How to Adjust Already Filed Partnership Returns under BBA CroweAdministrative Adjustment Requests under the BBA the Tax AdviserA 2022

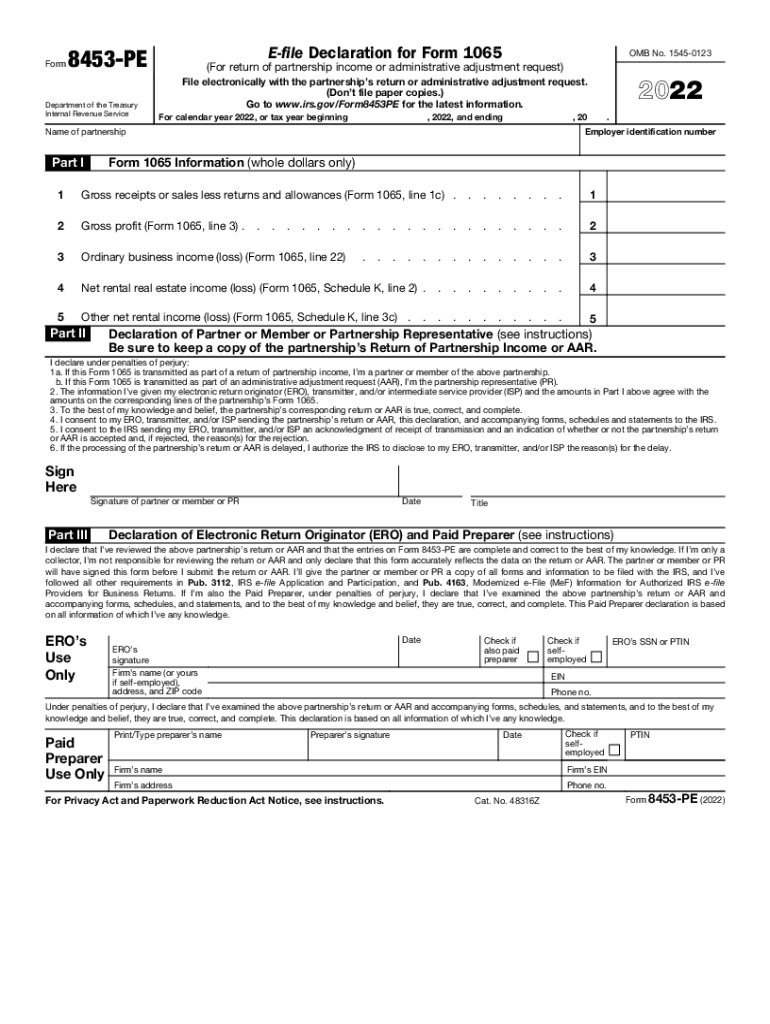

IRS Guidelines for Form 1065

The Internal Revenue Service (IRS) provides specific guidelines for completing Form 1065, which is essential for partnerships to report their income, deductions, and credits. Understanding these guidelines helps ensure compliance and accuracy in reporting. The IRS outlines the necessary sections to complete, including partner information, income details, and deductions. It's important to refer to the latest IRS instructions for Form 1065 to stay updated on any changes that may affect filing requirements.

Filing Deadlines and Important Dates

Timely filing of Form 1065 is crucial to avoid penalties. The IRS requires partnerships to file Form 1065 by March 15 for calendar year filers. If additional time is needed, partnerships can apply for a six-month extension, which moves the deadline to September 15. It's essential to keep track of these dates to ensure compliance and avoid late filing penalties.

Required Documents for Filing

To successfully complete Form 1065, partnerships must gather several documents, including:

- Partnership agreement

- Financial statements

- Records of income and expenses

- Partner K-1 forms for each partner

Having these documents ready will streamline the filing process and help ensure that all necessary information is accurately reported.

Form Submission Methods

Partnerships have multiple options for submitting Form 1065. The form can be filed electronically through the IRS e-file system, which is often the fastest method. Alternatively, partnerships may choose to submit the form by mail or in person at designated IRS offices. Each method has its own processing times and requirements, so selecting the most suitable option is important for timely compliance.

Penalties for Non-Compliance

Failure to file Form 1065 on time can result in significant penalties. The IRS imposes a penalty for each month the return is late, up to a maximum of twelve months. Additionally, incorrect or incomplete filings can lead to further penalties. Understanding these potential consequences emphasizes the importance of accurate and timely submissions.

Digital vs. Paper Version of Form 1065

Choosing between the digital and paper versions of Form 1065 can impact the filing experience. The digital version, available through the IRS e-file system, often offers faster processing and confirmation of receipt. In contrast, the paper version may take longer to process and does not provide immediate confirmation. Evaluating the benefits of each option can help partnerships decide the best method for their needs.

Quick guide on how to complete how to adjust already filed partnership returns under bba croweadministrative adjustment requests under the bba the tax

Accomplish How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Manage How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

The simplest way to modify and eSign How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA with ease

- Locate How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with the tools offered by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then hit the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA to guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to adjust already filed partnership returns under bba croweadministrative adjustment requests under the bba the tax

Create this form in 5 minutes!

People also ask

-

What is the internal revenue service e file solution offered by airSlate SignNow?

The internal revenue service e file solution from airSlate SignNow allows businesses to electronically sign and submit tax documents directly to the IRS. This process simplifies compliance and ensures that submissions are secure and timely. By using our platform, you can efficiently manage your tax documents with minimal hassle.

-

How much does airSlate SignNow's internal revenue service e file feature cost?

airSlate SignNow offers competitive pricing plans tailored for businesses of all sizes. Our internal revenue service e file feature is included in various subscription options, which provide great value considering the efficiency it adds to tax filing. You can find detailed pricing information on our website tailored to your needs.

-

What are the key features of the internal revenue service e file service?

The internal revenue service e file service includes features such as document templates, automatic reminders, and secure storage. Additionally, real-time collaboration and tracking ensure that all stakeholders stay informed throughout the e-filing process. This comprehensive feature set simplifies tax document management.

-

How can airSlate SignNow help with compliance when using the internal revenue service e file?

Using airSlate SignNow for your internal revenue service e file needs helps ensure compliance with IRS regulations. Our platform provides audit trails and secure document storage, making it easy to keep track of your submissions. Ensuring compliance reduces the risk of potential penalties and enhances your overall tax management strategy.

-

Does airSlate SignNow integrate with accounting software for internal revenue service e file submissions?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, enhancing your internal revenue service e file experience. This integration allows for the smooth transfer of financial data and documents between your accounting tools and our e-signature platform. Consequently, it streamlines the entire tax filing process.

-

What benefits does eSigning offer for internal revenue service e file submissions?

eSigning through airSlate SignNow signNowly speeds up the internal revenue service e file process, allowing for quicker submission and confirmation of documents. The security features ensure that sensitive tax information remains protected. Additionally, the ease of use promotes better collaboration among your team members.

-

Is it easy to use airSlate SignNow for the internal revenue service e file process?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. The intuitive interface allows users with minimal tech experience to navigate the internal revenue service e file process effortlessly, ensuring a smooth experience from document preparation to e-signature.

Get more for How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497322440 form

- Ohio marital property form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497322442 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497322443 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts effective 497322444 form

- Ohio dissolution package to dissolve corporation ohio form

- Ohio dissolution package to dissolve limited liability company llc ohio form

- Living trust for husband and wife with no children ohio form

Find out other How To Adjust Already filed Partnership Returns Under BBA CroweAdministrative Adjustment Requests Under The BBA The Tax AdviserA

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form