Form 8453 Pe Instructions 2013

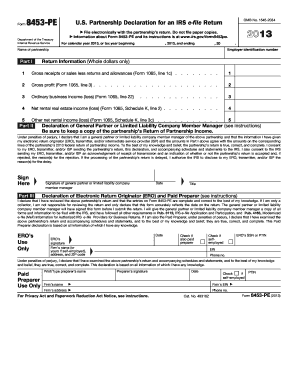

What is the Form 8453 PE?

The Form 8453 PE is a document used by partnerships to electronically file their tax returns with the IRS. This form serves as a declaration that the partnership has authorized an electronic return originator (ERO) to submit their return electronically. It acts as a signature document, ensuring that the partnership's return is valid and compliant with IRS regulations. Understanding the purpose of this form is crucial for partnerships looking to streamline their tax filing process.

Steps to Complete the Form 8453 PE

Completing the Form 8453 PE involves several important steps to ensure accuracy and compliance. Here’s a concise guide:

- Gather necessary information, including the partnership's name, address, and Employer Identification Number (EIN).

- Provide details of the ERO, including their name and EFIN (Electronic Filing Identification Number).

- Review the partnership's tax return to ensure all information is correct before signing.

- Sign and date the form, ensuring that the authorized partner or member of the partnership completes this step.

- Submit the completed form along with the electronic tax return to the ERO for filing.

Legal Use of the Form 8453 PE

The legal validity of the Form 8453 PE hinges on its compliance with IRS regulations. When filled out correctly, it serves as an official record of the partnership's intent to file electronically. It is essential that the form is signed by an authorized individual within the partnership, as this signature validates the submission. The IRS recognizes eSignatures as legally binding, provided they meet specific criteria outlined in the ESIGN Act and UETA.

IRS Guidelines for Form 8453 PE

The IRS provides specific guidelines for the completion and submission of the Form 8453 PE. These guidelines include:

- Ensuring that all information on the form matches the partnership's tax return.

- Maintaining a copy of the signed form for the partnership's records.

- Filing the form with the electronic return, as it cannot be submitted separately.

- Adhering to deadlines for electronic filing to avoid penalties.

Form Submission Methods

The Form 8453 PE must be submitted electronically through an authorized ERO. Partnerships cannot file this form directly with the IRS. The ERO will transmit the form along with the electronic tax return. It is important for partnerships to choose a reliable ERO to ensure that their forms are submitted accurately and on time.

Required Documents for Form 8453 PE

To complete the Form 8453 PE, partnerships need to have several documents on hand, including:

- The partnership's tax return, which includes all necessary schedules and attachments.

- Documentation supporting any claims or deductions made on the return.

- The ERO's identifying information, including their EFIN.

Quick guide on how to complete form 8453 pe instructions

Effortlessly Prepare Form 8453 Pe Instructions on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documentation, enabling you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage Form 8453 Pe Instructions on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related processes today.

Efficiently Modify and eSign Form 8453 Pe Instructions with Ease

- Find Form 8453 Pe Instructions and click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize signNow sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8453 Pe Instructions to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8453 pe instructions

Create this form in 5 minutes!

People also ask

-

What is form 8453 pe?

Form 8453 pe is an IRS document used for the electronic filing of certain tax returns. It serves as an e-signature authorization, allowing you to submit documents digitally. By using airSlate SignNow, you can easily eSign form 8453 pe and streamline your e-filing process.

-

How does airSlate SignNow support form 8453 pe e-signatures?

airSlate SignNow provides a user-friendly interface for signing form 8453 pe electronically. With our platform, you can quickly create and send the document for e-signature, ensuring compliance with IRS regulations. This simplifies the process and saves valuable time when handling tax filings.

-

Is airSlate SignNow cost-effective for eSigning form 8453 pe?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it cost-effective for eSigning form 8453 pe. Our subscriptions include features specifically designed to facilitate document management. You can choose a plan that best fits your budget while ensuring efficient e-signature processes.

-

What features does airSlate SignNow offer for form 8453 pe?

airSlate SignNow includes several features to enhance your experience with form 8453 pe, such as customizable templates, real-time tracking, and team collaboration tools. These features enable you to manage your document workflows efficiently. Additionally, you can integrate your existing tools to further streamline operations.

-

Can I track the status of my form 8453 pe with airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your form 8453 pe in real-time. This means you’ll get notifications when the document is viewed, signed, or completed. Such transparency helps you stay on top of your e-signature processes.

-

Does airSlate SignNow integrate with other applications for form 8453 pe?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing for easier management of form 8453 pe. You can connect it with popular software like Google Drive, Dropbox, and others to enhance your document workflows. These integrations ensure a smooth experience across your business tools.

-

What are the benefits of using airSlate SignNow for form 8453 pe?

Using airSlate SignNow for form 8453 pe offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. By going digital, you minimize errors and speed up approval processes. Additionally, our platform is designed to protect sensitive information during the e-signing process.

Get more for Form 8453 Pe Instructions

- Discovery interrogatories from defendant to plaintiff with production requests virginia form

- Va discovery form

- Quitclaim deed husband and wife to trust virginia form

- Virginia husband wife 497428007 form

- Warranty deed two individuals to one individual virginia form

- Virginia escheat form

- Custodial trust act form

- Va custodial form

Find out other Form 8453 Pe Instructions

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe