Internal Revenue Service 2021

What is the Internal Revenue Service

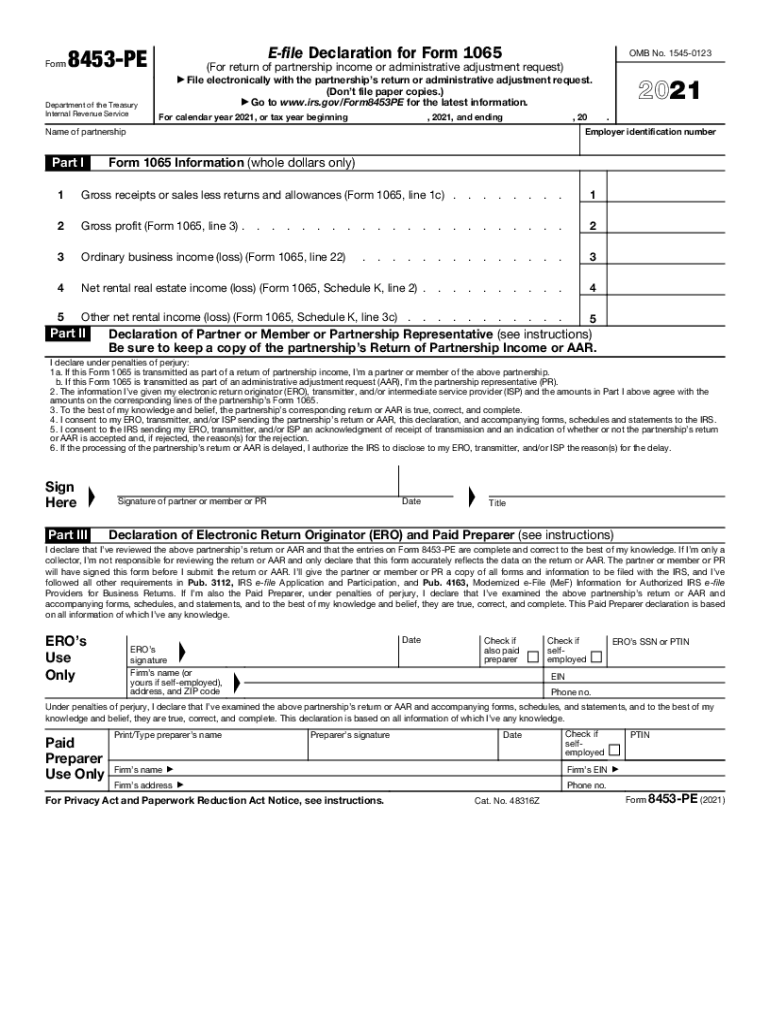

The Internal Revenue Service (IRS) is the U.S. government agency responsible for the administration and enforcement of federal tax laws. Established in 1862, the IRS plays a crucial role in collecting taxes, processing tax returns, and ensuring compliance with tax regulations. It operates under the Department of the Treasury and is tasked with managing various tax-related services, including the issuance of forms such as the 2021 internal revenue service form.

Steps to complete the Internal Revenue Service form

Filling out the 2021 internal revenue service form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, including income statements and previous tax returns. Next, fill out the form carefully, ensuring all information is correct. Pay attention to specific sections that may require additional documentation or signatures. Once completed, review the form for any errors before submission. Finally, choose your submission method, whether electronically or via mail, to ensure timely processing.

Filing Deadlines / Important Dates

Understanding filing deadlines is essential for compliance with IRS regulations. For the 2021 tax year, individual taxpayers typically must file their returns by April 15, 2022. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Extensions may be available, but it's important to file for an extension before the original deadline to avoid penalties. Staying informed about these dates helps ensure that taxpayers meet their obligations without incurring late fees.

Required Documents

When preparing to fill out the 2021 internal revenue service form, certain documents are essential for accurate reporting. Taxpayers should gather W-2 forms from employers, 1099 forms for any freelance or contract work, and records of any other income sources. Additionally, documentation for deductions, such as mortgage interest statements and medical expenses, should be compiled. Having these documents ready will streamline the filing process and help ensure all income and deductions are reported correctly.

