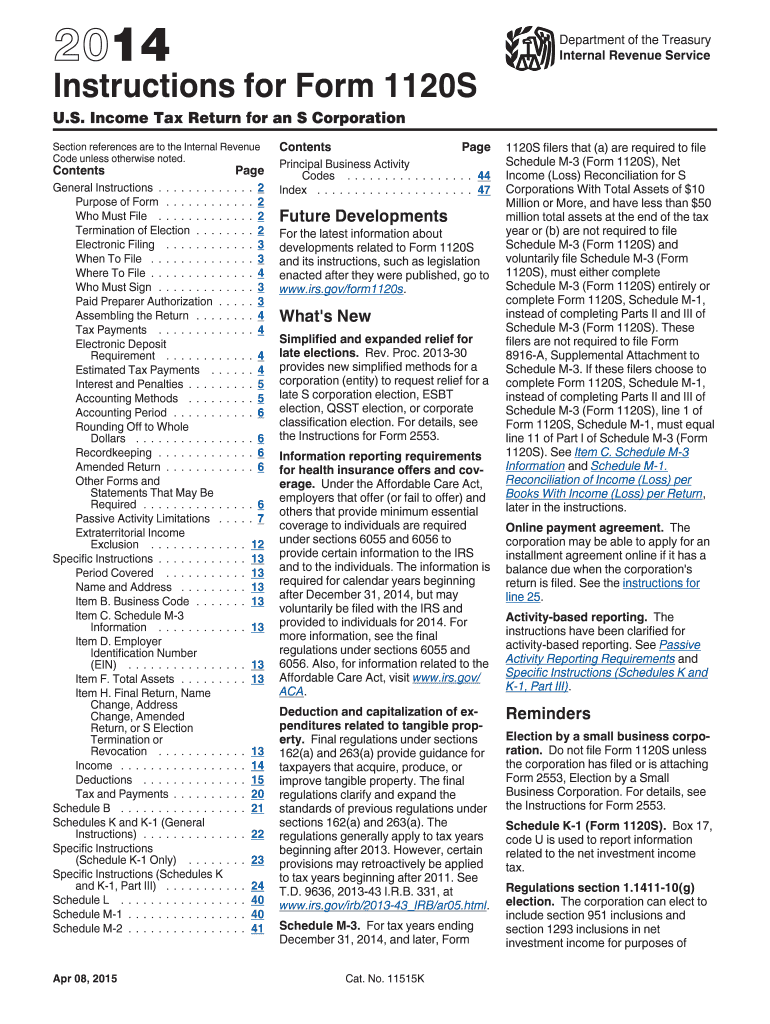

I1120s Form 2014

What is the I1120s Form

The I1120s Form is a tax document used by S corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). This form is essential for S corporations, as it allows them to pass income directly to shareholders, avoiding double taxation. Each shareholder receives a Schedule K-1, which details their share of the corporation's income, deductions, and credits, ensuring that they can report this information on their personal tax returns.

How to use the I1120s Form

To effectively use the I1120s Form, an S corporation must first gather all necessary financial information, including income, expenses, and any applicable deductions. The form requires detailed reporting of the corporation's financial activities for the tax year. After completing the form, it must be signed by an authorized officer of the corporation and submitted to the IRS along with any required schedules and attachments. Shareholders will then receive their Schedule K-1, which they will use for their individual tax filings.

Steps to complete the I1120s Form

Completing the I1120s Form involves several key steps:

- Gather financial records, including income statements and expense reports.

- Fill out the I1120s Form, ensuring all income, deductions, and credits are accurately reported.

- Complete Schedule K-1 for each shareholder, detailing their share of the corporation's income and deductions.

- Review the form for accuracy and completeness.

- Sign the form and file it with the IRS by the due date.

Legal use of the I1120s Form

The I1120s Form is legally binding when filed correctly and on time. It must comply with IRS regulations, including accurate reporting of all income and expenses. Failure to adhere to these requirements can lead to penalties or audits. Furthermore, the form must be signed by an authorized officer of the corporation, ensuring that the information provided is true and accurate to the best of their knowledge.

Filing Deadlines / Important Dates

The I1120s Form is typically due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is crucial for S corporations to meet this deadline to avoid penalties and ensure compliance with IRS regulations.

Required Documents

When completing the I1120s Form, several documents are necessary:

- Financial statements, including profit and loss statements.

- Records of all income and expenses for the tax year.

- Previous year's tax returns for reference.

- Any relevant documentation for deductions and credits claimed.

Who Issues the Form

The I1120s Form is issued by the Internal Revenue Service (IRS). It is specifically designed for S corporations, which are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This form is part of the IRS's efforts to streamline tax reporting for S corporations and ensure compliance with tax laws.

Quick guide on how to complete 2014 i1120s form

Effortlessly Prepare I1120s Form on Any Device

Digital document management has gained signNow traction among enterprises and individuals alike. It serves as an excellent eco-conscious substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents promptly and without delay. Manage I1120s Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

Easily Edit and Electronically Sign I1120s Form

- Find I1120s Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to finalize your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign I1120s Form to ensure clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 i1120s form

Create this form in 5 minutes!

How to create an eSignature for the 2014 i1120s form

The way to make an eSignature for your PDF file in the online mode

The way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the I1120s Form and who needs it?

The I1120s Form is a tax return specific to S corporations. Businesses that have elected to be classified as S corporations must file this form annually with the IRS to report income, deductions, and credits. Understanding the requirements of the I1120s Form is essential for compliance and proper tax reporting.

-

How can airSlate SignNow help with the I1120s Form?

airSlate SignNow provides a streamlined way to prepare and eSign the I1120s Form. Our platform allows users to easily fill out, sign, and send the form electronically, ensuring that the submission process is both efficient and secure. By using SignNow, you can simplify your tax filing procedures effectively.

-

What are the pricing options for using airSlate SignNow for the I1120s Form?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs, starting from a basic plan for individuals to advanced options for larger businesses. Depending on your needs related to the I1120s Form, you can choose a plan that provides you with the essential features without overpaying. Additionally, there are free trials available to test out functionality before committing.

-

Is it safe to use airSlate SignNow for the I1120s Form?

Yes, security is a top priority for airSlate SignNow. We implement advanced encryption and security protocols to ensure that your I1120s Form and any sensitive information are fully protected during transmission and storage. You can trust SignNow to keep your documents safe and secure.

-

Can I integrate airSlate SignNow with accounting software for the I1120s Form?

Absolutely! airSlate SignNow is designed to integrate seamlessly with various accounting software, making it easier to manage your financial documents, including the I1120s Form. These integrations allow for better data management and accuracy, helping you streamline your tax reporting processes.

-

What features does airSlate SignNow offer for managing the I1120s Form?

airSlate SignNow offers a wealth of features for managing the I1120s Form, including templates for quick setup, customizable workflows, and reminders for important tax deadlines. Additionally, our platform supports eSignature functionality, simplifying the signing process and ensuring compliance with legal requirements.

-

How does airSlate SignNow improve efficiency when filing the I1120s Form?

Using airSlate SignNow signNowly enhances efficiency by minimizing the time spent on paperwork for the I1120s Form. With instant access to templates, secure eSigning, and document tracking, businesses can file their forms accurately and timely, allowing them to focus more on their core activities.

Get more for I1120s Form

- Option to purchase addendum to residential lease lease or rent to own georgia form

- Georgia prenuptial premarital agreement with financial statements georgia form

- Georgia prenuptial premarital agreement without financial statements georgia form

- Amendment to prenuptial or premarital agreement georgia form

- Financial statements only in connection with prenuptial premarital agreement georgia form

- Georgia prenuptial agreement 497303594 form

- Ga no fault form

- Georgia wage form

Find out other I1120s Form

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free