Me Real Form 2018

What is the Me Real Form

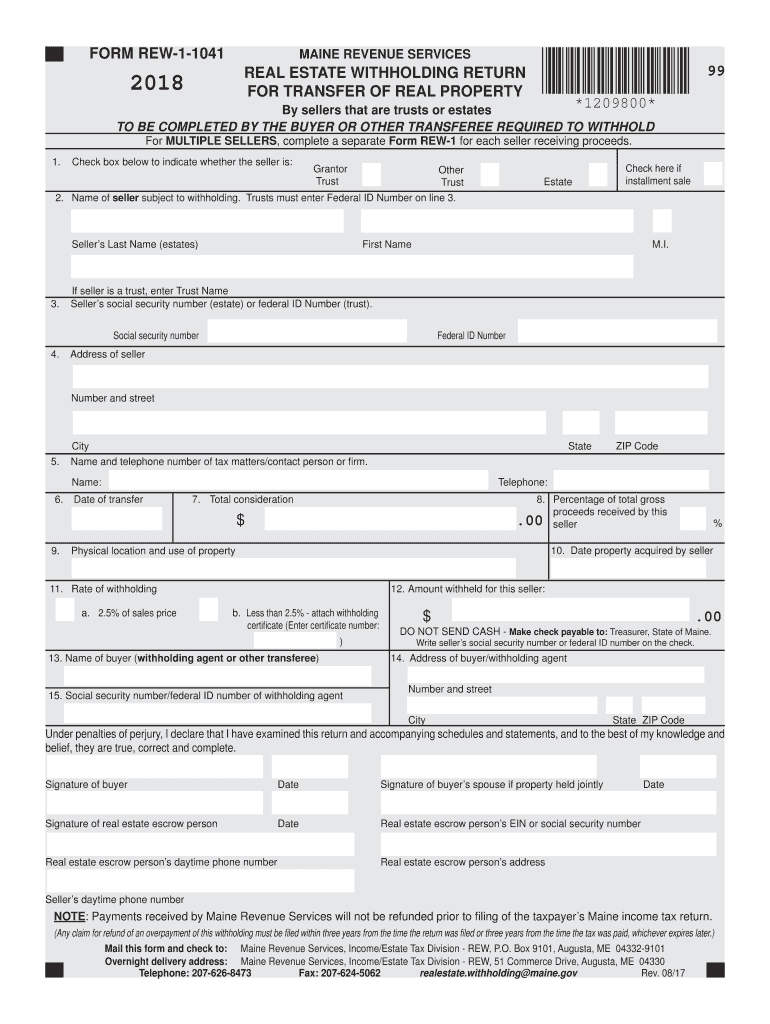

The Me Real Form is a specific document used in various legal and administrative contexts, particularly in the state of Maine. It serves as a means for individuals to provide essential personal and financial information. This form is crucial for ensuring compliance with state regulations and may be required for various applications, including tax filings and legal documentation. Understanding its purpose and requirements is essential for proper completion and submission.

How to use the Me Real Form

Using the Me Real Form involves several straightforward steps. First, ensure you have the correct version of the form, as updates may occur. Next, gather all necessary information, including personal details, financial data, and any relevant identification numbers. Carefully fill out each section of the form, ensuring accuracy to avoid delays or issues. Once completed, review the form for any errors before submitting it according to the specified guidelines.

Steps to complete the Me Real Form

Completing the Me Real Form requires attention to detail. Follow these steps for a successful submission:

- Obtain the latest version of the Me Real Form from an official source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, ensuring accuracy in names, addresses, and identification numbers.

- Provide any required financial information, including income and assets.

- Review the completed form for any mistakes or missing information.

- Submit the form as directed, either online, by mail, or in person.

Legal use of the Me Real Form

The Me Real Form is legally recognized and must be used in accordance with state laws. It is essential to complete the form accurately to ensure compliance with legal requirements. Incorrect or incomplete submissions may lead to penalties or delays in processing. Understanding the legal implications of the information provided is crucial for maintaining compliance and avoiding potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Me Real Form can vary based on the specific context in which it is used. It is important to be aware of these deadlines to ensure timely submission. Typically, deadlines may align with tax filing dates or specific legal requirements. Always check the latest updates from official sources to confirm the relevant dates and avoid any penalties for late submissions.

Required Documents

When preparing to submit the Me Real Form, certain documents may be required to support the information provided. Commonly needed documents include:

- Identification documents, such as a driver's license or Social Security card.

- Financial statements or records that verify income and assets.

- Previous tax returns, if applicable.

- Any additional documentation requested in the form instructions.

Form Submission Methods (Online / Mail / In-Person)

The Me Real Form can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal, which may offer the fastest processing time.

- Mailing the completed form to the appropriate address, ensuring it is sent well before the deadline.

- In-person submission at designated offices, which may provide immediate confirmation of receipt.

Quick guide on how to complete form rew 1 1041 2018 2019

Your assistance manual on how to prepare your Me Real Form

If you’re curious about how to finalize and submit your Me Real Form, here are a few concise guidelines on how to simplify tax submission.

To begin, all you need to do is create your airSlate SignNow account to revolutionize how you handle documents online. airSlate SignNow is an exceptionally user-friendly and powerful document management solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editing features, you can toggle between text, checkboxes, and eSignatures, returning to update responses when necessary. Optimize your tax processes with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the steps below to complete your Me Real Form in a matter of minutes:

- Create your account and begin handling PDFs in moments.

- Access our library to acquire any IRS tax form; browse through different versions and schedules.

- Click Obtain form to launch your Me Real Form in our editor.

- Populate the necessary fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to insert your legally-recognized eSignature (if applicable).

- Examine your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Use this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that paper filing can result in errors and delays in reimbursements. Before e-filing your taxes, make sure to consult the IRS website for filing regulations in your location.

Create this form in 5 minutes or less

Find and fill out the correct form rew 1 1041 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill out the JEE Mains 2018 form after 1 Jan?

No students cannot fill the JEE Main 2018 application or admission form after 1 January. If they want to updated with details, so can visit at

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the CBSE class 12th compartment 2018 online form?

Here is the details:Step 1: Visit the official website www.cbse.nic.in.Step 2: Check out the “Recent Announcements” section.Step 3: Click on “Online Application for Class XII Compartment”Step 4: Now look for “Online Submission of LOC for Compartment/IOP Exam 2018” or “Online Application for Private Candidate for Comptt/IOP Examination 2018”.Step 5: Select a suitable link as per your class. Enter Roll Number, School Code, Centre Number and click on “Proceed” Button.Step 6: Now a form will be displayed on the screen. Fill the form carefully and submit. Pay attention and fill all your details correctly. If your details are incorrect, your form may get rejected.Step 7: After filling all your details correctly, upload the scanned copy of your photo and signature.Step 8: After uploading all your documents, go to the fee payment option. You can pay the fee via demand draft or e-challan.Step 9: After making the payment click on “Submit” button and take printout of confirmation page.Step 10: Now you have to send your documents to the address of regional office within 7 days. Documents including the photocopy of the confirmation page, photocopy of marksheet and e-challan or if you have paid via demand draft, then the original DD must be sent.Students who have successfully registered themselves for the exam may download their CBSE Compartment Admit Card once it is available on the official website.I hope you got your answer.

Create this form in 5 minutes!

How to create an eSignature for the form rew 1 1041 2018 2019

How to generate an eSignature for your Form Rew 1 1041 2018 2019 in the online mode

How to create an eSignature for the Form Rew 1 1041 2018 2019 in Chrome

How to create an electronic signature for putting it on the Form Rew 1 1041 2018 2019 in Gmail

How to make an electronic signature for the Form Rew 1 1041 2018 2019 right from your smart phone

How to create an electronic signature for the Form Rew 1 1041 2018 2019 on iOS devices

How to make an electronic signature for the Form Rew 1 1041 2018 2019 on Android devices

People also ask

-

What is the 'me real form' and how does it work?

The 'me real form' is an advanced feature of airSlate SignNow that allows users to create, send, and eSign forms efficiently. By streamlining your document signing process, this tool ensures that you can complete transactions swiftly and securely, meeting your business needs effortlessly.

-

Is there a cost associated with using the 'me real form' feature?

Yes, the 'me real form' feature is available through various pricing plans tailored to fit different business sizes and needs. airSlate SignNow offers competitive pricing, making it a cost-effective solution for managing documents and electronic signatures.

-

What key benefits does the 'me real form' offer?

The 'me real form' offers numerous benefits, including enhanced efficiency, improved accuracy, and reduced turnaround times for document processes. With this feature, businesses can automate several tasks, allowing them to focus on growth and productivity.

-

Can I integrate 'me real form' with other applications?

'Me real form' integrates seamlessly with various applications, enhancing your workflow and streamlining processes. airSlate SignNow supports integration with services like Google Drive, Salesforce, and others, which allows for a cohesive experience across your business tools.

-

Is 'me real form' user-friendly for non-technical users?

Absolutely, the 'me real form' is designed to be intuitive and easy to use, even for those who are not technically inclined. airSlate SignNow provides a straightforward interface that guides users through the process, ensuring that everyone can take advantage of its features.

-

How secure is the 'me real form' feature?

Security is a top priority with the 'me real form.' airSlate SignNow employs advanced encryption standards and secure protocols to protect your data and ensure compliance with industry regulations, giving you peace of mind while handling sensitive documents.

-

What types of documents can I use with 'me real form'?

'Me real form' can be used with a wide range of documents, including contracts, agreements, and forms of all types. This flexibility makes it suitable for various industries, enabling businesses to manage their documents more effectively.

Get more for Me Real Form

- Medical imaging exam request form intermountain healthcare intermountainhealthcare

- Pto forms

- Molecule models model to formula huskers k12 mo

- Biodata printable form

- Revised bworksheetb for affidavit tier 1a attempted to apply bb mybfaa form

- Ordained minister and ministerial internship program mip form

- Application instructions nashville school of law form

- Tn motor vehicle commission form

Find out other Me Real Form

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document