the form, ensuring compliance with federal tax laws.

How to use the Irs Instructions Form 1120s

To effectively use the Irs Instructions Form 1120S, start by reviewing the entire document to understand the requirements and guidelines. Follow the step-by-step instructions provided for each section of Form 1120S. Pay attention to specific details such as the types of income that need to be reported, allowable deductions, and credits. It is also important to gather all necessary documentation before beginning the form to ensure a smooth filing process.

Steps to complete the Irs Instructions Form 1120s

Completing the Irs Instructions Form 1120S involves several key steps:

- Gather all relevant financial documents, including income statements and expense records.

- Review the instructions to understand the specific requirements for each section of Form 1120S.

- Fill out the form accurately, ensuring all necessary information is included.

- Double-check calculations and entries for accuracy.

- Submit the completed form by the designated filing deadline, either electronically or by mail.

Legal use of the Irs Instructions Form 1120s

The Irs Instructions Form 1120S is legally binding when completed accurately and submitted to the IRS. It is crucial to use the most current version of the form and instructions to ensure compliance with tax regulations. Failing to adhere to these guidelines can lead to penalties or issues with the IRS. Always keep a copy of the submitted form and any supporting documents for your records.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Instructions Form 1120S are typically set for the fifteenth day of the third month after the end of the corporation's tax year. For S corporations operating on a calendar year, this means the form is due by March 15. If additional time is needed, S corporations can file for an extension, which allows for an additional six months to submit the form. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The Irs Instructions Form 1120S can be submitted in several ways. S corporations may choose to file electronically through IRS-approved e-filing software, which can streamline the process and reduce errors. Alternatively, the form can be mailed to the appropriate IRS address based on the corporation's location. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete irs instructions form 1120s 2017

Discover the simplest method to complete and sign your Irs Instructions Form 1120s

Are you still spending time preparing your official paperwork on physical copies instead of handling it online? airSlate SignNow offers a superior approach to finalize and sign your Irs Instructions Form 1120s and related forms for public services. Our intelligent eSignature solution provides everything needed to manage documents swiftly and in compliance with official standards - powerful PDF editing, organizing, securing, signing, and sharing features all at your fingertips within a user-friendly interface.

There are just a few steps to follow to complete and sign your Irs Instructions Form 1120s:

- Upload the fillable template to the editor using the Get Form button.

- Verify what information you need to include in your Irs Instructions Form 1120s.

- Move between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the top menu.

- Emphasize what is crucial or Redact details that are no longer relevant.

- Select Sign to generate a legally valid eSignature using any preferred option.

- Add the Date beside your signature and finish your task with the Done button.

Store your completed Irs Instructions Form 1120s in the Documents folder in your profile, download it, or transfer it to your chosen cloud storage. Our service also offers adaptable form sharing. There’s no need to print your templates when you need to submit them to the relevant public office - do it via email, fax, or by arranging a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct irs instructions form 1120s 2017

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

Create this form in 5 minutes!

How to create an eSignature for the irs instructions form 1120s 2017

How to create an eSignature for the Irs Instructions Form 1120s 2017 online

How to make an electronic signature for your Irs Instructions Form 1120s 2017 in Chrome

How to make an eSignature for putting it on the Irs Instructions Form 1120s 2017 in Gmail

How to create an electronic signature for the Irs Instructions Form 1120s 2017 from your mobile device

How to generate an eSignature for the Irs Instructions Form 1120s 2017 on iOS devices

How to generate an electronic signature for the Irs Instructions Form 1120s 2017 on Android devices

People also ask

-

What are the IRS instructions for Form 1120S?

The IRS Instructions for Form 1120S provide guidance on how S corporations should report their income, deductions, and credits. These instructions detail the filing process, eligibility requirements, and necessary documentation to ensure compliance with IRS regulations.

-

How does airSlate SignNow simplify the eSigning process for IRS Form 1120S?

airSlate SignNow streamlines the eSigning process for IRS Form 1120S by allowing users to securely sign and send documents electronically. This not only saves time but also ensures that all signatures are legally binding and compliant with IRS standards.

-

What features does airSlate SignNow offer for managing IRS Form 1120S?

airSlate SignNow offers features such as document templates, customizable workflows, and real-time tracking, making it easy to manage IRS Form 1120S. These tools help businesses efficiently prepare, send, and track their tax forms, ensuring timely submissions.

-

Is airSlate SignNow cost-effective for businesses filing IRS Form 1120S?

Yes, airSlate SignNow is a cost-effective solution for businesses filing IRS Form 1120S. With flexible pricing plans, companies can choose a package that fits their needs without compromising on essential features for eSigning and document management.

-

Can I integrate airSlate SignNow with accounting software for IRS Form 1120S?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software. This allows users to sync their IRS Form 1120S data efficiently, helping to streamline the filing process and reduce the risk of errors.

-

What benefits does airSlate SignNow provide for filing IRS Form 1120S?

By using airSlate SignNow for filing IRS Form 1120S, businesses benefit from enhanced efficiency, security, and compliance. The platform's user-friendly interface and advanced features help ensure that all filings are completed accurately and on time.

-

How does eSigning IRS Form 1120S with airSlate SignNow ensure compliance?

eSigning IRS Form 1120S with airSlate SignNow ensures compliance through secure storage and audit trails. The platform meets industry standards for security and legality, providing assurance that your signed documents adhere to IRS requirements.

Get more for Irs Instructions Form 1120s

- Hang on baby monkey running record form

- Wba weiterbewilligungsantrag sgb ii antrag auf weiterbewilligung der leistungen zur sicherung des lebensunterhalts nach dem form

- Formularios galeno

- Job description acknowledgement 252172833 form

- Percentage missing number questions form

- Nursing home blue book order form dhh louisiana

- Pharmacy technician skills checklist form

- Payment car installment payment agreement template form

Find out other Irs Instructions Form 1120s

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free