TC 20 Utah Corporation Franchise or Income Tax Forms & Publications 2022

Understanding the TC-20 Utah Corporation Franchise or Income Tax Forms

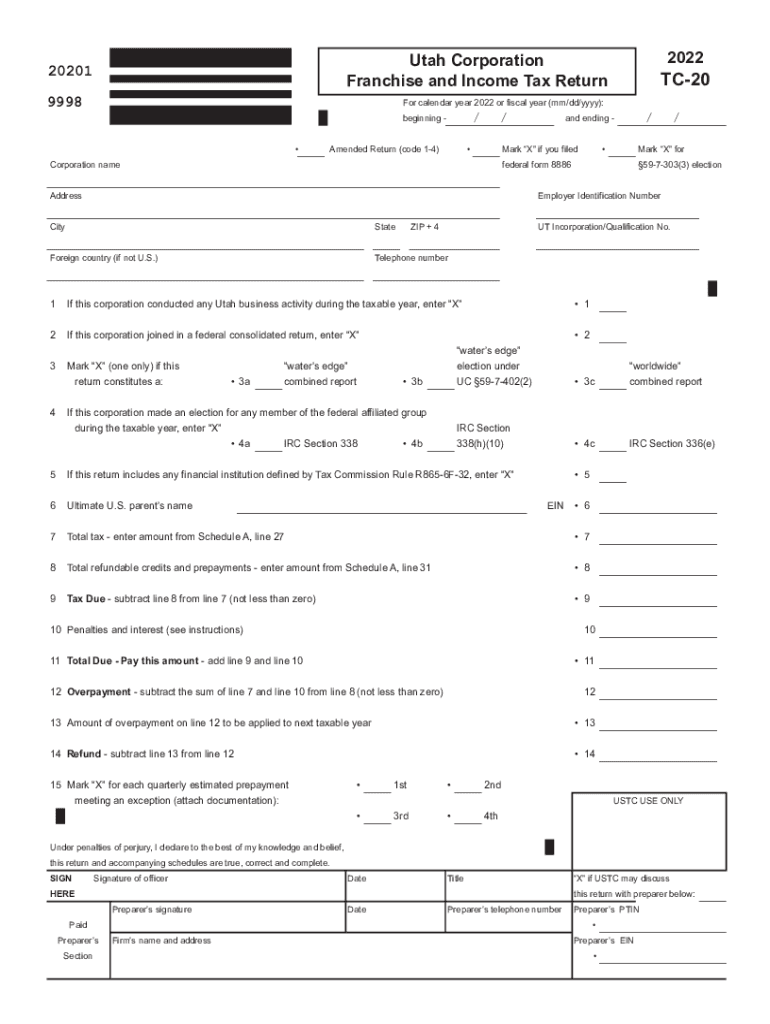

The TC-20 form is essential for corporations operating in Utah, as it is used to report franchise or income tax obligations. This form is crucial for ensuring compliance with state tax laws and is applicable to various business entity types, including corporations and limited liability companies (LLCs). Understanding the purpose of the TC-20 form helps businesses accurately report their income and calculate their tax liabilities. It is important to review the specific requirements and guidelines provided by the Utah State Tax Commission to ensure proper completion.

Steps to Complete the TC-20 Utah Corporation Franchise or Income Tax Forms

Completing the TC-20 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and balance sheets. Next, accurately fill out the form by entering your business's income, deductions, and other relevant financial information. Pay close attention to the specific line items, as errors can lead to delays or penalties. Once completed, review the form for accuracy before submitting it to the Utah State Tax Commission.

Filing Deadlines and Important Dates for TC-20 Forms

Timely filing of the TC-20 form is crucial to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of your corporation's tax year. For corporations operating on a calendar year, this means the form must be filed by April 15. If additional time is needed, businesses may file for an extension, but it is essential to understand that an extension to file is not an extension to pay any taxes owed.

Required Documents for TC-20 Form Submission

When preparing to submit the TC-20 form, ensure you have all required documentation. This typically includes financial statements, proof of deductions, and any relevant schedules that support your income and expenses. Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations. Additionally, maintaining organized records can assist in future filings and audits.

Digital vs. Paper Version of the TC-20 Form

Filing the TC-20 form can be done either digitally or via paper submission. The digital version offers several advantages, including faster processing times and reduced risk of errors. Electronic submissions are often more secure and provide immediate confirmation of receipt. However, some businesses may prefer the traditional paper method for record-keeping purposes. It is essential to choose the method that best suits your business needs while ensuring compliance with filing requirements.

Penalties for Non-Compliance with TC-20 Form Requirements

Failure to file the TC-20 form on time or inaccuracies in reporting can result in significant penalties. The Utah State Tax Commission imposes fines for late submissions and may also charge interest on any unpaid taxes. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. Businesses should prioritize staying informed about their obligations to avoid unnecessary financial burdens.

Quick guide on how to complete 2022 tc 20 utah corporation franchise or income tax forms ampamp publications

Manage TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Handle TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications without hassle

- Obtain TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to store your changes.

- Choose how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 tc 20 utah corporation franchise or income tax forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the 2022 tc 20 utah corporation franchise or income tax forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Utah tax forms and how do I access them?

Utah tax forms are official documents required for filing taxes in the state of Utah. You can access them through the Utah State Tax Commission website or by using services like airSlate SignNow, which streamline the process for easier access and management.

-

How can airSlate SignNow help with completing Utah tax forms?

airSlate SignNow provides an easy-to-use platform that enables you to fill out and eSign Utah tax forms quickly. Our solution simplifies document management, ensuring that you can efficiently complete and submit these forms without any hassle.

-

Are there any costs associated with using airSlate SignNow for Utah tax forms?

Yes, airSlate SignNow offers a range of pricing plans designed to meet the needs of individuals and businesses. Our plans are cost-effective and designed to provide access to features that make managing Utah tax forms seamless and straightforward.

-

Can I integrate airSlate SignNow with other software for managing Utah tax forms?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to manage your documents and Utah tax forms more efficiently. This connectivity enhances your workflow and keeps all your essential documents in one place.

-

What benefits does airSlate SignNow offer for handling Utah tax forms?

Using airSlate SignNow for your Utah tax forms provides numerous benefits, including an intuitive interface, secure eSigning, and increased efficiency in document handling. These features save you time and ensure that your forms are completed accurately and on time.

-

Is it safe to use airSlate SignNow for my Utah tax forms?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When using our platform for your Utah tax forms, you can trust that your information is safe and secure.

-

How can I get support if I have issues with Utah tax forms on airSlate SignNow?

airSlate SignNow provides comprehensive customer support to assist you with any issues related to Utah tax forms. Our support team is available through various channels, ensuring that you receive prompt assistance whenever you need it.

Get more for TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications

- Distributorship agreement form

- Church for removal form

- Sample letter to attorneys transmitting copy of final judgment of dismissal with prejudice form

- Notice meeting board template form

- Report authorization form

- Sample letter for youth group fundraiser form

- Letter release form

- Meeting directors 497328157 form

Find out other TC 20 Utah Corporation Franchise Or Income Tax Forms & Publications

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors