Trusts Must Enter Federal ID Number on Line 3 2020

Understanding the Federal ID Number Requirement

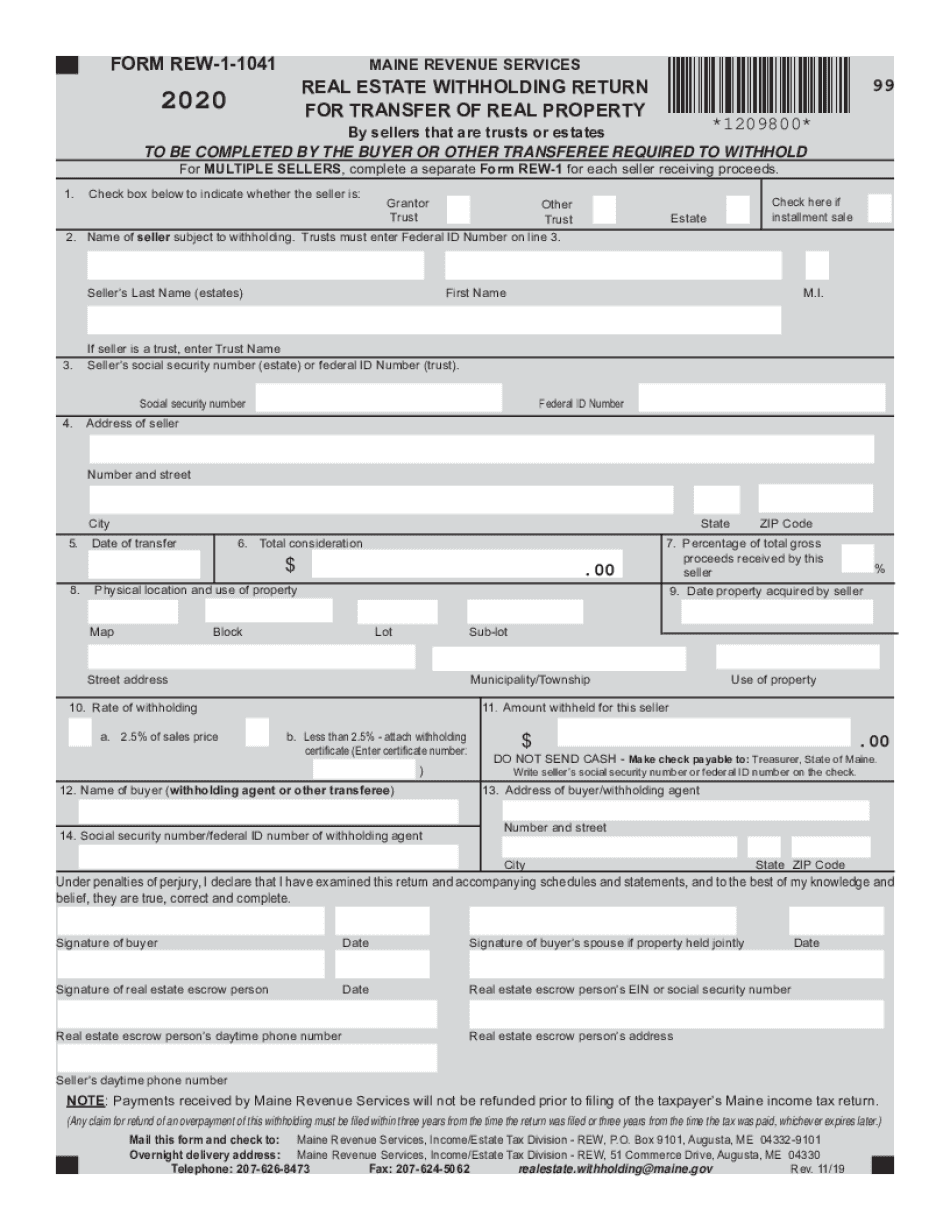

The me real form requires trusts to enter a Federal ID number on Line 3. This number, also known as the Employer Identification Number (EIN), is essential for identifying the trust in tax matters. It is similar to a Social Security number but is specifically designated for businesses and trusts.

How to Obtain the Federal ID Number

To obtain a Federal ID number, trusts must complete an application with the IRS. This can be done online through the IRS website, by mail, or via fax. The online application is the fastest method, allowing for immediate issuance of the EIN upon completion. Trusts should have the necessary information ready, including the legal name of the trust, the name and Social Security number of the trustee, and the trust's formation date.

Steps to Complete the Form Accurately

Completing the me real form accurately is crucial for compliance. Follow these steps:

- Gather necessary documents, including the trust agreement and any prior tax returns.

- Ensure the trust's name and Federal ID number are correctly entered on Line 3.

- Review all entries for accuracy before submission.

- Consult a tax professional if unsure about any information.

Legal Use of the Federal ID Number

The Federal ID number is legally required for trusts that have employees or are required to file certain tax returns. Using the correct number ensures that the trust complies with federal tax regulations. Failure to provide a valid Federal ID number may result in delays in processing the me real form and potential penalties.

Filing Deadlines and Important Dates

Trusts must be aware of specific filing deadlines associated with the me real form. Generally, the form should be filed by the due date of the trust's tax return. It's important to check the IRS guidelines for any changes to deadlines, which can vary year by year.

Penalties for Non-Compliance

Failure to comply with the requirements of the me real form can result in penalties. These may include fines for late filing or incorrect information. Trusts should ensure they understand their obligations to avoid unnecessary costs and complications.

Quick guide on how to complete trusts must enter federal id number on line 3

Finish Trusts Must Enter Federal ID Number On Line 3 effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, adjust, and eSign your documents swiftly without hold-ups. Handle Trusts Must Enter Federal ID Number On Line 3 on any gadget using airSlate SignNow's Android or iOS applications, and simplify any document-related task today.

How to modify and eSign Trusts Must Enter Federal ID Number On Line 3 with ease

- Obtain Trusts Must Enter Federal ID Number On Line 3 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of the documents or censor sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to save your edits.

- Choose how you prefer to send your form, via email, SMS, invitation link, or download it to your computer.

Put an end to lost or misplaced records, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Trusts Must Enter Federal ID Number On Line 3 and guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct trusts must enter federal id number on line 3

Create this form in 5 minutes!

How to create an eSignature for the trusts must enter federal id number on line 3

The best way to generate an eSignature for a PDF in the online mode

The best way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to create an eSignature right from your smart phone

How to create an eSignature for a PDF on iOS devices

How to create an eSignature for a PDF on Android OS

People also ask

-

What is the 'me real form' feature in airSlate SignNow?

The 'me real form' feature in airSlate SignNow allows users to create, manage, and send fillable forms securely and efficiently. This feature streamlines the process of gathering information and obtaining signatures, making it perfect for businesses of all sizes. By utilizing 'me real form,' you can enhance your document workflows and ensure compliance effortlessly.

-

How does airSlate SignNow's pricing work for the 'me real form' feature?

airSlate SignNow offers flexible pricing plans that include access to the 'me real form' feature. You can choose from various tiers based on your business needs, whether you’re a small team or a larger organization. This transparency in pricing allows you to find a plan that fits your budget while benefiting from powerful features.

-

What are the benefits of using 'me real form' in airSlate SignNow?

Using 'me real form' in airSlate SignNow provides numerous benefits, such as increased efficiency in data collection and improved accuracy in document management. Additionally, it enhances collaboration and speeds up the signature process, allowing you to close deals faster. Ultimately, this feature contributes to a more productive workflow for your business.

-

Can I integrate 'me real form' with other applications?

Yes, airSlate SignNow supports integrations with various applications, enhancing the functionality of the 'me real form' feature. You can connect it to popular tools such as CRMs, project management software, and cloud storage services. These integrations allow for a seamless flow of information and maintain consistency across your business processes.

-

Is 'me real form' suitable for businesses of all sizes?

Absolutely! The 'me real form' feature in airSlate SignNow is designed to cater to businesses of any size, from startups to large enterprises. No matter your industry, you can easily implement this solution into your existing workflows and see immediate improvements in efficiency and productivity.

-

How secure is the 'me real form' feature?

The security of your documents is a top priority for airSlate SignNow. The 'me real form' feature employs robust encryption and complies with industry-standard security protocols to protect your data. You can confidently send and receive information, knowing that your sensitive documents are secure.

-

What types of documents can I create with 'me real form'?

With the 'me real form' feature in airSlate SignNow, you can create a variety of document types, including contracts, agreements, application forms, and more. This flexibility allows you to tailor your documents according to your specific needs and ensure they are optimized for efficient processing. It's an invaluable tool for any business looking to streamline documentation.

Get more for Trusts Must Enter Federal ID Number On Line 3

Find out other Trusts Must Enter Federal ID Number On Line 3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors