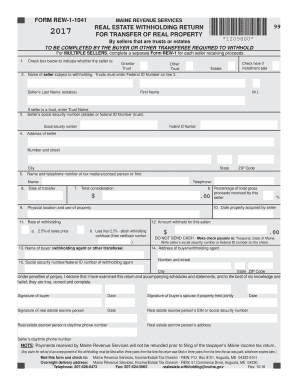

Form Rew 1 1041 2017

What is the Form Rew 1 1041

The Form Rew 1 1041 is a specific tax document used primarily for reporting income and calculating tax liabilities for certain entities in the United States. This form is essential for businesses and organizations that need to comply with federal tax regulations. It serves as a means for the Internal Revenue Service (IRS) to collect information regarding income, deductions, and credits claimed by the entity filing the form. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the Form Rew 1 1041

Using the Form Rew 1 1041 involves several key steps to ensure compliance with IRS regulations. First, gather all necessary financial documents, including income statements and expense records. Next, accurately fill out the form, providing detailed information as required. It's important to double-check all entries for accuracy before submission. After completing the form, you can choose to eSign it using a compliant platform, which simplifies the process and ensures your submission is timely and secure.

Steps to complete the Form Rew 1 1041

Completing the Form Rew 1 1041 requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial information, including income and expenses.

- Download the form from an official source or access it through a digital platform.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review the form for any errors or omissions.

- eSign the form if submitting electronically or prepare it for mailing if submitting a paper version.

- Keep a copy of the completed form for your records.

Legal use of the Form Rew 1 1041

The legal use of the Form Rew 1 1041 is governed by IRS guidelines, which stipulate that the form must be filled out accurately and submitted by the designated deadline. Failure to comply with these regulations can result in penalties or delays in processing. It is important to ensure that the information provided is truthful and complete, as any discrepancies may lead to audits or further scrutiny from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Form Rew 1 1041 are critical to avoid penalties. Typically, the form must be filed by the tax deadline, which is usually April fifteenth for most entities. However, certain extensions may apply, allowing for additional time to file. It is advisable to check the IRS website for the most current deadlines and any specific requirements related to your entity type.

Form Submission Methods (Online / Mail / In-Person)

The Form Rew 1 1041 can be submitted through various methods to accommodate different preferences. Options include:

- Online Submission: Use an eSignature platform to fill out and sign the form electronically, ensuring a quick and secure submission.

- Mail: Print the completed form and send it to the appropriate IRS address based on your entity type and location.

- In-Person: Some taxpayers may choose to deliver their forms directly to local IRS offices, although this method is less common.

Quick guide on how to complete form rew 1 1041 2017

Your assistance manual on how to prepare your Form Rew 1 1041

If you’re wondering how to create and distribute your Form Rew 1 1041, here are some succinct instructions on how to simplify tax filing.

To begin, all you need to do is register your airSlate SignNow profile to transform the way you manage documents online. airSlate SignNow is an intuitive and powerful document solution that enables you to modify, create, and finalize your tax files effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revisit to update responses where necessary. Streamline your tax handling with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps below to complete your Form Rew 1 1041 in a few minutes:

- Set up your account and start working on PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Hit Get form to access your Form Rew 1 1041 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-recognized eSignature (if needed).

- Review your document and correct any inaccuracies.

- Preserve changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting via paper can lead to more errors and delay refunds. Additionally, before electronically filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1041 2017

FAQs

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Which private college form should I fill out as I expect to get a 155 in the JEE Mains 2017?

Before trying to fill out private college forms, have a through knowing on filling up JOSAA, hope you will land up around +/- 25k rank in jee main, so you could easily get into iiit kanjeepuram and iiit Sri City, compared to last year data.

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1041 2017

How to create an eSignature for the Form Rew 1 1041 2017 online

How to generate an eSignature for the Form Rew 1 1041 2017 in Google Chrome

How to generate an eSignature for signing the Form Rew 1 1041 2017 in Gmail

How to make an electronic signature for the Form Rew 1 1041 2017 right from your mobile device

How to make an electronic signature for the Form Rew 1 1041 2017 on iOS devices

How to create an electronic signature for the Form Rew 1 1041 2017 on Android devices

People also ask

-

What is Form Rew 1 1041 and how does it work with airSlate SignNow?

Form Rew 1 1041 is a specific tax form used for reporting income and deductions on a U.S. federal tax return. With airSlate SignNow, you can easily upload, fill out, and eSign Form Rew 1 1041, streamlining the document management process for tax preparation. Our platform ensures that your forms are securely stored and accessible for future needs.

-

How can I integrate Form Rew 1 1041 into my existing workflow?

Integrating Form Rew 1 1041 into your workflow with airSlate SignNow is straightforward. You can connect our platform with popular applications like Google Drive, Dropbox, and Microsoft Office, making it easy to import and export your tax forms. This reduces manual entry and enhances efficiency in managing your tax documentation.

-

What are the pricing plans for using airSlate SignNow for Form Rew 1 1041?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. Whether you need basic features for small-scale use or advanced functionalities for larger operations, our plans ensure you can manage Form Rew 1 1041 and other documents cost-effectively. Check our website for detailed pricing options.

-

Can I collaborate with others on Form Rew 1 1041 using airSlate SignNow?

Yes, airSlate SignNow allows you to collaborate seamlessly with team members on Form Rew 1 1041. You can share documents, add comments, and track changes in real-time, ensuring everyone is on the same page during the tax preparation process. This feature enhances teamwork and increases productivity.

-

What security measures does airSlate SignNow implement for Form Rew 1 1041?

Security is a top priority at airSlate SignNow, especially for sensitive documents like Form Rew 1 1041. We employ advanced encryption protocols, secure data storage, and user authentication to safeguard your information. You can confidently eSign and send your tax forms knowing that your data is protected.

-

Is there customer support available for using Form Rew 1 1041?

Absolutely! airSlate SignNow provides dedicated customer support for users dealing with Form Rew 1 1041. Whether you have questions about eSigning or need assistance with form integration, our support team is available via chat, email, or phone to help you navigate any issues.

-

What features does airSlate SignNow offer for managing Form Rew 1 1041?

airSlate SignNow offers a variety of features to simplify the management of Form Rew 1 1041. You can create templates, add fields for signers, set signing order, and automate reminders for pending signatures. These tools enhance efficiency and ensure that your forms are completed accurately and on time.

Get more for Form Rew 1 1041

- Eap referral form

- Volcano maze form

- Signature page template form

- Mississippi title application 78 002 form

- Petition for review of real property valuation mohave county resource co mohave az form

- Trade name certificate form town of cheshire cheshirect

- Farm marketing plan the hueber report form

- Blueline investigations form

Find out other Form Rew 1 1041

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document