IA 1040 Iowa Individual Income Tax Return 2020

What is the IA 1040 Iowa Individual Income Tax Return

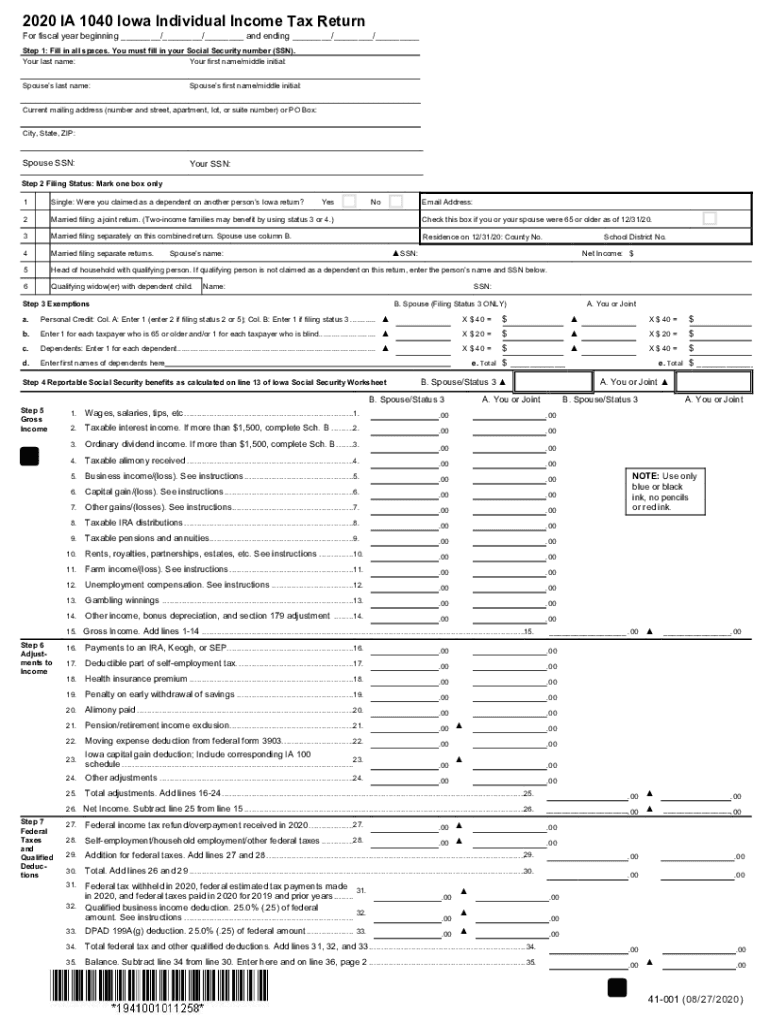

The IA 1040 is the official Iowa Individual Income Tax Return form used by residents to report their income and calculate their state tax liability. This form is essential for individuals who earn income in Iowa, including wages, self-employment income, and other sources. It is a key document for ensuring compliance with state tax laws and is required for filing annual tax returns. The IA 1040 includes sections for personal information, income details, deductions, and credits, allowing taxpayers to accurately reflect their financial situation for the tax year.

Steps to complete the IA 1040 Iowa Individual Income Tax Return

Completing the IA 1040 involves several systematic steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and any other income statements. Next, fill out the personal information section, including your name, address, and Social Security number. Then, report all income sources in the designated sections. After that, apply any eligible deductions and credits to reduce your taxable income. Finally, review the completed form for accuracy before signing and submitting it. Consider using electronic tools for ease and to enhance accuracy.

Legal use of the IA 1040 Iowa Individual Income Tax Return

The IA 1040 form is legally binding when filed correctly and in accordance with Iowa tax laws. To ensure its legal validity, it must be signed by the taxpayer, indicating that the information provided is true and accurate to the best of their knowledge. Electronic signatures are accepted, provided they comply with the relevant eSignature laws. Filing the IA 1040 on time is crucial to avoid penalties and interest on any owed taxes. Understanding the legal implications of this form helps taxpayers navigate their responsibilities more effectively.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the IA 1040 to avoid late fees and penalties. Typically, the deadline for filing the Iowa Individual Income Tax Return is April 30 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest charges. Keeping track of these important dates is essential for timely compliance.

Required Documents

To successfully complete the IA 1040, several documents are necessary. Taxpayers should gather the following:

- W-2 forms from employers

- 1099 forms for any self-employment or freelance income

- Records of other income sources, such as interest or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Any previous year tax returns for reference

Having these documents ready will streamline the process of completing the IA 1040 and help ensure all income and deductions are accurately reported.

Form Submission Methods

Taxpayers have several options for submitting the IA 1040. The form can be filed electronically through approved e-filing services, which often provide a faster processing time and confirmation of receipt. Alternatively, taxpayers can print the completed form and mail it to the appropriate Iowa Department of Revenue address. In-person submissions may also be possible at designated state offices. Each method has its advantages, so taxpayers should choose the one that best fits their needs.

Examples of using the IA 1040 Iowa Individual Income Tax Return

Understanding practical scenarios can help taxpayers effectively utilize the IA 1040. For instance, a full-time employee receiving a W-2 will report their wages, while a self-employed individual will need to include income from 1099 forms. Additionally, someone who has incurred medical expenses may apply for deductions to lower their taxable income. Each example illustrates the form's versatility in accommodating various taxpayer situations, ensuring that all individuals can accurately report their financial activities.

Quick guide on how to complete 2020 ia 1040 iowa individual income tax return

Effortlessly Prepare IA 1040 Iowa Individual Income Tax Return on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage IA 1040 Iowa Individual Income Tax Return on any device using the airSlate SignNow applications for Android or iOS and enhance any document-driven task today.

The Easiest Way to Alter and Electronically Sign IA 1040 Iowa Individual Income Tax Return Seamlessly

- Locate IA 1040 Iowa Individual Income Tax Return and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or redact sensitive data with the features provided by airSlate SignNow specifically for this task.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a standard wet ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose your preferred method to send your form: email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mismanaged files, tedious form searching, or errors that require new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your preferred device. Edit and electronically sign IA 1040 Iowa Individual Income Tax Return to ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 ia 1040 iowa individual income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 ia 1040 iowa individual income tax return

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the Iowa 1040 form?

The Iowa 1040 form is a state income tax return used by residents of Iowa to report their income and calculate their state tax liability. It is essential for individuals to correctly fill out the Iowa 1040 to ensure compliance with state tax laws. By using the airSlate SignNow platform, you can easily eSign and manage your Iowa 1040 forms online.

-

How does airSlate SignNow help with submitting the Iowa 1040?

airSlate SignNow provides a user-friendly interface that allows you to complete and eSign your Iowa 1040 form digitally. With our platform, you can easily gather necessary signatures, store documents securely, and submit your completed form with minimal hassle. This streamlines your filing process and helps ensure accuracy.

-

Is airSlate SignNow affordable for filing Iowa 1040 forms?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for both individuals and businesses. Our competitive pricing ensures that you can manage your Iowa 1040 filings without breaking the bank. You can choose from various plans that suit your needs while benefiting from the platform's robust features.

-

Can I integrate airSlate SignNow with other software for my Iowa 1040 taxes?

Absolutely! airSlate SignNow seamlessly integrates with a variety of third-party applications, facilitating an efficient workflow for handling your Iowa 1040 forms. You can connect it with accounting software, CRM systems, and other tools to enhance your productivity. This integration allows for easy data transfer and reduces the risk of errors.

-

What features of airSlate SignNow specifically benefit Iowa 1040 filers?

AirSlate SignNow offers several features that are beneficial for Iowa 1040 filers, including a customizable document editor and an intuitive eSignature solution. You can also track the status of your forms in real-time and receive notifications upon completion. These features help ensure timely filings and enhance overall efficiency.

-

How can airSlate SignNow increase the security of my Iowa 1040 documents?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and authentication measures to protect your Iowa 1040 documents from unauthorized access. By leveraging these security features, you can have peace of mind knowing that your sensitive financial information is safeguarded.

-

What if I need help filling out my Iowa 1040 using airSlate SignNow?

If you need assistance with filling out your Iowa 1040, airSlate SignNow provides access to helpful resources, including tutorials and customer support. Our dedicated team is available to assist you with any questions you may have about the platform or the filing process. This means you are never alone when handling your state taxes.

Get more for IA 1040 Iowa Individual Income Tax Return

- Collier county subcontractor form

- Birth certificate mn form

- General power of attorney form uk pdf

- Adds chart wa health form

- Norton medical records form

- Vaccines for children vfc program patient eligibility screening form

- Vaccines for children afc programpatient eligib form

- Digital data logger sign off sheet vfc03 17 form

Find out other IA 1040 Iowa Individual Income Tax Return

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy