TC 20 Utah Corporation Franchise or Income Tax Forms & Publications 2023-2026

Understanding the TC 20 Utah Corporation Franchise or Income Tax Forms

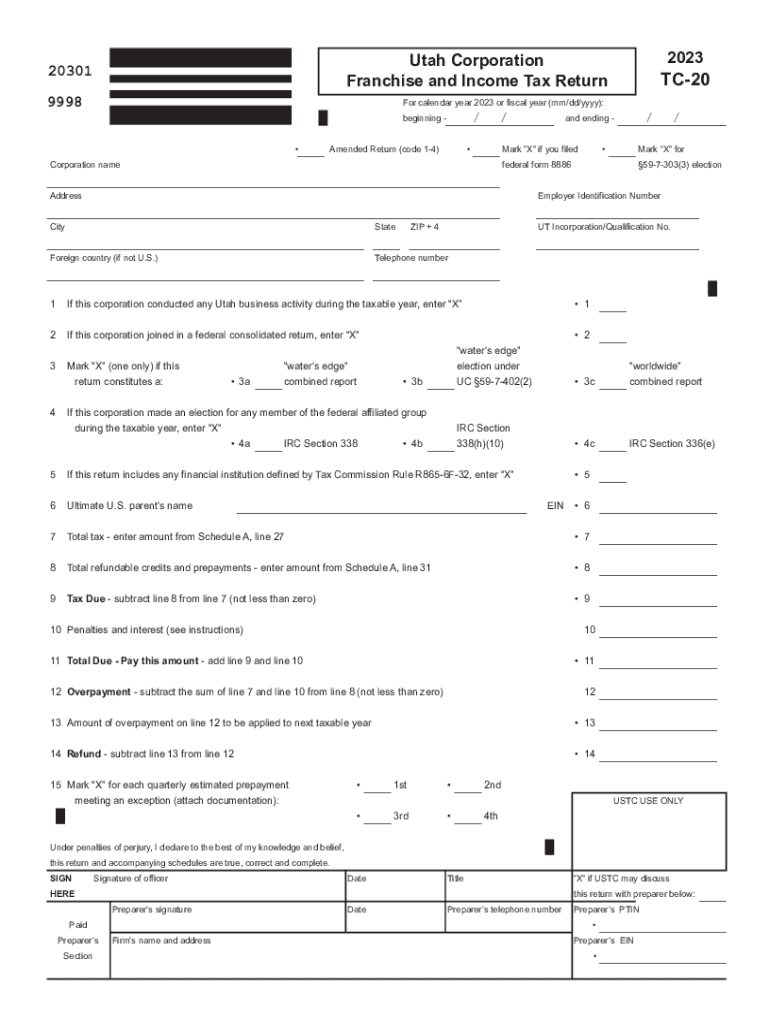

The TC 20 form is essential for corporations operating in Utah, serving as the primary document for reporting franchise or income tax obligations. This form is required for all corporations, including S corporations, that are doing business in the state. It provides the Utah State Tax Commission with necessary financial information to assess the corporation's tax liability. The TC 20 must be completed accurately to ensure compliance with state tax regulations.

Steps to Complete the TC 20 Utah Corporation Franchise or Income Tax Forms

Completing the TC 20 involves several key steps:

- Gather financial records, including income statements and balance sheets, for the tax year.

- Ensure you understand the specific tax rates applicable to your corporation type.

- Fill out the TC 20 form, providing accurate information regarding income, deductions, and credits.

- Review the form for accuracy and completeness before submission.

Following these steps can help streamline the filing process and reduce the likelihood of errors.

Filing Deadlines for the TC 20 Form

Corporations in Utah must be aware of the filing deadlines for the TC 20 form to avoid penalties. The standard due date for filing is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the TC 20 is due by April 15. Extensions may be available, but they must be requested prior to the original deadline.

Required Documents for TC 20 Submission

When preparing to submit the TC 20 form, several documents are necessary to support the information provided. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Previous year’s tax returns for reference.

- Any additional documentation related to deductions or credits claimed.

Having these documents ready can facilitate a smoother filing process and ensure compliance with state requirements.

Penalties for Non-Compliance with TC 20 Filing

Failure to file the TC 20 form on time or inaccuracies in the submitted information can lead to significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes that accrue over time.

- Potential legal action for persistent non-compliance.

It is crucial for corporations to adhere to filing requirements to avoid these consequences.

Obtaining the TC 20 Utah Corporation Franchise or Income Tax Forms

The TC 20 form can be obtained through the Utah State Tax Commission's official website or directly from their offices. It is available in both digital and paper formats. Corporations are encouraged to use the online version for convenience and to ensure the most up-to-date information is being used. Additionally, tax professionals can assist in acquiring and completing the form accurately.

Quick guide on how to complete tc 20 utah corporation franchise or income tax forms ampamp publications

Effortlessly Prepare TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without lag. Manage TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and Electronically Sign TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications with Ease

- Obtain TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional signature made with ink.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications while ensuring smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 20 utah corporation franchise or income tax forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the tc 20 utah corporation franchise or income tax forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for managing a Utah corporation?

airSlate SignNow provides robust features for managing documents that are crucial for a Utah corporation. These features include eSignatures, document templates, and secure storage, all designed to streamline your corporate documentation process.

-

How can airSlate SignNow help with compliance for my Utah corporation?

Using airSlate SignNow helps ensure your Utah corporation stays compliant with state laws and regulations. The platform offers features such as audit trails and secure storage of documents, providing the legal assurance your corporation needs.

-

What is the pricing structure for airSlate SignNow tailored for Utah corporations?

airSlate SignNow offers flexible pricing plans suitable for any Utah corporation, whether small or large. You can choose from monthly and annual subscription options, ensuring you only pay for what suits your business needs.

-

Can airSlate SignNow integrate with other tools used by my Utah corporation?

Absolutely! airSlate SignNow integrates seamlessly with various tools that many Utah corporations use, such as CRM systems, cloud storage services, and productivity applications. This enhances your workflow and minimizes disruptions in your operations.

-

What benefits does airSlate SignNow provide for remote teams in a Utah corporation?

For remote teams within a Utah corporation, airSlate SignNow offers a convenient way to eSign documents and share files securely. It fosters collaboration, regardless of location, enabling your team to complete essential tasks efficiently and with ease.

-

Is airSlate SignNow suitable for all sizes of Utah corporations?

Yes, airSlate SignNow is designed to cater to corporations of all sizes in Utah. From startups to established enterprises, the platform provides scalable features that adjust to your specific business requirements.

-

How secure is airSlate SignNow for a Utah corporation’s documents?

Security is paramount for airSlate SignNow, especially for a Utah corporation handling sensitive information. The platform employs industry-standard encryption, along with compliance with strict security regulations, to protect your documents.

Get more for TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications

- Witnesseth that grantor for and in consideration of the sum of ten dollars 10 form

- Rights of survivorship hereinafter grantees the words grantor and grantees to include their form

- Hereinafter referred to as grantor and and form

- Husband and wife as joint tenants with rights of survivorship hereinafter form

- Hereinafter referred to as grantor and an form

- Swa in acquisition 102208 information security risk

- Fillable online fws english entry form fws fax email

- Request for copy of board records wc 12pdf fpdf doc form

Find out other TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure