About Form 8453 PE, U S Partnership Declaration for an 2024

Overview of Form 8453-PE: U.S. Partnership Declaration

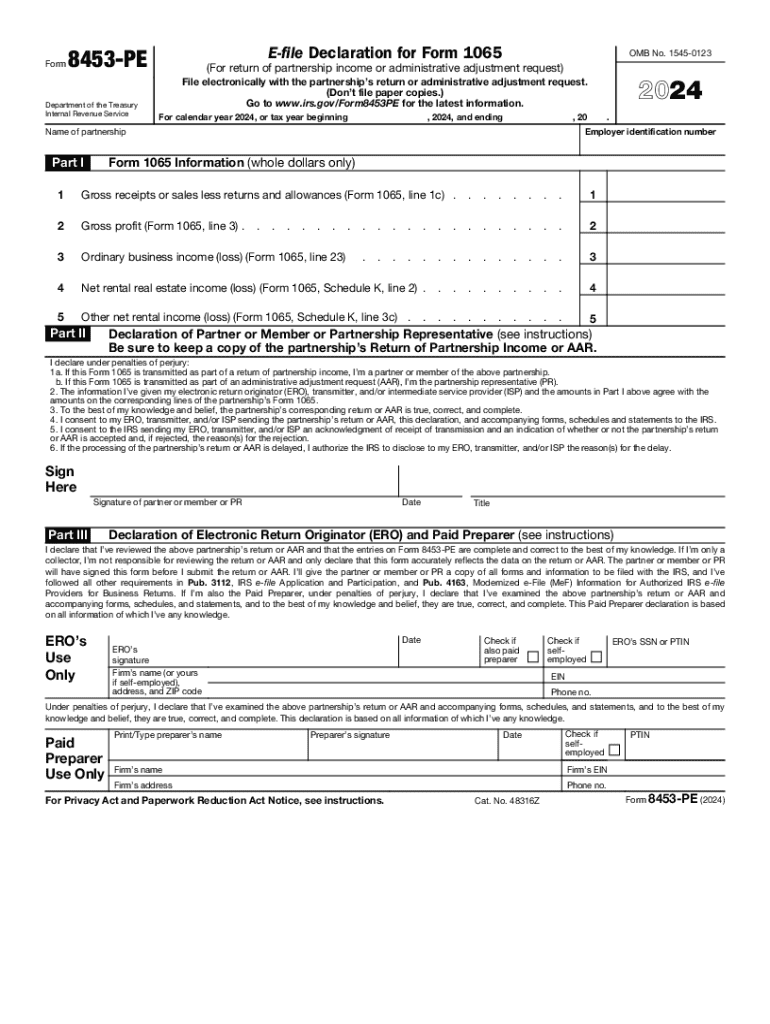

Form 8453-PE is a crucial document used by partnerships to declare their electronic filing of tax returns with the Internal Revenue Service (IRS). This form serves as a declaration that the partnership's electronic return has been completed and is accurate. It is essential for ensuring compliance with IRS regulations and provides a means for partners to authorize the electronic submission of their tax information.

How to Use Form 8453-PE

To effectively utilize Form 8453-PE, partnerships must complete it after preparing their electronic tax return. The form requires signatures from all partners, confirming their agreement with the information submitted. It is important to ensure that the form is filed alongside the electronic return, as it acts as a declaration of authenticity for the submitted data. Partnerships should retain a copy of the signed form for their records.

Steps to Complete Form 8453-PE

Completing Form 8453-PE involves several key steps:

- Gather necessary information, including the partnership's name, address, and Employer Identification Number (EIN).

- Ensure all partners review the electronic return for accuracy.

- Have each partner sign the form to indicate their approval of the electronic submission.

- Submit the signed form along with the electronic tax return to the IRS.

Filing Deadlines for Form 8453-PE

Partnerships must adhere to specific filing deadlines when submitting Form 8453-PE. Generally, the electronic return, along with the completed form, is due on the 15th day of the third month following the end of the partnership's tax year. It is crucial to be aware of these deadlines to avoid penalties and ensure timely compliance with IRS requirements.

Required Documents for Form 8453-PE

When preparing to submit Form 8453-PE, partnerships should have the following documents ready:

- The completed electronic tax return.

- Any supporting documentation related to income, deductions, and credits.

- Identification information for all partners, including their Social Security Numbers or EINs.

IRS Guidelines for Form 8453-PE

The IRS provides specific guidelines for the completion and submission of Form 8453-PE. Partnerships should familiarize themselves with these guidelines to ensure compliance. This includes understanding the requirements for electronic signatures, the importance of accuracy in the information provided, and the implications of failing to submit the form correctly.

Create this form in 5 minutes or less

Find and fill out the correct about form 8453 pe u s partnership declaration for an

Create this form in 5 minutes!

How to create an eSignature for the about form 8453 pe u s partnership declaration for an

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the internal revenue service e file and how does it work?

The internal revenue service e file is a method that allows taxpayers to electronically submit their tax returns to the IRS. By using airSlate SignNow, you can easily prepare and eSign your documents, ensuring a smooth submission process. This method is not only faster but also reduces the chances of errors compared to traditional paper filing.

-

How can airSlate SignNow help with the internal revenue service e file process?

airSlate SignNow streamlines the internal revenue service e file process by providing an intuitive platform for document preparation and electronic signatures. With our solution, you can quickly gather necessary signatures and send documents securely, making tax filing more efficient. This helps you meet IRS deadlines without the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for internal revenue service e file?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, making it cost-effective for internal revenue service e file submissions. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required. This ensures you only pay for what you need while benefiting from our comprehensive eSigning capabilities.

-

Are there any features specifically designed for internal revenue service e file?

Yes, airSlate SignNow includes features tailored for the internal revenue service e file process, such as customizable templates and automated workflows. These tools help you prepare your tax documents efficiently and ensure compliance with IRS requirements. Additionally, our platform allows for real-time tracking of document status, giving you peace of mind during the filing process.

-

What benefits does airSlate SignNow provide for businesses filing with the internal revenue service e file?

Using airSlate SignNow for the internal revenue service e file offers numerous benefits, including increased efficiency and reduced turnaround times. Our platform minimizes the risk of errors and ensures that all necessary signatures are collected promptly. This not only saves time but also enhances the overall accuracy of your tax submissions.

-

Can airSlate SignNow integrate with other software for internal revenue service e file?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, enhancing your internal revenue service e file experience. This integration allows for easy data transfer and document management, ensuring that your tax filings are accurate and up-to-date. You can connect with popular platforms to streamline your workflow further.

-

Is airSlate SignNow secure for handling internal revenue service e file documents?

Yes, airSlate SignNow prioritizes security, making it a safe choice for handling internal revenue service e file documents. Our platform employs advanced encryption and security protocols to protect your sensitive information. You can confidently eSign and send your tax documents, knowing that they are secure throughout the process.

Get more for About Form 8453 PE, U S Partnership Declaration For An

Find out other About Form 8453 PE, U S Partnership Declaration For An

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form