Instructions for Form 1120 S 2024-2026

What is the Instructions for Form 1120-S

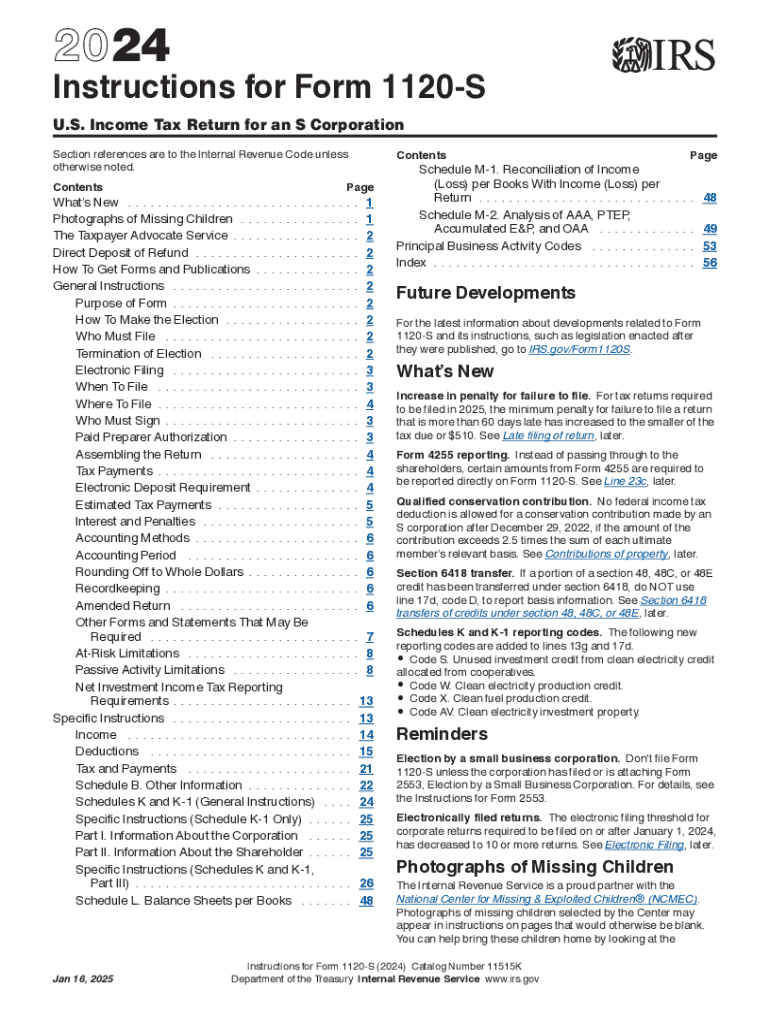

The Instructions for Form 1120-S provide detailed guidance on how to complete and file the 1120-S form, which is used by S corporations to report income, deductions, and credits. This form is essential for S corporations as it allows them to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. The instructions cover various aspects, including eligibility criteria, required information, and specific line-by-line directions to ensure accurate reporting.

Steps to Complete the Instructions for Form 1120-S

Completing the Instructions for Form 1120-S involves several key steps:

- Gather necessary financial documents, including income statements, balance sheets, and prior year tax returns.

- Review the eligibility requirements to ensure your corporation qualifies as an S corporation.

- Follow the line-by-line instructions provided in the form to report your corporation's income, deductions, and credits accurately.

- Complete Schedule K-1 for each shareholder, detailing their share of the income, deductions, and credits.

- Double-check all entries for accuracy and completeness before submission.

How to Obtain the Instructions for Form 1120-S

The Instructions for Form 1120-S can be obtained directly from the IRS website. They are available in PDF format for easy download and printing. Additionally, you can request a physical copy by contacting the IRS or visiting a local IRS office. It is advisable to always use the most current version of the instructions to ensure compliance with any recent tax law changes.

Key Elements of the Instructions for Form 1120-S

Key elements of the Instructions for Form 1120-S include:

- Eligibility criteria for S corporations.

- Detailed descriptions of each section of the form, including income, deductions, and credits.

- Guidance on completing Schedule K-1 for shareholders.

- Information on filing deadlines and penalties for late submission.

- Examples of common scenarios and how they affect reporting on the form.

IRS Guidelines

The IRS provides specific guidelines for completing the 1120-S form, emphasizing the importance of accuracy and compliance with federal tax regulations. These guidelines include instructions on how to report various types of income, allowable deductions, and the treatment of credits. Adhering to these guidelines helps prevent errors that could lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120-S are crucial for compliance. Generally, the form must be filed by the fifteenth day of the third month after the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Understanding these dates helps ensure timely submission and avoids potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 1120 s

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1120 s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1120s form and why is it important?

The 1120s form is a tax return used by S corporations to report income, deductions, and credits to the IRS. It is crucial for ensuring compliance with federal tax regulations and for determining the tax obligations of the corporation and its shareholders.

-

How can airSlate SignNow help with the 1120s form?

airSlate SignNow simplifies the process of completing and eSigning the 1120s form by providing an intuitive platform for document management. Users can easily fill out, sign, and send the form securely, ensuring that all necessary information is accurately captured.

-

What features does airSlate SignNow offer for managing the 1120s form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the 1120s form. These tools enhance efficiency and ensure that users can manage their tax documents with ease and confidence.

-

Is there a cost associated with using airSlate SignNow for the 1120s form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and provides access to a range of features that streamline the process of managing the 1120s form and other documents.

-

Can I integrate airSlate SignNow with other software for the 1120s form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage the 1120s form alongside your other financial documents. This integration helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for the 1120s form?

Using airSlate SignNow for the 1120s form offers numerous benefits, including time savings, enhanced security, and improved accuracy. The platform reduces the risk of errors and ensures that your tax documents are handled efficiently and securely.

-

Is airSlate SignNow user-friendly for completing the 1120s form?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the 1120s form. The intuitive interface allows users to navigate the document easily, ensuring a smooth eSigning process.

Get more for Instructions For Form 1120 S

- Nevada landlord tenant 497320666 form

- Landlord tenant use 497320667 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497320668 form

- Letter tenant notice template 497320669 form

- Letter from landlord to tenant about tenant engaging in illegal activity in premises as documented by law enforcement and if 497320670 form

- Nv violation form

- Letter tenant rent sample 497320672 form

- Tenant notice increase form

Find out other Instructions For Form 1120 S

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free

- Help Me With Sign California Healthcare / Medical Lease Agreement Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will