Types of Fraudulent Activities General Fraud Internal Revenue Form

IRS Guidelines

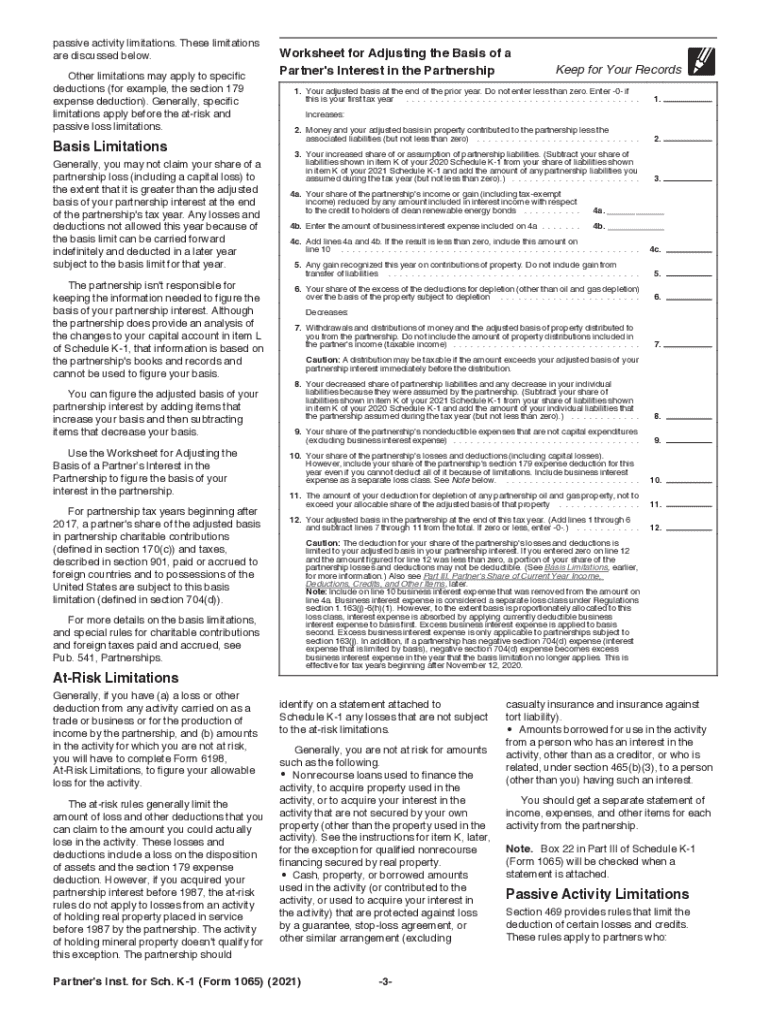

The IRS provides specific guidelines for completing the K-1 1065 instructions. These guidelines are essential for ensuring that all information is accurately reported. The K-1 form is used to report income, deductions, and credits from partnerships. Each partner receives a K-1 that details their share of the partnership's income, which they must then report on their individual tax returns. Understanding these guidelines helps avoid errors that could lead to penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the K-1 1065 instructions are crucial for compliance. Generally, the partnership must file Form 1065 by the 15th day of the third month after the end of its tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. Partners should receive their K-1s by this date to ensure they can accurately report their income on their personal tax returns, which are due on April 15. Missing these deadlines can result in penalties for both the partnership and the individual partners.

Required Documents

To complete the K-1 1065 instructions, certain documents are required. These include the partnership agreement, financial statements, and any prior year K-1 forms. The partnership agreement outlines the terms of the partnership, while financial statements provide an overview of the partnership's income, expenses, and distributions. Having these documents on hand ensures that all necessary information is accurately reported on the K-1 form.

Form Submission Methods (Online / Mail / In-Person)

Submitting the K-1 1065 instructions can be done through various methods. Partnerships can file Form 1065 electronically using IRS-approved software, which often simplifies the process and reduces errors. Alternatively, they can mail the completed form to the appropriate IRS address. In-person submission is typically not available for this form, as electronic filing is encouraged. Choosing the right submission method can facilitate quicker processing and confirmation of receipt.

Penalties for Non-Compliance

Failure to comply with the K-1 1065 instructions can result in significant penalties. If a partnership does not file Form 1065 on time, it may incur a penalty for each month the return is late. Additionally, partners who do not report their income from the K-1 may face penalties for underreporting income. Understanding these penalties emphasizes the importance of timely and accurate filing to avoid unnecessary financial consequences.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can affect how the K-1 1065 instructions are applied. For instance, self-employed individuals may need to consider self-employment tax on their share of partnership income reported on the K-1. Retired individuals may have different tax implications based on their overall income sources. Students receiving income from a partnership may also need to be aware of how this affects their tax status. Each scenario requires careful consideration of the K-1 information to ensure compliance with tax regulations.

Quick guide on how to complete types of fraudulent activities general fraud internal revenue

Complete Types Of Fraudulent Activities General Fraud Internal Revenue seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Types Of Fraudulent Activities General Fraud Internal Revenue on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to edit and eSign Types Of Fraudulent Activities General Fraud Internal Revenue effortlessly

- Find Types Of Fraudulent Activities General Fraud Internal Revenue and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Types Of Fraudulent Activities General Fraud Internal Revenue and facilitate effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the types of fraudulent activities general fraud internal revenue

How to generate an e-signature for a PDF online

How to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to make an e-signature right from your smartphone

The best way to create an e-signature for a PDF on iOS

How to make an e-signature for a PDF on Android

People also ask

-

What are K 1 1065 instructions?

K 1 1065 instructions provide guidance for partners and shareholders to report income, deductions, and credits from partnerships or S corporations. Understanding these instructions is crucial for accurate tax filing to avoid penalties or audits.

-

How can airSlate SignNow help with K 1 1065 instructions?

airSlate SignNow simplifies the document management process, allowing users to easily send, sign, and collaborate on K 1 1065 instructions online. This efficient solution ensures that your tax documents are processed in a timely manner, improving accuracy.

-

Are there any costs associated with using airSlate SignNow for K 1 1065 instructions?

Yes, using airSlate SignNow comes with a subscription fee that varies depending on the plan you choose. However, the cost is competitive, especially when considering the time saved and the increase in efficiency when handling K 1 1065 instructions.

-

What features does airSlate SignNow offer for managing K 1 1065 instructions?

airSlate SignNow offers various features, including customizable templates, secure eSigning, and document tracking. These features make it easier to manage and execute K 1 1065 instructions accurately and efficiently.

-

Can airSlate SignNow be integrated with other software for K 1 1065 instructions?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, enhancing your ability to work with K 1 1065 instructions. This integration allows for a streamlined workflow and better data management.

-

What benefits does airSlate SignNow provide for handling K 1 1065 instructions?

By using airSlate SignNow, businesses benefit from improved accuracy, speed, and security in managing K 1 1065 instructions. The platform helps eliminate paperwork hassles, ensuring your documents are always in order.

-

Is airSlate SignNow user-friendly for those unfamiliar with K 1 1065 instructions?

Yes! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with K 1 1065 instructions. The intuitive interface guides users through the process seamlessly.

Get more for Types Of Fraudulent Activities General Fraud Internal Revenue

- Tuh claim form

- Verdienstbescheinigung vorlage word form

- Dynamic risk assessment template form

- Pilots cafe ifr pdf form

- Fedex signature release form 63327251

- Taguig business permit application form 2022

- Amendment of foreign registration statement llc foreign form

- Sample wage verification form the paralegal mentor

Find out other Types Of Fraudulent Activities General Fraud Internal Revenue

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now