Printable Louisiana Form R 210NR Nonresident and Part Year Resident Underpayment Penalty Computation Worksheet 2019

What is the Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

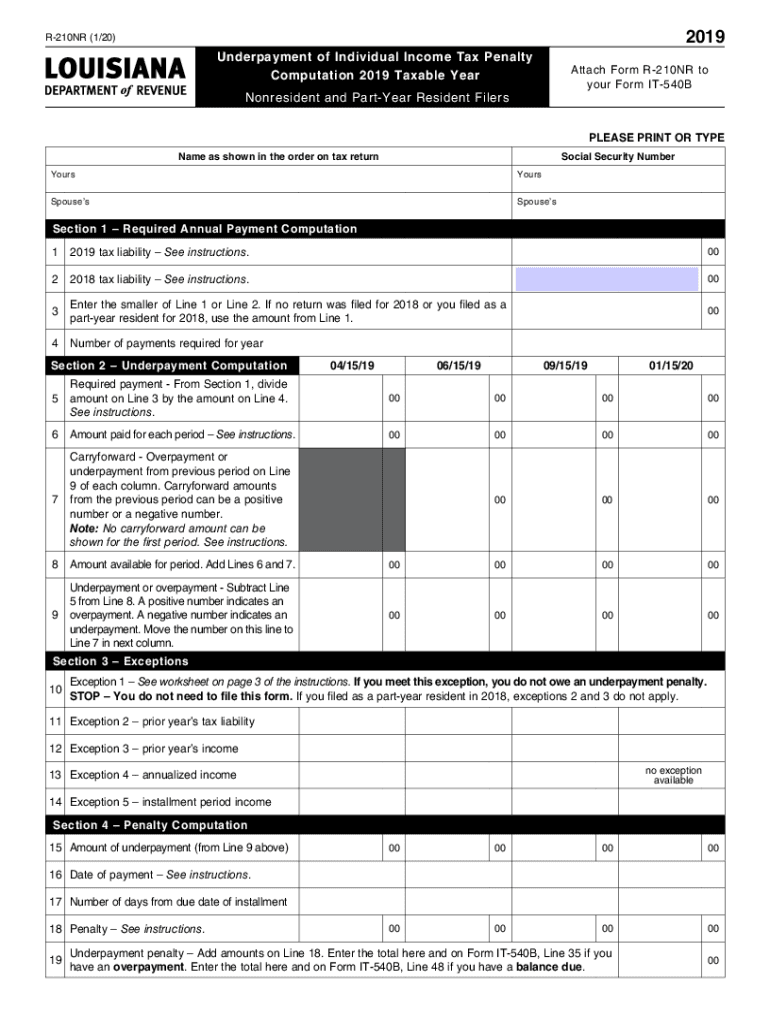

The Printable Louisiana Form R 210NR is designed for nonresidents and part-year residents who may be subject to an underpayment penalty. This form allows individuals to compute any potential penalties resulting from insufficient tax payments throughout the year. It is essential for ensuring compliance with Louisiana tax laws and helps taxpayers determine if they owe any penalties due to underpayment of taxes owed to the state.

How to use the Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

Using the Printable Louisiana Form R 210NR involves several steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form by entering your income details, tax payments made, and any credits applicable. The worksheet will guide you through the calculation process to determine if you owe an underpayment penalty. It is important to ensure accuracy in your entries to avoid errors that could lead to further penalties.

Steps to complete the Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

To complete the Printable Louisiana Form R 210NR, follow these steps:

- Begin by entering your total income for the year.

- List all tax payments made during the year, including estimated payments.

- Calculate the total tax liability based on your income.

- Compare your total tax payments to your total tax liability.

- If your payments are less than your liability, use the form's calculations to determine the penalty amount.

Key elements of the Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

The key elements of the Printable Louisiana Form R 210NR include sections for income reporting, tax payment records, and penalty calculations. It requires taxpayers to input their total income, any tax credits, and payments made to determine if they have underpaid their taxes. Understanding these elements is crucial for accurately completing the form and ensuring compliance with state tax regulations.

Penalties for Non-Compliance

Failing to comply with the requirements outlined in the Printable Louisiana Form R 210NR can result in significant penalties. If the state determines that you have underpaid your taxes, you may face financial penalties, which can accumulate over time. Additionally, non-compliance could lead to interest charges on unpaid taxes. It is vital to address any underpayment issues promptly to avoid further complications.

Filing Deadlines / Important Dates

Filing deadlines for the Printable Louisiana Form R 210NR are typically aligned with the state tax return deadlines. Taxpayers should be aware of these dates to ensure timely submission of the form and any associated payments. Missing these deadlines can result in penalties and interest, making it crucial to stay informed about the specific dates each tax year.

Quick guide on how to complete printable 2020 louisiana form r 210nr nonresident and part year resident underpayment penalty computation worksheet

Effortlessly Prepare Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet on Any Device

The management of online documents has gained immense popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet Without Effort

- Acquire Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct printable 2020 louisiana form r 210nr nonresident and part year resident underpayment penalty computation worksheet

Create this form in 5 minutes!

How to create an eSignature for the printable 2020 louisiana form r 210nr nonresident and part year resident underpayment penalty computation worksheet

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the louisiana underpayment penalty?

The louisiana underpayment penalty is a charge imposed by the state for failing to pay enough tax throughout the year. This can occur if businesses or individuals do not meet their estimated tax payments or withholdings. Understanding this penalty is crucial for avoiding additional costs during tax season.

-

How can airSlate SignNow help avoid the louisiana underpayment penalty?

By using airSlate SignNow, businesses can efficiently manage their documentation and ensure timely submissions, reducing the risk of incurring a louisiana underpayment penalty. The platform allows for quick electronic signatures and document routing, promoting faster tax preparation and filings.

-

Is airSlate SignNow cost-effective for managing tax documents related to the louisiana underpayment penalty?

Yes, airSlate SignNow provides a cost-effective solution for managing tax documents. By streamlining the signing and sending process, businesses can save time and resources, ultimately preventing issues like the louisiana underpayment penalty due to delays or oversights.

-

What features does airSlate SignNow offer to assist with tax compliance and avoiding penalties?

airSlate SignNow offers features like customizable templates, secure cloud storage, and complete audit trails for document transactions. These features help ensure that all necessary tax documents are properly managed, reducing the likelihood of facing a louisiana underpayment penalty.

-

Does airSlate SignNow integrate with accounting software to help prevent the louisiana underpayment penalty?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions. This integration helps streamline financial processes, ensuring that returns and estimated payments are managed efficiently, thus minimizing risks associated with the louisiana underpayment penalty.

-

Can airSlate SignNow assist with tracking payment deadlines related to the louisiana underpayment penalty?

Absolutely. airSlate SignNow includes features that allow users to set reminders for important payment deadlines. Staying organized and aware of these deadlines is essential for businesses to avoid incurring any louisiana underpayment penalty.

-

What benefits does airSlate SignNow provide that can reduce stress related to the louisiana underpayment penalty?

Using airSlate SignNow can signNowly reduce stress by automating document handling and ensuring timely communications about tax obligations. This proactive approach helps businesses stay compliant, ultimately minimizing the risk of penalties such as the louisiana underpayment penalty.

Get more for Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

Find out other Printable Louisiana Form R 210NR Nonresident And Part Year Resident Underpayment Penalty Computation Worksheet

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online