Form Submission Methods (Online / Mail / In-Person)

The IRS offers multiple methods for submitting the 2021 internal revenue service form, catering to different preferences and needs. Taxpayers can file electronically using IRS-approved e-filing software, which often provides a more efficient and faster processing time. Alternatively, forms can be printed and mailed to the appropriate IRS address. Some taxpayers may also choose to file in person at designated IRS offices. Each method has its own advantages, and selecting the right one can depend on individual circumstances.

Penalties for Non-Compliance

Failing to comply with IRS regulations can lead to significant penalties. Taxpayers who do not file their 2021 internal revenue service form by the deadline may incur late filing fees, which can increase over time. Additionally, underreporting income or failing to pay taxes owed can result in penalties and interest charges. It is crucial for taxpayers to understand these potential consequences and take proactive steps to ensure compliance with all tax obligations.

Quick guide on how to complete 2021 internal revenue service 581856268

Effortlessly Prepare Internal Revenue Service on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct format and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to Edit and eSign Internal Revenue Service with Ease

- Locate Internal Revenue Service and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the document or conceal sensitive information with the tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all information and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Internal Revenue Service and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 internal revenue service 581856268

Create this form in 5 minutes!

People also ask

-

What is the 2021 internal revenue service form and why is it important?

The 2021 internal revenue service form refers to the official documentation required by the IRS for tax filing purposes in 2021. It is important because it ensures compliance with tax laws and helps individuals and businesses accurately report their income and claim deductions. Utilizing tools like airSlate SignNow can streamline the process of filling out and submitting these forms.

-

How can airSlate SignNow help with the 2021 internal revenue service form?

AirSlate SignNow simplifies the process of preparing and eSigning the 2021 internal revenue service form. Its user-friendly interface allows you to easily fill in necessary information, and securely send and receive documents, making tax season less stressful. This digital process can save time and reduce error rates.

-

Is there a cost associated with using airSlate SignNow for the 2021 internal revenue service form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different needs when handling the 2021 internal revenue service form. You can choose from different tiers based on features and usage levels, ensuring you have a cost-effective solution for your document signing and management needs.

-

What features does airSlate SignNow offer for managing the 2021 internal revenue service form?

AirSlate SignNow provides features like document templates, easy eSigning, and secure cloud storage, all designed to facilitate the management of the 2021 internal revenue service form. These tools help ensure accuracy and compliance while allowing you to track document status in real time.

-

Can I integrate airSlate SignNow with other tools to assist with the 2021 internal revenue service form?

Absolutely! AirSlate SignNow offers integrations with popular software such as Google Drive, Salesforce, and Microsoft applications. This allows users to efficiently manage the 2021 internal revenue service form within their existing workflows, enhancing productivity and ease of use.

-

What are the benefits of using airSlate SignNow for the 2021 internal revenue service form?

Using airSlate SignNow for the 2021 internal revenue service form helps reduce paperwork and streamline the eSignature process. Benefits include faster turnaround times, enhanced security, and the ability to manage all signing activities in one place, which is particularly useful during tax season.

-

Is airSlate SignNow secure for submitting the 2021 internal revenue service form?

Yes, airSlate SignNow ensures high-level security for all documents including the 2021 internal revenue service form. The platform uses encryption and complies with industry standards to protect sensitive information, ensuring that your data is safe from unauthorized access.

Get more for Internal Revenue Service

- Virginia quitclaim 497427995 form

- Quitclaim deed real estate form 497427997

- Warranty deed from individual to individual virginia form

- Gift deed virginia form

- Virginia certificate form

- Warranty deed to child reserving a life estate in the parents virginia form

- Warranty deed from husband and wife to two individuals virginia form

- Discovery interrogatories from plaintiff to defendant with production requests virginia form

Find out other Internal Revenue Service

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation