Utah State Tax Form 2018

What is the Utah State Tax Form

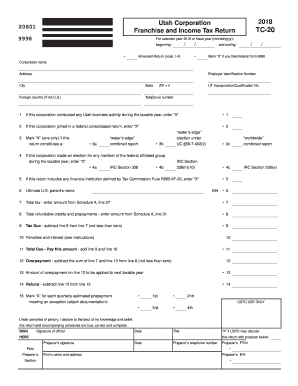

The Utah State Tax Form, specifically the Utah Form TC 20, is a crucial document used by residents to report their state income tax obligations. This form is essential for individuals and businesses to ensure compliance with state tax laws. It captures income, deductions, and credits applicable to taxpayers in Utah, facilitating the calculation of the amount owed or the refund due. Understanding the purpose of this form is vital for accurate tax reporting and compliance.

Steps to complete the Utah State Tax Form

Completing the Utah Form TC 20 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Then, report your total income and applicable deductions. It is important to double-check all entries for accuracy before signing and dating the form. Finally, ensure that you keep a copy for your records.

Legal use of the Utah State Tax Form

The Utah Form TC 20 must be used in accordance with state tax laws to be considered legally valid. Taxpayers are required to complete and submit this form accurately and on time to avoid penalties. The form can be signed electronically, aligning with recent IRS guidelines that allow eSignatures for tax forms. It is crucial to ensure that all information provided is truthful and complete, as any discrepancies can lead to audits or legal consequences.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Utah Form TC 20. The form can be filed online through the Utah State Tax Commission's website, which provides a convenient and efficient way to submit your tax return. Alternatively, you can mail a completed paper form to the designated address provided on the form. For those who prefer in-person submissions, visiting a local tax office is also an option. Each method has its own processing times, so it is advisable to choose the one that best fits your needs.

Filing Deadlines / Important Dates

Filing deadlines for the Utah Form TC 20 are critical for taxpayers to observe. Typically, the form must be submitted by April 15 of each year for the previous tax year. However, if April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, allowing for additional time to file, but not to pay any taxes owed. Keeping track of these dates is essential to avoid late fees and penalties.

Required Documents

To accurately complete the Utah Form TC 20, several documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documents related to deductions, such as mortgage interest statements, property tax records, and receipts for deductible expenses, should be collected. Having these documents ready will streamline the filing process and help ensure that all income and deductions are reported accurately.

Quick guide on how to complete 2015 utah form tc 20 2018 2019

Your assistance manual on how to prepare your Utah State Tax Form

If you’re curious about how to finalize and submit your Utah State Tax Form, here are a few concise guidelines on making tax submission less challenging.

To begin, all you need to do is set up your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an exceptionally user-friendly and powerful document platform that enables you to modify, generate, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and go back to modify responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and user-friendly sharing.

Follow these steps to complete your Utah State Tax Form in just a few minutes:

- Create your account and start working on PDFs within minutes.

- Use our directory to find any IRS tax form; browse through versions and schedules.

- Click Get form to open your Utah State Tax Form in our editor.

- Complete the required fillable fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to electronically file your taxes with airSlate SignNow. Please be aware that filing by paper can lead to more errors and delays in refunds. Of course, before e-filing your taxes, visit the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 utah form tc 20 2018 2019

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

Create this form in 5 minutes!

How to create an eSignature for the 2015 utah form tc 20 2018 2019

How to create an eSignature for the 2015 Utah Form Tc 20 2018 2019 in the online mode

How to create an eSignature for your 2015 Utah Form Tc 20 2018 2019 in Google Chrome

How to make an electronic signature for putting it on the 2015 Utah Form Tc 20 2018 2019 in Gmail

How to make an eSignature for the 2015 Utah Form Tc 20 2018 2019 straight from your smart phone

How to generate an eSignature for the 2015 Utah Form Tc 20 2018 2019 on iOS

How to make an electronic signature for the 2015 Utah Form Tc 20 2018 2019 on Android OS

People also ask

-

What is the utah form tc 20 and why is it important?

The Utah Form TC 20 is a tax form used for filing various state tax obligations in Utah. Understanding this form is crucial for ensuring compliance with state tax regulations. Accurate submission of the Utah Form TC 20 can prevent penalties and streamline your tax processes.

-

How can airSlate SignNow help with the utah form tc 20?

airSlate SignNow provides an efficient platform to electronically sign and send the Utah Form TC 20, saving you time and reducing paperwork. Our solution ensures that your documents are securely transmitted and stored, making it easier to manage your tax obligations.

-

Is the pricing for airSlate SignNow competitive for users filing the utah form tc 20?

Yes, airSlate SignNow offers competitive pricing plans that are designed to provide excellent value for users needing to file the Utah Form TC 20. Our plans cater to businesses of all sizes, ensuring that you only pay for the features that support your specific needs.

-

What features does airSlate SignNow offer for managing documents like the utah form tc 20?

airSlate SignNow includes features such as customizable templates, multi-party signing, and real-time tracking of document status. These tools are particularly useful for efficiently managing the completion and submission of the Utah Form TC 20.

-

Can I integrate airSlate SignNow with other software for easier management of the utah form tc 20?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to synchronize your workflow when handling the Utah Form TC 20. This interoperability can greatly enhance your document management processes.

-

What benefits does eSigning the utah form tc 20 provide?

eSigning the Utah Form TC 20 through airSlate SignNow offers several advantages, including faster processing times and enhanced security. Additionally, it eliminates the need for printing, scanning, or mailing documents, which streamlines your tax filing process.

-

Is airSlate SignNow suitable for individuals or just businesses when dealing with the utah form tc 20?

airSlate SignNow is suitable for both individuals and businesses when managing the Utah Form TC 20. Whether you are a sole proprietor or part of a large enterprise, our user-friendly platform caters to diverse needs and ensures you can handle tax documents efficiently.

Get more for Utah State Tax Form

- Chr1 form download

- Philippines purse seine and ringnet logsheet bfar da gov form

- Request for medical consultation identcom form

- Application form for import export code india

- Chapter 13 collection of blood samples form

- Auto contract template form

- Auto finance contract template form

- Auto loan contract template form

Find out other Utah State Tax Form

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online