Form REW 1 1041 Real Estate Withholding Return Maine Gov 2022

What is the REW 1 1041 Real Estate Withholding Return?

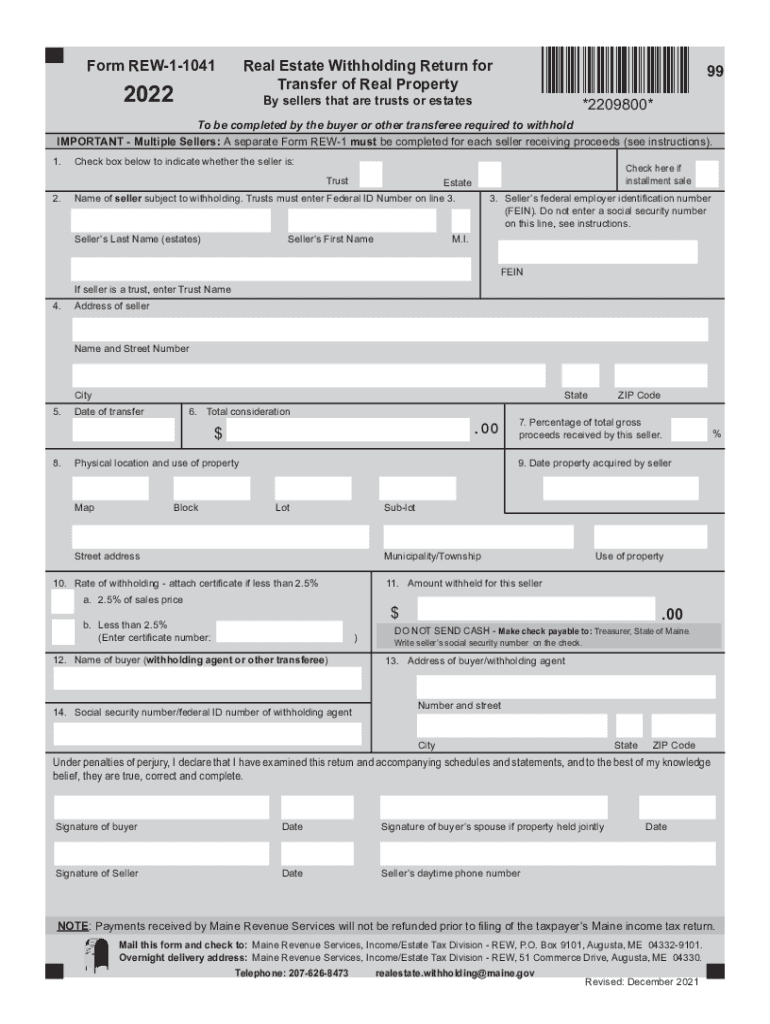

The REW 1 1041 Real Estate Withholding Return is a specific form used in Maine for reporting and remitting withholding tax on the sale of real estate. This form is essential for sellers who are not residents of Maine and are required to withhold a portion of the sales proceeds for state tax purposes. The withholding ensures that the state collects taxes owed on the gains from the sale of property, which can help prevent tax evasion and ensure compliance with state tax laws.

Steps to Complete the REW 1 1041 Real Estate Withholding Return

Completing the REW 1 1041 form involves several key steps to ensure accuracy and compliance with Maine tax regulations. Follow these steps for proper completion:

- Gather necessary information, including the seller's details, the buyer's information, and property specifics.

- Calculate the withholding amount based on the sale price and applicable tax rates.

- Fill out the form accurately, ensuring all fields are completed as required.

- Review the completed form for any errors or omissions before submission.

- Submit the form along with the required payment to the appropriate Maine tax authority.

Key Elements of the REW 1 1041 Real Estate Withholding Return

Understanding the key elements of the REW 1 1041 form is crucial for proper filing. The form typically includes:

- Seller Information: Details about the seller, including name, address, and taxpayer identification number.

- Buyer Information: Information about the buyer, including their name and contact details.

- Property Details: Description of the property being sold, including the address and sale price.

- Withholding Amount: The calculated amount that needs to be withheld based on the sale price.

- Signature: The seller's signature, affirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the REW 1 1041 form to avoid penalties. Typically, the form must be submitted at the time of the property sale or shortly thereafter. Specific deadlines may vary, so it is advisable to consult the Maine tax authority or official resources for the most current dates related to withholding tax submissions.

Penalties for Non-Compliance

Failure to comply with the requirements for the REW 1 1041 form can result in significant penalties. These may include:

- Monetary fines based on the amount of tax that should have been withheld.

- Interest charges on unpaid withholding amounts.

- Potential legal action for repeated non-compliance or fraudulent activity.

Ensuring timely and accurate submission of the REW 1 1041 form is crucial to avoid these consequences.

Digital vs. Paper Version

The REW 1 1041 form can be completed and submitted in both digital and paper formats. Using digital tools, such as electronic signatures, can streamline the process and enhance accuracy. Digital submissions may offer benefits such as immediate confirmation of receipt and reduced processing times. However, some individuals may prefer the traditional paper method for record-keeping or personal comfort. It is important to check with the Maine tax authority for any specific requirements regarding the submission format.

Quick guide on how to complete form rew 1 1041 real estate withholding return mainegov

Effortlessly prepare Form REW 1 1041 Real Estate Withholding Return Maine gov on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Form REW 1 1041 Real Estate Withholding Return Maine gov across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Form REW 1 1041 Real Estate Withholding Return Maine gov with ease

- Obtain Form REW 1 1041 Real Estate Withholding Return Maine gov and select Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form REW 1 1041 Real Estate Withholding Return Maine gov to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1041 real estate withholding return mainegov

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1041 real estate withholding return mainegov

How to make an e-signature for a PDF file online

How to make an e-signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

How to create an e-signature straight from your mobile device

The best way to make an e-signature for a PDF file on iOS

How to create an e-signature for a PDF document on Android devices

People also ask

-

What is Maine real withholding property?

Maine real withholding property refers to the regulations and tax obligations tied to the transfer of real property in Maine. It's essential for property buyers and sellers to understand these requirements to avoid potential penalties. The process helps ensure proper tax collection on property transactions in the state.

-

How does airSlate SignNow assist with Maine real withholding property documents?

AirSlate SignNow streamlines the signing and management of documents related to Maine real withholding property. With its easy-to-use platform, users can securely eSign important documents, ensuring compliance with local laws. This helps facilitate smoother property transactions for all parties involved.

-

What are the pricing options for using airSlate SignNow?

AirSlate SignNow offers flexible pricing plans designed to accommodate different business needs, including those handling Maine real withholding property transactions. Users can choose from monthly or annual subscriptions based on their anticipated document volume. This cost-effective approach ensures businesses can manage their workflow without breaking the bank.

-

Are there features specifically for real estate transactions in Maine?

Yes, airSlate SignNow includes features tailored for Maine real withholding property transactions. Users can create custom templates, set signing order, and easily track document status. These features enhance efficiency and help ensure that all legal requirements are met promptly.

-

Can airSlate SignNow integrate with other real estate tools?

Absolutely! AirSlate SignNow seamlessly integrates with various real estate tools and CRM systems. This makes it easier for professionals working with Maine real withholding property to manage their documents within their existing workflows, eliminating the need for duplicate data entry and minimizing errors.

-

What are the benefits of using airSlate SignNow for property transactions in Maine?

Using airSlate SignNow for property transactions in Maine offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance with local laws related to real withholding property. The platform helps reduce turnaround times for document signing, ultimately speeding up the closing process. Plus, its user-friendly interface ensures a positive experience for all users.

-

How secure is airSlate SignNow for handling Maine real withholding property documents?

AirSlate SignNow prioritizes security and uses industry-leading encryption to protect sensitive documents related to Maine real withholding property. This ensures that all data remains confidential and secure during the signing process. Users can also benefit from advanced authentication options to further enhance document security.

Get more for Form REW 1 1041 Real Estate Withholding Return Maine gov

Find out other Form REW 1 1041 Real Estate Withholding Return Maine gov

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal