Underpayment of Estimated Tax by Individuals Penalty 2023

Understanding the Underpayment of Estimated Tax Penalty

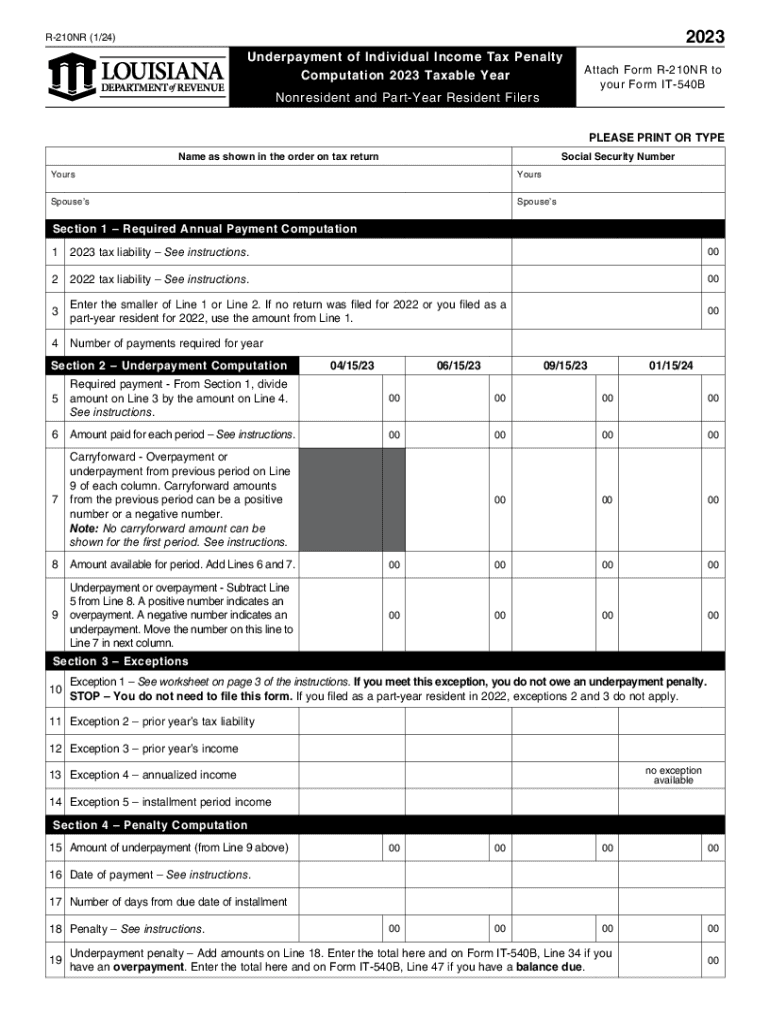

The Underpayment of Estimated Tax by Individuals Penalty applies when taxpayers do not pay enough tax throughout the year. This penalty is particularly relevant for those who earn income that is not subject to withholding, such as self-employed individuals or those with investment income. The IRS calculates this penalty based on the amount of underpayment and the duration of the underpayment period. Understanding this penalty can help taxpayers avoid unexpected costs and ensure compliance with tax obligations.

Steps to Complete the Underpayment of Estimated Tax Penalty Calculation

To calculate the Underpayment of Estimated Tax Penalty, follow these steps:

- Determine your total tax liability for the year.

- Calculate the amount of tax you have already paid through withholding and estimated payments.

- Subtract the total payments from your tax liability to find the underpayment amount.

- Identify the periods of underpayment based on your payment schedule.

- Use IRS Form 2210 to compute the penalty, which provides detailed instructions and worksheets.

IRS Guidelines for the Underpayment of Estimated Tax Penalty

The IRS provides specific guidelines regarding the Underpayment of Estimated Tax Penalty. Taxpayers are generally required to pay at least 90% of their current year's tax liability or 100% of the previous year's tax liability to avoid penalties. The IRS also offers a safe harbor provision for certain taxpayers, which can help mitigate the penalty if they meet specific criteria. Understanding these guidelines is essential for accurate tax planning and compliance.

Filing Deadlines and Important Dates

Filing deadlines for estimated tax payments are critical to avoid penalties. Typically, estimated taxes are due quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year. Taxpayers should mark these dates on their calendars and ensure timely payments to avoid incurring the Underpayment of Estimated Tax Penalty. Staying informed about these deadlines can help maintain compliance and prevent financial penalties.

Eligibility Criteria for the Underpayment of Estimated Tax Penalty

To determine eligibility for the Underpayment of Estimated Tax Penalty, taxpayers should consider their income level and payment history. Generally, individuals who expect to owe more than one thousand dollars in tax after subtracting withholding and refundable credits must pay estimated taxes. Additionally, taxpayers must have a tax liability in the previous year and have filed a return to qualify for the safe harbor provision. Understanding these criteria can help taxpayers navigate their obligations effectively.

Penalties for Non-Compliance with Estimated Tax Payments

Failing to comply with estimated tax payment requirements can result in significant penalties. The IRS calculates the penalty based on the amount of underpayment and the number of days the payment is late. These penalties can accumulate quickly, leading to increased financial burdens for taxpayers. Being aware of these consequences emphasizes the importance of timely and accurate estimated tax payments.

Quick guide on how to complete underpayment of estimated tax by individuals penalty

Easily prepare Underpayment Of Estimated Tax By Individuals Penalty on any device

The management of online documents has become increasingly popular among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the required form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and electronically sign your documents without any delays. Manage Underpayment Of Estimated Tax By Individuals Penalty on any device using airSlate SignNow's Android or iOS applications, and streamline your document-related tasks today.

The simplest way to edit and electronically sign Underpayment Of Estimated Tax By Individuals Penalty effortlessly

- Find Underpayment Of Estimated Tax By Individuals Penalty and click on Get Form to begin.

- Use the tools we provide to fill in your document.

- Highlight important sections of your documents or redact sensitive information with the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Underpayment Of Estimated Tax By Individuals Penalty and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct underpayment of estimated tax by individuals penalty

Create this form in 5 minutes!

How to create an eSignature for the underpayment of estimated tax by individuals penalty

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2210 and why do I need it?

Form 2210 is used to determine if you owe a penalty for underpayment of estimated tax. Understanding what is form 2210 can help taxpayers avoid unnecessary penalties and ensure compliance with IRS tax regulations.

-

How can airSlate SignNow help me with form 2210?

airSlate SignNow streamlines the process of filling and eSigning documents like form 2210. With its user-friendly interface and efficient features, you can complete your tax paperwork swiftly and securely.

-

Is there a cost associated with using airSlate SignNow for form 2210?

While airSlate SignNow offers various pricing plans, creating and eSigning form 2210 can be cost-effective based on your needs. Explore our pricing options to find the right plan for your business or personal tax needs.

-

What features does airSlate SignNow provide for form 2210?

With airSlate SignNow, you gain access to features such as eSignature, document templates, and collaboration tools, all of which enhance your experience with form 2210. These features make completing your tax forms simpler and more efficient.

-

Can I integrate airSlate SignNow with other software for form 2210?

Yes, airSlate SignNow seamlessly integrates with various software solutions, making it easier to manage your documents like form 2210. You can connect to popular platforms such as Google Drive and Dropbox for enhanced functionality.

-

What benefits does airSlate SignNow offer for completing form 2210?

Using airSlate SignNow for form 2210 provides numerous benefits, including time savings, improved accuracy, and enhanced security. These advantages can help ensure that your tax submissions are completed correctly and on time.

-

Is my data secure when using airSlate SignNow for form 2210?

Absolutely! airSlate SignNow employs top-notch security measures to protect your data while working on form 2210. This includes encryption and secure storage to ensure that your sensitive information is safe.

Get more for Underpayment Of Estimated Tax By Individuals Penalty

- Welcome claim administrators south dakota department of form

- Claim of unpaid wages state of south dakota form

- Form 107 monthly payment report state of south dakota

- Form 112 finger amppub

- Small claims petition for hearingdoc form

- Statement of weekly earningsdoc form

- State of south dakota hereinafter referred to as the trustor whether one or form

- As provided in this agreement and the laws of the state of south dakota form

Find out other Underpayment Of Estimated Tax By Individuals Penalty

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement