Iowa Income Tax Forms Fillable 2017

What is the Iowa Income Tax Forms Fillable

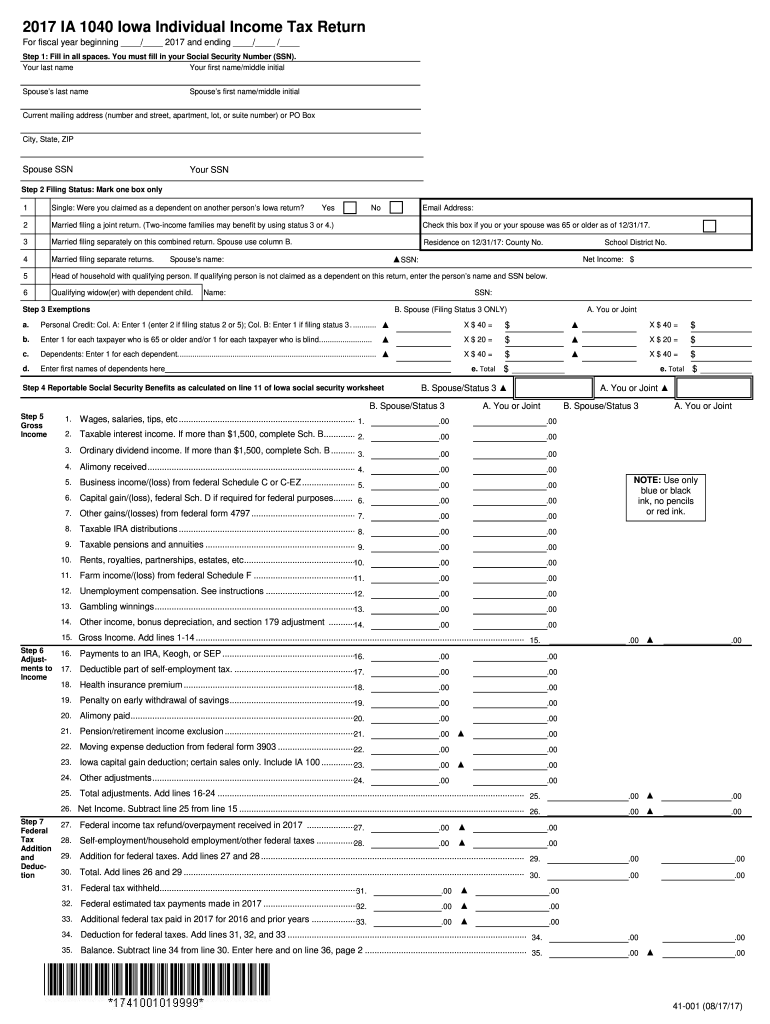

The Iowa Income Tax Forms Fillable are official documents used by residents of Iowa to report their income and calculate their state tax obligations. These forms are designed to be completed online, allowing taxpayers to enter their information directly into fillable fields. This digital format not only simplifies the process of filing taxes but also ensures that the forms meet the necessary government requirements and specifications set by the Iowa Department of Revenue.

How to use the Iowa Income Tax Forms Fillable

Using the Iowa Income Tax Forms Fillable is straightforward. Taxpayers can access the forms through a secure online platform. Once on the platform, users can select the appropriate form based on their filing status, such as individual or business. After selecting the form, individuals can fill in their personal information, income details, and deductions directly into the designated fields. It is important to review all entries for accuracy before submission, as errors can lead to delays in processing.

Steps to complete the Iowa Income Tax Forms Fillable

Completing the Iowa Income Tax Forms Fillable involves several key steps:

- Select the appropriate form based on your filing needs.

- Enter personal information, including name, address, and Social Security number.

- Input income details from all sources, including wages, interest, and dividends.

- Claim any deductions or credits applicable to your situation.

- Review the completed form for accuracy and completeness.

- Sign the form electronically using a secure eSignature solution.

- Submit the form electronically or print it for mailing, based on your preference.

Legal use of the Iowa Income Tax Forms Fillable

The Iowa Income Tax Forms Fillable are legally recognized documents that comply with state tax regulations. When completed and submitted correctly, these forms fulfill the taxpayer's legal obligation to report income and pay taxes. The use of electronic signatures on these forms is valid under the ESIGN Act, ensuring that digitally signed documents hold the same legal weight as traditional handwritten signatures. It is essential to ensure that all information provided is accurate to avoid potential legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Iowa Income Tax Forms Fillable typically align with federal tax deadlines. For most individuals, the deadline to file is April 30 of each year. Extensions may be available, but it is crucial to file for an extension before the original deadline. Taxpayers should also be aware of any specific deadlines related to estimated tax payments, which may vary based on individual circumstances.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Iowa Income Tax Forms Fillable. The most efficient method is to file electronically through a secure online platform, which allows for immediate processing. Alternatively, individuals can print the completed forms and mail them to the Iowa Department of Revenue. In-person submissions may also be possible at designated tax offices, but it is advisable to check for any specific requirements or restrictions before visiting.

Quick guide on how to complete iowa income tax forms fillable 2017 2019

Your assistance manual on how to prepare your Iowa Income Tax Forms Fillable

If you’re wondering how to generate and submit your Iowa Income Tax Forms Fillable, here are some concise tips on how to facilitate tax processing.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documentation online. airSlate SignNow is an incredibly user-friendly and robust document solution that enables you to adjust, create, and finalize your tax papers effortlessly. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revisit to modify data as necessary. Streamline your tax oversight with advanced PDF editing, eSigning, and simple sharing options.

Follow the instructions below to complete your Iowa Income Tax Forms Fillable in just minutes:

- Establish your account and start editing PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your Iowa Income Tax Forms Fillable in our editor.

- Complete the mandatory fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to append your legally-binding eSignature (if needed).

- Review your document and correct any discrepancies.

- Save changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can lead to increased mistakes and delayed refunds. Definitely, before e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct iowa income tax forms fillable 2017 2019

FAQs

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How do you fill out an income tax form for a director of a company in India?

There are no special provisions for a director of a company. He should file the return on the basis of his income . If he is just earning salary ten ITR-1.~Sayantan Sen Gupta~

Create this form in 5 minutes!

How to create an eSignature for the iowa income tax forms fillable 2017 2019

How to generate an eSignature for your Iowa Income Tax Forms Fillable 2017 2019 in the online mode

How to create an electronic signature for your Iowa Income Tax Forms Fillable 2017 2019 in Chrome

How to create an eSignature for signing the Iowa Income Tax Forms Fillable 2017 2019 in Gmail

How to create an eSignature for the Iowa Income Tax Forms Fillable 2017 2019 straight from your mobile device

How to create an electronic signature for the Iowa Income Tax Forms Fillable 2017 2019 on iOS devices

How to make an electronic signature for the Iowa Income Tax Forms Fillable 2017 2019 on Android

People also ask

-

What are Iowa Income Tax Forms Fillable?

Iowa Income Tax Forms Fillable are digital tax forms that allow Iowa residents to complete their tax returns online. These forms are designed to be user-friendly and can be filled out electronically, eliminating the need for printing and handwritten entries. With airSlate SignNow, you can easily access and sign these forms, streamlining your tax filing process.

-

How can airSlate SignNow help with Iowa Income Tax Forms Fillable?

airSlate SignNow offers a seamless solution for managing Iowa Income Tax Forms Fillable by allowing users to fill out, sign, and send documents electronically. Our platform simplifies the process, ensuring that your forms are completed accurately and securely. You can also save your progress and return to your forms at any time.

-

Are the Iowa Income Tax Forms Fillable available for free?

While airSlate SignNow provides various pricing options, some features related to Iowa Income Tax Forms Fillable may not be available for free. However, our services are cost-effective and designed to provide signNow value, especially with features like eSigning and document management. Check our pricing page for specific details on the options available.

-

Can I integrate airSlate SignNow with other software for Iowa Income Tax Forms Fillable?

Yes, airSlate SignNow integrates seamlessly with a variety of software applications, enhancing the management of Iowa Income Tax Forms Fillable. Whether you are using accounting software or document management systems, our integrations ensure that your tax forms are easily accessible and manageable within your existing workflows.

-

What are the benefits of using airSlate SignNow for Iowa Income Tax Forms Fillable?

Using airSlate SignNow for Iowa Income Tax Forms Fillable provides numerous benefits, including enhanced efficiency, security, and accessibility. You can fill out and sign forms from anywhere, reducing the hassle of traditional paper forms. Additionally, our platform ensures that your personal information is protected with top-notch security features.

-

Is airSlate SignNow user-friendly for filling out Iowa Income Tax Forms Fillable?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to fill out Iowa Income Tax Forms Fillable. The intuitive interface guides users through the process, ensuring that even those with minimal tech experience can efficiently complete their forms.

-

What types of Iowa Income Tax Forms Fillable can I access through airSlate SignNow?

airSlate SignNow provides access to a wide range of Iowa Income Tax Forms Fillable, including individual income tax returns, schedules, and other necessary documentation. This comprehensive selection ensures that you have all the forms needed to complete your tax filing accurately and on time.

Get more for Iowa Income Tax Forms Fillable

- The federalist society for law public policy studies fed soc form

- Ethos pathos logos read each passage and determine answers form

- Prewriting template form

- Ice machine cleaning log form

- Utorrent download hollywood movies in hindi dubbed 1080p form

- Edi lesson plan template dataworks educational research form

- Paytm kyc form

- Pharmacy remodeling application pennsylvania form

Find out other Iowa Income Tax Forms Fillable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors