Tn Department of Revenue Forms Fill Out and Sign Printable

Understanding the Tennessee Department of Revenue Power of Attorney Form

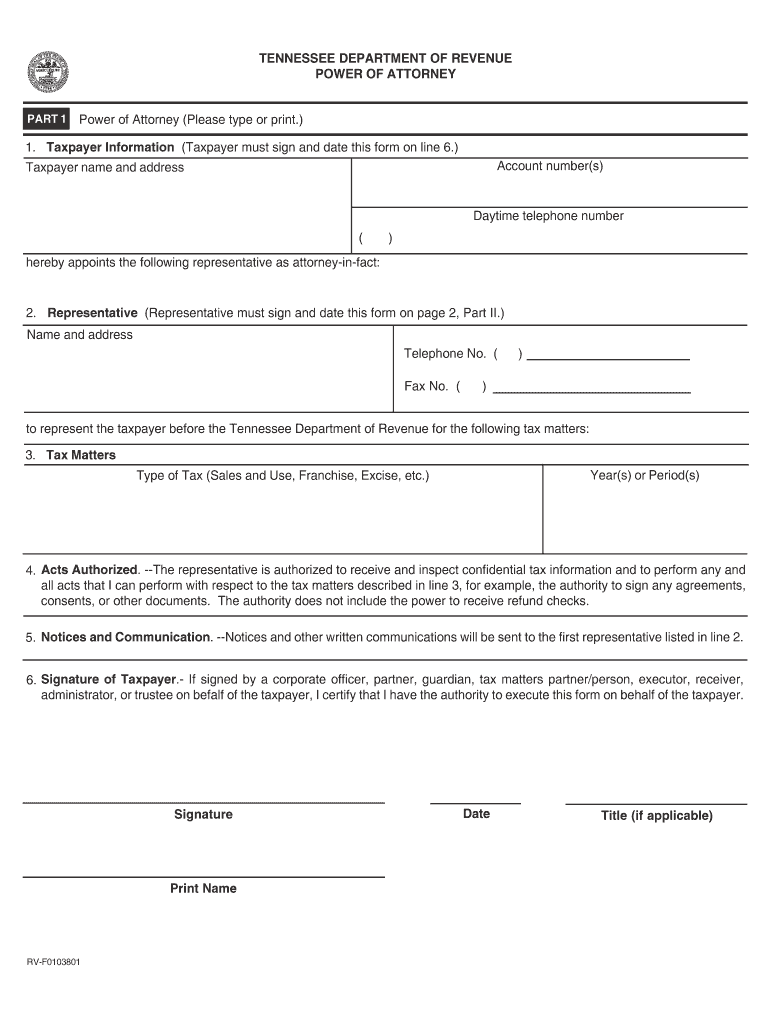

The Tennessee Department of Revenue Power of Attorney form, commonly referred to as the tn dor poa, allows individuals to designate another person to act on their behalf in tax matters. This form is crucial for taxpayers who may not be able to handle their tax affairs personally, such as those who are out of the state or require assistance due to health issues. The form outlines the specific powers granted to the representative, ensuring that they can effectively manage the taxpayer's obligations with the Department of Revenue.

Steps to Complete the Tennessee Revenue Power of Attorney Form

Filling out the tn dor poa requires careful attention to detail. Begin by downloading the form, which is available in a printable format. Ensure that you fill in all required fields accurately, including the taxpayer's name, address, and Social Security number. Next, specify the powers granted to the representative, whether they are general or limited. After completing the form, both the taxpayer and the representative must sign and date it. Finally, submit the form to the Tennessee Department of Revenue as instructed, ensuring that you retain a copy for your records.

Legal Use of the Tennessee Department of Revenue Power of Attorney Form

The tn dor poa is legally binding when completed correctly, allowing the designated representative to act on behalf of the taxpayer. To ensure its validity, the form must comply with Tennessee state laws regarding power of attorney documents. This includes proper signatures and the inclusion of necessary details about the powers being granted. Additionally, it is important to understand that the form must be submitted to the Department of Revenue to be recognized officially.

Required Documents for the Tennessee Revenue Power of Attorney

When submitting the tn dor poa, certain documents may be required to validate the request. Typically, you will need to provide identification for both the taxpayer and the representative, such as a driver's license or Social Security card. If the representative is a business entity, additional documentation proving the authority of the individual signing on behalf of the business may also be necessary. Always check for any specific requirements from the Tennessee Department of Revenue to ensure compliance.

Form Submission Methods for the Tennessee Revenue Power of Attorney

The tn dor poa can be submitted through various methods to the Tennessee Department of Revenue. Taxpayers may choose to send the completed form via mail, ensuring it is addressed correctly to the appropriate department. Alternatively, electronic submission may be available, depending on the specific guidelines set by the Department of Revenue. It is important to confirm the submission method that best suits your needs and ensures timely processing of the power of attorney.

Key Elements of the Tennessee Department of Revenue Power of Attorney Form

Several key elements must be included in the tn dor poa for it to be valid. These include the full name and contact information of both the taxpayer and the representative, a clear statement of the powers being granted, and the signatures of both parties. Additionally, the form should indicate the duration of the power of attorney, whether it is for a specific period or indefinite. Ensuring these elements are present will help prevent any issues with the form's acceptance by the Department of Revenue.

Quick guide on how to complete tn department of revenue forms fill out and sign printable

Finish Tn Department Of Revenue Forms Fill Out And Sign Printable effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Tn Department Of Revenue Forms Fill Out And Sign Printable across any platform using airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Tn Department Of Revenue Forms Fill Out And Sign Printable without any hassle

- Obtain Tn Department Of Revenue Forms Fill Out And Sign Printable and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or cover sensitive details with tools that airSlate SignNow provides specifically for that reason.

- Craft your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as an old-fashioned wet ink signature.

- Review all the details and press the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Tn Department Of Revenue Forms Fill Out And Sign Printable and ensure outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the tn dor poa and how can airSlate SignNow help?

The tn dor poa refers to the Tennessee Department of Revenue Power of Attorney form. airSlate SignNow offers an efficient way to complete, eSign, and manage this important document digitally, ensuring compliance and easy access for users.

-

Is there a cost associated with using airSlate SignNow for tn dor poa?

Yes, airSlate SignNow provides a range of pricing plans tailored to your needs. Our competitive pricing ensures that you can manage the tn dor poa without sacrificing quality or efficiency, making it a cost-effective solution.

-

What are the key features of airSlate SignNow for managing tn dor poa?

airSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage. These tools make managing the tn dor poa far more efficient, saving you time while ensuring your documents are legally binding.

-

How can airSlate SignNow improve my workflow with tn dor poa documents?

With airSlate SignNow, you can streamline your workflow by sending tn dor poa documents for eSignature instantly. The platform allows for real-time tracking and notifications, ensuring you stay updated on the document's status without delays.

-

Are there any integrations available for airSlate SignNow related to tn dor poa?

Absolutely! airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to work with tn dor poa documents. This includes integrations with popular tools like Google Drive, Dropbox, and CRM systems, making document management effortless.

-

Can I access my tn dor poa documents from my mobile device using airSlate SignNow?

Yes, airSlate SignNow is fully functional on mobile devices, allowing you to access and manage your tn dor poa documents on the go. This flexibility ensures that you can eSign and manage your documents anytime and anywhere, enhancing your productivity.

-

What security measures are in place for tn dor poa documents handled by airSlate SignNow?

airSlate SignNow prioritizes security with bank-level encryption and secure access controls. This means your tn dor poa documents are safe from unauthorized access and data bsignNowes, giving you peace of mind when sending sensitive information.

Get more for Tn Department Of Revenue Forms Fill Out And Sign Printable

- Form indiana department of revenue mailingcontact information ivt 1

- About form 2106 employee business expensesinternal revenue service

- Gettingattentionorgform 990 schedule b donorform 990 schedule b ampamp donor disclosures whats required

- Instructions for schedule b form 941 rev june 2022 instructions for schedule b form 941 report of tax liability for semiweekly

- 2022 publication 15 circular e employers tax guide form

- 2022 form w 2 wage and tax statement

- Irs 1099 nec rev january 2022 form

- Form 1099 misc rev january 2022 irs tax forms

Find out other Tn Department Of Revenue Forms Fill Out And Sign Printable

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself