About Form 2210, Underpayment of Estimated Tax 2022

What is Form 2210, Underpayment of Estimated Tax

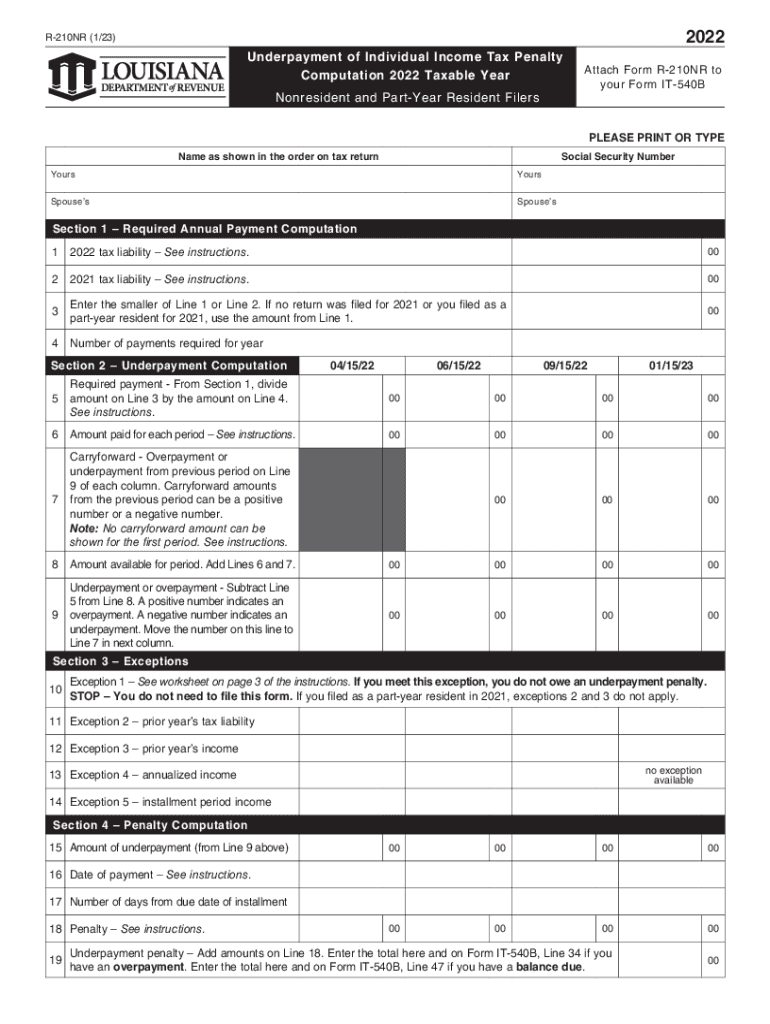

Form 2210 is a tax form used by individuals in the United States to determine if they owe a penalty for underpayment of estimated tax. This form is essential for taxpayers who do not meet the required tax payment thresholds throughout the year. The IRS mandates that individuals pay a certain amount of their tax liability through withholding or estimated tax payments. If these payments fall short, the taxpayer may be subject to penalties. Understanding the nuances of Form 2210 can help taxpayers avoid unexpected financial burdens.

Steps to Complete Form 2210

Completing Form 2210 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, determine your total tax liability for the year. Then, calculate your estimated tax payments made throughout the year. If your payments are less than required, use the form to compute the penalty amount. Finally, fill out the form accurately and submit it with your tax return or separately, depending on your situation.

IRS Guidelines for Form 2210

The IRS provides specific guidelines for using Form 2210, which include eligibility criteria and instructions for completion. Taxpayers must review these guidelines to understand their obligations and avoid penalties. The form is divided into different sections, each addressing various aspects of underpayment calculations. Familiarizing oneself with these guidelines can help ensure that taxpayers correctly report their estimated tax payments and any penalties incurred.

Filing Deadlines for Form 2210

Filing deadlines for Form 2210 align with the overall tax filing deadlines in the United States. Typically, individual taxpayers must submit their tax returns by April 15 of the following year. If you owe a penalty and are filing Form 2210, it should be submitted along with your tax return. If you are unable to meet the deadline, consider filing for an extension to avoid late penalties. Staying informed about these deadlines is crucial for maintaining compliance.

Penalties for Non-Compliance with Form 2210

Failure to comply with the requirements of Form 2210 can result in significant penalties. The IRS assesses penalties based on the amount of underpayment and the duration of the underpayment period. Understanding these penalties can motivate taxpayers to accurately estimate their tax payments and file the necessary forms on time. By proactively managing tax obligations, individuals can avoid unnecessary financial strain.

Eligibility Criteria for Using Form 2210

Eligibility for using Form 2210 typically applies to individual taxpayers who have underpaid their estimated taxes. This includes self-employed individuals, retirees, and those with multiple income sources. Taxpayers must meet specific income thresholds and payment requirements to qualify for the form. Understanding these criteria is essential for determining whether filing Form 2210 is necessary and beneficial.

Examples of Using Form 2210

Form 2210 can be utilized in various scenarios, such as when a self-employed individual fails to make adequate estimated tax payments throughout the year or when a retiree receives unexpected income from investments. Each situation may lead to different calculations regarding underpayment penalties. By examining these examples, taxpayers can better understand how to apply the form to their unique financial circumstances.

Quick guide on how to complete about form 2210 underpayment of estimated tax

Easily prepare About Form 2210, Underpayment Of Estimated Tax on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage About Form 2210, Underpayment Of Estimated Tax on any platform using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign About Form 2210, Underpayment Of Estimated Tax effortlessly

- Obtain About Form 2210, Underpayment Of Estimated Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or conceal sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements for document management in just a few clicks from your chosen device. Edit and electronically sign About Form 2210, Underpayment Of Estimated Tax and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 2210 underpayment of estimated tax

Create this form in 5 minutes!

How to create an eSignature for the about form 2210 underpayment of estimated tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2210 and why is it important?

Form 2210 is used by taxpayers to determine if they owe a penalty for underpayment of estimated tax. Understanding form 2210 is crucial for individuals and businesses to ensure they meet their tax obligations and avoid penalties. Utilizing airSlate SignNow can simplify the process of preparing and eSigning this form.

-

How can airSlate SignNow assist with electronic signatures on form 2210?

airSlate SignNow provides an easy-to-use platform for electronically signing form 2210, ensuring that signatures are legally binding and secure. This streamlines the process, allowing users to quickly complete their tax filings without the hassles of printing and mailing. Our solution is designed for efficiency and compliance.

-

What features does airSlate SignNow offer for managing form 2210 submissions?

AirSlate SignNow offers features like document templates, automated workflows, and real-time tracking for form 2210 submissions. Users can easily create, edit, and manage forms, ensuring that their tax documents are organized and accessible. These features help streamline tax processes and improve overall workflow.

-

Is there a pricing plan for using airSlate SignNow for form 2210 filings?

Yes, airSlate SignNow offers flexible pricing plans tailored to suit different business needs. Users can choose from various subscription models that allow unlimited access to features for handling form 2210 efficiently. The cost-effective pricing ensures that businesses can manage their tax documentation without breaking the bank.

-

Can airSlate SignNow integrate with other software for handling form 2210?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and financial software solutions. This capability allows users to streamline their workflow and manage form 2210 more effectively by connecting their existing tools. Integration enhances productivity and simplifies the tax preparation process.

-

What are the benefits of using airSlate SignNow for form 2210?

Using airSlate SignNow for form 2210 provides numerous benefits, including faster processing times and enhanced security for sensitive information. The ability to eSign documents digitally reduces the need for physical paperwork, allowing for more efficient tax reporting. Additionally, airSlate SignNow's user-friendly interface makes the process accessible for everyone.

-

Is it safe to send form 2210 through airSlate SignNow?

Yes, it is completely safe to send form 2210 through airSlate SignNow. Our platform employs advanced encryption and security protocols to protect your personal information and documents. Users can trust that their sensitive tax data will remain secure throughout the submission process.

Get more for About Form 2210, Underpayment Of Estimated Tax

Find out other About Form 2210, Underpayment Of Estimated Tax

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free