Form REW 1 1041 Real Estate Withholding Return for 99 2021

What is the Form REW 1 1041 Real Estate Withholding Return

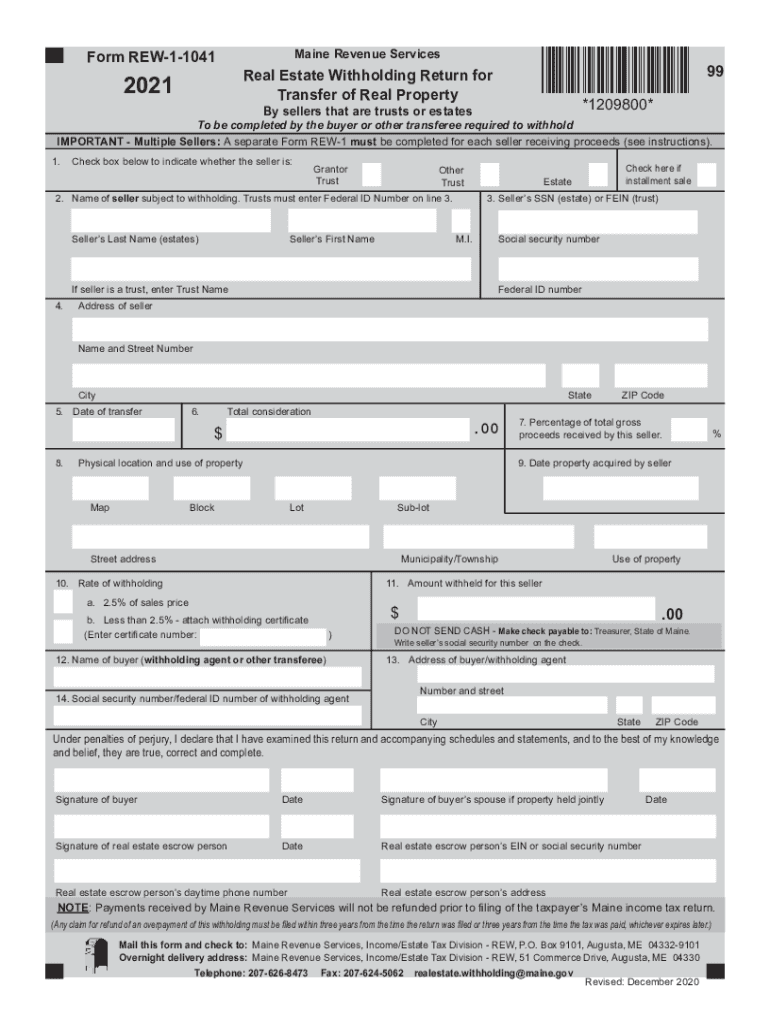

The Form REW 1 1041 is a crucial document used in the state of Maine for real estate transactions involving the withholding of state income tax. This form is specifically designed for sellers of real property who are required to report and remit a portion of the sales proceeds to the Maine Revenue Services. The withholding is typically calculated as a percentage of the sale price, ensuring that the state collects taxes owed on any capital gains realized from the sale. Understanding this form is essential for compliance with Maine tax laws and to avoid potential penalties.

Steps to Complete the Form REW 1 1041

Completing the Form REW 1 1041 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the seller's details, property address, and sale price. Next, calculate the withholding amount based on the applicable percentage set by the state. Fill in the form with the required information, ensuring that all fields are completed accurately. Finally, review the form for any errors before submitting it to the appropriate tax authority. Proper completion of this form is vital for both the seller and the buyer to fulfill their tax obligations.

Filing Deadlines / Important Dates

Timely filing of the Form REW 1 1041 is essential to avoid penalties. Generally, the form must be submitted to Maine Revenue Services at the time of the property transfer. It is advisable to check for any specific deadlines related to the transaction date, as these can vary based on the circumstances of the sale. Staying informed about these deadlines helps ensure compliance with state regulations and prevents unnecessary complications during the property transfer process.

Key Elements of the Form REW 1 1041

Several key elements must be included in the Form REW 1 1041 to ensure it is valid. These elements include the seller's name and address, the buyer's information, details about the property being sold, and the sale price. Additionally, the form requires the calculation of the withholding amount, which is a percentage of the sale price. Accurate reporting of these elements is crucial for the form's acceptance by tax authorities and for the proper withholding of state income tax.

Legal Use of the Form REW 1 1041

The legal use of the Form REW 1 1041 is governed by Maine tax law, which mandates that certain real estate transactions involve withholding state income tax. This form serves as a declaration of the withholding amount and must be filed correctly to comply with legal requirements. Failure to use the form appropriately can result in penalties for both the seller and the buyer, making it essential to understand the legal implications of the form and its requirements.

How to Obtain the Form REW 1 1041

The Form REW 1 1041 can be obtained through the Maine Revenue Services website or by contacting their office directly. It is essential to ensure that you are using the most current version of the form, as updates may occur. Additionally, local real estate offices or tax professionals may also provide access to this form, ensuring that sellers have the necessary resources to comply with withholding requirements during property transactions.

Quick guide on how to complete form rew 1 1041 real estate withholding return for 99 2021

Complete Form REW 1 1041 Real Estate Withholding Return For 99 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form REW 1 1041 Real Estate Withholding Return For 99 across all platforms using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to edit and electronically sign Form REW 1 1041 Real Estate Withholding Return For 99 with minimal effort

- Find Form REW 1 1041 Real Estate Withholding Return For 99 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Form REW 1 1041 Real Estate Withholding Return For 99 to guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1041 real estate withholding return for 99 2021

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1041 real estate withholding return for 99 2021

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is ME real estate withholding?

ME real estate withholding refers to the requirement for sellers to withhold a portion of the proceeds from the sale of real estate in Maine. This withholding is to ensure that tax obligations are met. Understanding this process is crucial for real estate transactions in the state.

-

How does airSlate SignNow help with ME real estate withholding?

airSlate SignNow streamlines the process of eSigning and managing documents related to ME real estate withholding. With our user-friendly platform, users can quickly prepare, send, and sign necessary documents, making compliance easier and faster. This ensures a seamless transaction process for all parties involved.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including options tailored for real estate professionals handling ME real estate withholding. Pricing is designed to be cost-effective, allowing users to select a plan that fits their usage and budget while maintaining access to essential features.

-

Can airSlate SignNow integrate with other software for real estate transactions?

Yes, airSlate SignNow integrates smoothly with numerous software applications frequently used in real estate transactions. This includes CRMs, accounting software, and transaction management tools, which enhances workflow efficiency. Such integrations are especially beneficial when managing ME real estate withholding tasks.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides key features such as electronic signatures, document templates, and tracking tools to manage the entire document lifecycle. These features are crucial for managing ME real estate withholding documents. Users can easily customize templates to fit specific transaction needs.

-

How secure is airSlate SignNow for handling sensitive documents?

Security is a top priority for airSlate SignNow, which utilizes industry-standard encryption to protect sensitive documents. This ensures that information related to ME real estate withholding remains confidential and secure. Regular security audits provide additional peace of mind for users.

-

What benefits do users experience when using airSlate SignNow for real estate?

Users of airSlate SignNow experience a range of benefits, including increased efficiency, improved compliance, and reduced paperwork. The platform's simplicity helps real estate professionals easily manage processes related to ME real estate withholding, resulting in faster transactions and happier clients.

Get more for Form REW 1 1041 Real Estate Withholding Return For 99

- Texas employer new hire reporting form pdf

- Twia lost policy voucher form

- Rent relief attestation form

- Unplanned intensive care unit admission following elective form

- Black oak casino winloss statement request form first name last name street address city state zip code birthdaymdy year of

- City of louisville speed hump form

- Sex offender safety plan example 467356333 form

- Template how to write an interior design contract form

Find out other Form REW 1 1041 Real Estate Withholding Return For 99

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template