IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa 1997

What is the IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

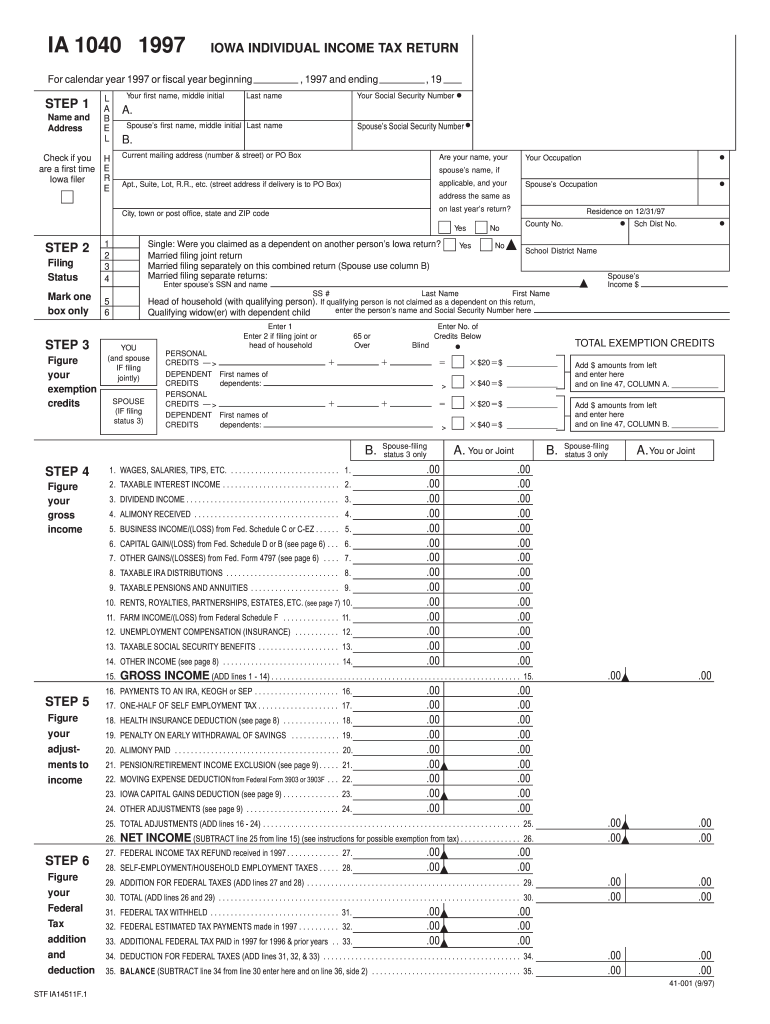

The IA 1040 Iowa Individual Income Tax Return Step 1 is a crucial document for residents of Iowa who need to report their individual income taxes. This form is used to calculate the amount of tax owed or the refund due based on the taxpayer's income, deductions, and credits. It is essential for ensuring compliance with state tax laws and is a key component of the overall tax filing process in Iowa.

Steps to complete the IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

Completing the IA 1040 Iowa Individual Income Tax Return Step 1 involves several steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your income by entering amounts from your income statements into the appropriate fields.

- Claim any deductions or credits you are eligible for, which can reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Review the form for accuracy before signing and dating it.

- Submit the completed form by the designated deadline.

Legal use of the IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

The IA 1040 Iowa Individual Income Tax Return Step 1 is legally recognized by the state of Iowa as the official form for reporting individual income taxes. It must be completed accurately and submitted on time to avoid penalties. The form is designed to comply with both state and federal tax regulations, ensuring that taxpayers fulfill their legal obligations while also protecting their rights as filers.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines for the IA 1040 Iowa Individual Income Tax Return Step 1. Typically, the deadline for submitting this form is April 30 of the tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also keep in mind any changes that may occur due to state legislation or special circumstances, such as extensions granted during emergencies.

Form Submission Methods (Online / Mail / In-Person)

The IA 1040 Iowa Individual Income Tax Return Step 1 can be submitted through various methods to accommodate different preferences:

- Online: Taxpayers can file electronically using approved tax software, which often simplifies the process and helps ensure accuracy.

- Mail: Completed forms can be printed and mailed to the appropriate Iowa Department of Revenue address.

- In-Person: Taxpayers may also choose to deliver their forms in person at designated state offices, if preferred.

Key elements of the IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

The IA 1040 Iowa Individual Income Tax Return Step 1 includes several key elements that are essential for accurate tax reporting:

- Personal Information: This section requires details such as your name, address, and Social Security number.

- Income Reporting: Taxpayers must report all sources of income, including wages, interest, and dividends.

- Deductions and Credits: The form allows for various deductions and credits that can lower taxable income.

- Tax Calculation: A section for calculating the total tax owed or refund due based on the information provided.

Quick guide on how to complete ia 1040 1997 iowa individual income tax return step 1 iowa

Your assistance manual on how to prepare your IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

If you’re wondering how to generate and submit your IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa, here are a few brief tips on making tax submission signNowly simpler.

To begin, you only need to establish your airSlate SignNow account to transform how you handle documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, create, and finalize your income tax forms effortlessly. Utilizing its editor, you can alternate between text, check boxes, and electronic signatures while being able to revise information as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa in minutes:

- Create your account and start editing PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa in our editor.

- Input the necessary fillable fields with your details (text, numbers, check marks).

- Use the Signature Tool to insert your legally-binding electronic signature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Utilize this manual to file your taxes online with airSlate SignNow. Remember that submitting on paper can lead to increased return errors and delay refunds. Of course, before e-filing your taxes, check the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ia 1040 1997 iowa individual income tax return step 1 iowa

FAQs

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Create this form in 5 minutes!

How to create an eSignature for the ia 1040 1997 iowa individual income tax return step 1 iowa

How to make an eSignature for the Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa online

How to make an eSignature for your Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa in Google Chrome

How to generate an eSignature for signing the Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa in Gmail

How to create an electronic signature for the Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa straight from your smartphone

How to generate an eSignature for the Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa on iOS devices

How to generate an electronic signature for the Ia 1040 1997 Iowa Individual Income Tax Return Step 1 Iowa on Android OS

People also ask

-

What is the IA 1040 Iowa Individual Income Tax Return Step 1?

The IA 1040 Iowa Individual Income Tax Return Step 1 is the initial form required for filing your individual income taxes in Iowa. This form collects essential information about your income and deductions, setting the stage for your tax return. Using airSlate SignNow, you can easily complete and eSign this document, streamlining your tax filing process.

-

How can airSlate SignNow help with the IA 1040 Iowa Individual Income Tax Return Step 1?

airSlate SignNow simplifies the process of completing the IA 1040 Iowa Individual Income Tax Return Step 1 by allowing you to fill out the form digitally. You can easily add your information, sign, and send it securely. This eliminates the hassle of paper forms and ensures that your tax return is submitted correctly and on time.

-

Is there a cost associated with using airSlate SignNow for the IA 1040 Iowa Individual Income Tax Return Step 1?

Yes, airSlate SignNow offers various pricing plans to suit different needs when filing the IA 1040 Iowa Individual Income Tax Return Step 1. The cost-effective solution ensures that you only pay for the features you need. Check our pricing page for detailed information on subscription options.

-

Can I integrate airSlate SignNow with other tools for filing my IA 1040 Iowa Individual Income Tax Return Step 1?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easy to file your IA 1040 Iowa Individual Income Tax Return Step 1. These integrations streamline your workflow and help maintain accurate records, ensuring a smooth filing experience.

-

What features does airSlate SignNow offer for the IA 1040 Iowa Individual Income Tax Return Step 1?

airSlate SignNow offers features such as customizable templates, eSigning, and secure document storage for the IA 1040 Iowa Individual Income Tax Return Step 1. These tools enhance efficiency and provide peace of mind knowing your documents are secure and accessible whenever you need them.

-

Is airSlate SignNow suitable for both individuals and businesses filing the IA 1040 Iowa Individual Income Tax Return Step 1?

Yes, airSlate SignNow is designed to cater to both individuals and businesses, making it an ideal solution for filing the IA 1040 Iowa Individual Income Tax Return Step 1. Whether you are a freelance professional or a business owner, our platform can accommodate your specific tax filing needs.

-

How secure is my information when using airSlate SignNow for the IA 1040 Iowa Individual Income Tax Return Step 1?

Your security is our priority at airSlate SignNow. When you use our platform for the IA 1040 Iowa Individual Income Tax Return Step 1, your information is encrypted and stored securely. We adhere to strict security protocols to protect your sensitive data throughout the entire process.

Get more for IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

Find out other IA 1040 IOWA INDIVIDUAL INCOME TAX RETURN STEP 1 Iowa

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document