LA R 210NR 2020

What is the LA R 210NR

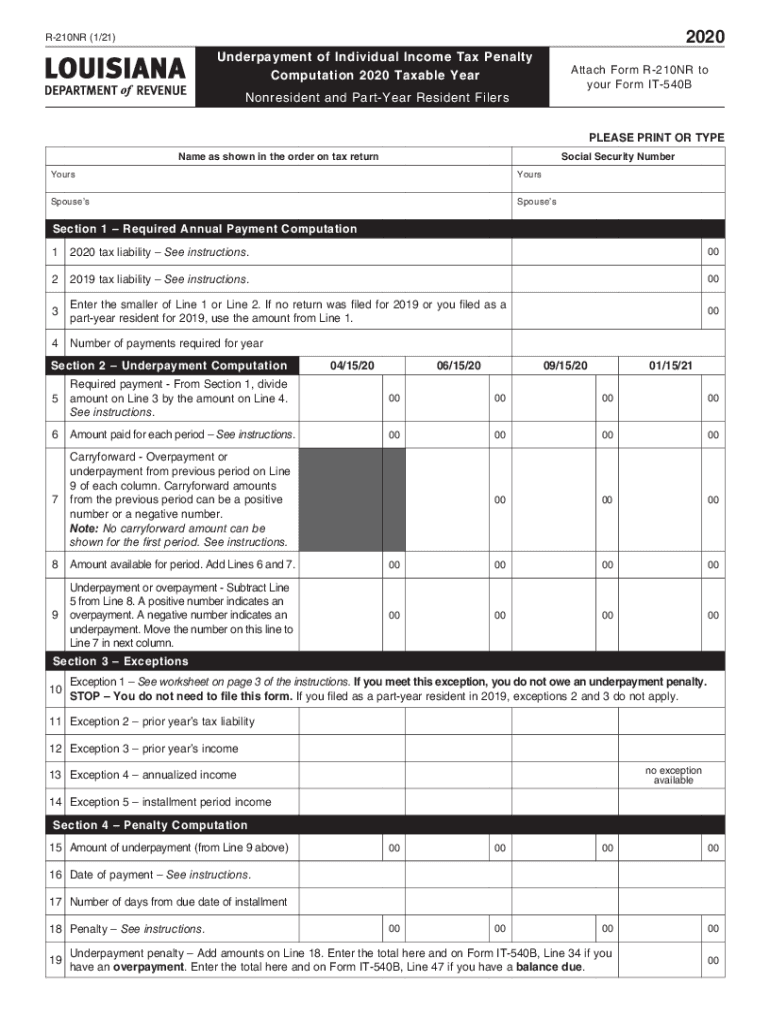

The LA R 210NR is a specific form used in the state of Louisiana for tax purposes. It is primarily associated with non-resident taxpayers who need to report income earned in Louisiana while residing in another state. This form ensures that individuals comply with state tax regulations, allowing them to accurately report their earnings and calculate any tax liabilities. Understanding the purpose of the LA R 210NR is crucial for individuals who may be earning income in Louisiana but are not residents of the state.

How to use the LA R 210NR

Using the LA R 210NR involves several steps to ensure accurate completion and submission. Taxpayers must first gather all necessary financial documents that detail their income earned in Louisiana. Next, they should carefully fill out the form, providing accurate information regarding their earnings and any applicable deductions. It is important to review the completed form for accuracy before submission. Once filled, the form can be submitted either electronically or via traditional mail, depending on the taxpayer's preference and the guidelines provided by the Louisiana Department of Revenue.

Steps to complete the LA R 210NR

Completing the LA R 210NR requires a methodical approach to ensure compliance with state tax laws. Here are the steps to follow:

- Gather all relevant income documents, including W-2s and 1099 forms.

- Download the LA R 210NR form from the Louisiana Department of Revenue website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income earned in Louisiana accurately, ensuring all figures align with your documentation.

- Calculate any deductions or credits you may qualify for as a non-resident.

- Double-check all entries for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the LA R 210NR

The LA R 210NR is legally binding when completed and submitted according to state regulations. It is essential for non-resident taxpayers to understand that failure to file this form can result in penalties and interest on any taxes owed. The form serves as an official document for the Louisiana Department of Revenue, ensuring that all income earned within the state is reported accurately. Compliance with the filing requirements not only helps avoid legal issues but also ensures that taxpayers fulfill their obligations under Louisiana tax law.

Filing Deadlines / Important Dates

Filing deadlines for the LA R 210NR are crucial for compliance with state tax laws. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April 15th. However, taxpayers should be aware of any extensions or specific guidelines issued by the Louisiana Department of Revenue that may affect these dates. It is advisable to stay updated on any changes to filing deadlines to avoid late penalties.

Required Documents

To complete the LA R 210NR, taxpayers must gather several key documents to ensure accurate reporting. These documents include:

- W-2 forms from employers for income earned in Louisiana.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any deductions or credits that may apply to non-resident taxpayers.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready will streamline the process of completing the LA R 210NR and help ensure compliance with state tax regulations.

Quick guide on how to complete la r 210nr

Complete LA R 210NR effortlessly on any platform

Digital document management has gained popularity among organizations and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without hindrance. Handle LA R 210NR on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign LA R 210NR effortlessly

- Locate LA R 210NR and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your edits.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Alter and eSign LA R 210NR to ensure seamless communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct la r 210nr

Create this form in 5 minutes!

How to create an eSignature for the la r 210nr

How to generate an e-signature for a PDF document online

How to generate an e-signature for a PDF document in Google Chrome

How to generate an e-signature for signing PDFs in Gmail

How to make an e-signature from your smart phone

The best way to create an e-signature for a PDF document on iOS

How to make an e-signature for a PDF file on Android OS

People also ask

-

What is LA R 210NR and how does it benefit businesses?

LA R 210NR is a powerful eSignature solution designed to streamline document management processes. It helps businesses reduce paperwork and enhance efficiency by allowing users to send and sign documents electronically. With features tailored for various industries, LA R 210NR optimizes workflows and saves time.

-

How much does LA R 210NR cost?

LA R 210NR offers competitive pricing plans that cater to various business needs. You can choose from monthly or annual subscriptions, each providing a cost-effective solution for document management. For detailed pricing, visit our website to compare plans that suit your requirements.

-

What features does LA R 210NR offer?

LA R 210NR includes a range of features designed to enhance the signing experience. These features include customizable templates, real-time tracking, and automated reminders. Such capabilities make it easy for users to manage their documents efficiently.

-

Is LA R 210NR accessible on mobile devices?

Yes, LA R 210NR is fully optimized for mobile devices, allowing users to send and sign documents on the go. The mobile-friendly interface ensures that you can manage your electronic signatures anytime, anywhere. This flexibility is ideal for businesses with remote teams or employees in the field.

-

Can LA R 210NR integrate with other software?

LA R 210NR offers seamless integration with various popular business applications. Whether you use CRM systems, cloud storage services, or project management tools, our eSignature solution ensures smooth data flow and enhances usability. This integration limits manual entry and reduces the potential for errors.

-

How secure is LA R 210NR for eSigning documents?

Security is a top priority for LA R 210NR. The platform employs advanced encryption methods and complies with industry standards to ensure the safe handling of your documents. With robust authentication processes, you can trust that your sensitive information remains protected.

-

What industries can benefit from using LA R 210NR?

LA R 210NR is versatile and serves various industries, including healthcare, finance, real estate, and education. Each sector can leverage the advantages of digital signatures to enhance operational efficiency. The customizable nature of LA R 210NR ensures it meets specific needs across different fields.

Get more for LA R 210NR

- As1 form example

- Inmar coupon redemption form

- Invoice declaration sample form

- Asset verification form

- Dna replication practice worksheet 46602773 form

- Sf 424a form fillable usda 21249639

- Tdh rider 27 child abuse reporting form child abuse reporting form

- State of utah department of workforce services heat form

Find out other LA R 210NR

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now