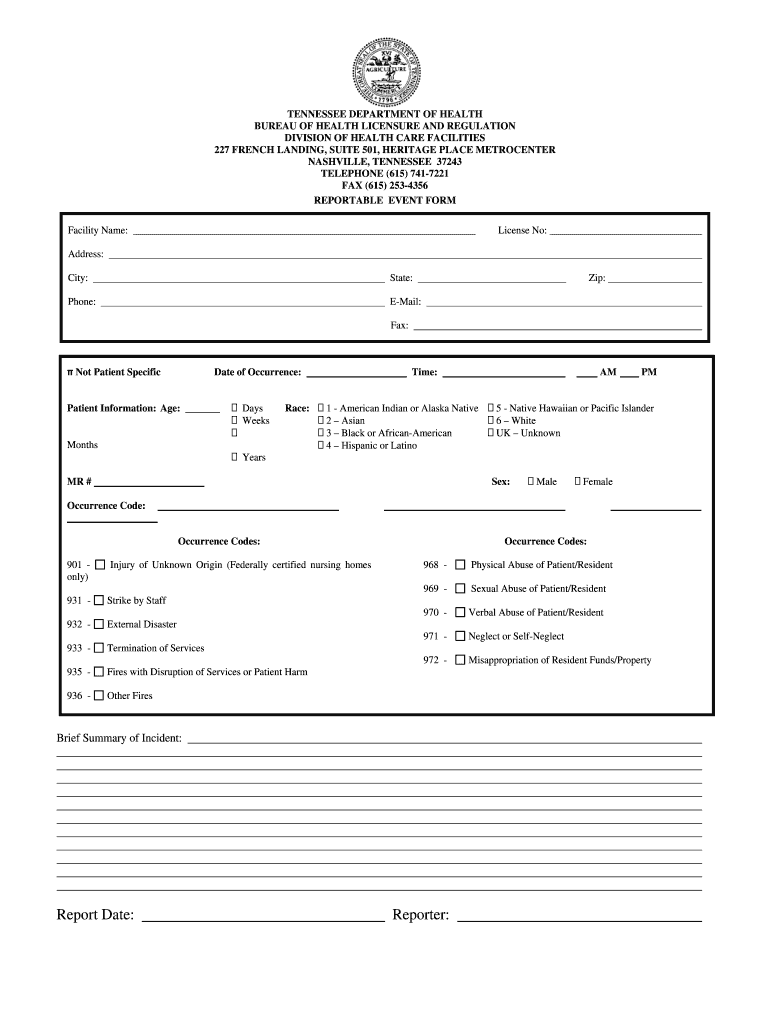

Reportable Disease Form Tn

IRS Guidelines

The IRS provides comprehensive guidelines for calculating taxes, ensuring taxpayers understand their obligations. These guidelines detail how to accurately report income, deductions, and credits, which are essential for a precise tax calculation. It's crucial to refer to the IRS publications relevant to your situation, such as Publication 17 for individual taxpayers or Publication 334 for small businesses. These resources outline the necessary forms, including the 1040 series for individuals and various business tax forms, helping you navigate the complexities of tax calculation.

Filing Deadlines / Important Dates

Awareness of filing deadlines is vital for all taxpayers. Typically, the deadline for filing individual tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. For businesses, deadlines can vary based on the entity type. Additionally, estimated tax payments for self-employed individuals are generally due quarterly. Keeping track of these dates helps avoid penalties and ensures compliance with tax obligations.

Required Documents

To accurately calculate your taxes, gather all necessary documents before starting the process. Commonly required documents include W-2 forms from employers, 1099 forms for freelance or contract work, and receipts for deductible expenses. For businesses, documentation such as profit and loss statements and payroll records is essential. Organizing these documents in advance streamlines the tax calculation process and ensures that you do not miss any critical information.

Taxpayer Scenarios

Different taxpayer scenarios can significantly impact how taxes are calculated. For instance, self-employed individuals may need to account for additional deductions related to business expenses, while retirees might have different sources of income, such as pensions or Social Security. Understanding these scenarios helps tailor your tax calculation approach, ensuring that all applicable deductions and credits are utilized based on your specific situation.

Penalties for Non-Compliance

Failure to comply with tax regulations can lead to significant penalties. The IRS imposes fines for late filing, late payment, and inaccuracies in tax returns. These penalties can accumulate quickly, making it essential to adhere to all tax obligations. Understanding the potential consequences of non-compliance encourages timely and accurate tax calculations, helping to avoid unnecessary financial burdens.

Digital vs. Paper Version

When calculating taxes, taxpayers have the option to file digitally or via paper forms. Digital filing often results in faster processing times and immediate confirmation of receipt, while paper filing can take longer to process. Additionally, many tax software solutions offer built-in calculators and error-checking features, which can enhance accuracy. Choosing the right method for your tax calculation can streamline the process and reduce the likelihood of mistakes.

Application Process & Approval Time

For certain tax-related applications, such as requesting an extension or applying for specific tax credits, understanding the application process is crucial. Typically, these applications can be completed online or via paper forms, depending on the nature of the request. Approval times can vary, so it's advisable to submit applications well in advance of deadlines to ensure compliance and avoid any last-minute issues.

Quick guide on how to complete reportable incidents to state in tn form

Utilize the simpler method to manage your Reportable Disease Form Tn

The traditional approaches to finalizing and authorizing documentation consume an excessively long duration compared to modern document management systems. You previously had to search for appropriate social forms, print them out, fill in all the details, and dispatch them through the mail. Now, you can find, fill out, and endorse your Reportable Disease Form Tn in a single browser tab with airSlate SignNow. Assembling your Reportable Disease Form Tn has never been easier.

Steps to finalize your Reportable Disease Form Tn with airSlate SignNow

- Access the category page you require and locate your state-specific Reportable Disease Form Tn. Alternatively, utilize the search bar.

- Verify the version of the form is accurate by previewing it.

- Click Obtain form and enter editing mode.

- Fill in your document with the necessary details using the editing tools.

- Examine the entered information and click the Sign option to signNow your form.

- Select the most suitable method to create your signature: generate it, draw your signature, or upload an image of it.

- Click FINISHED to save modifications.

- Download the document to your device or go to Sharing settings to send it electronically.

Efficient online solutions like airSlate SignNow simplify the process of completing and submitting your forms. Try it out to discover the actual time it should take for document management and approval processes. You’ll conserve a signNow amount of time.

Create this form in 5 minutes or less

FAQs

-

Do you have to fill out a separate form to avail state quota in NEET?

No..you dont have to fill form..But you have to register yourself in directorate of medical education/DME of your state for state quota counselling process..DME Will issue notice regarding process, date, of 1st round of counsellingCounselling schedule have info regarding date for registration , process of counselling etc.You will have to pay some amount of fee at the time of registration as registration fee..As soon as neet result is out..check for notification regarding counselling on DmE site..Hope this helpBest wishes dear.

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

-

How to decide my bank name city and state if filling out a form, if the bank is a national bank?

Somewhere on that form should be a blank for routing number and account number. Those are available from your check and/or your bank statements. If you can't find them, call the bank and ask or go by their office for help with the form. As long as those numbers are entered correctly, any error you make in spelling, location or naming should not influence the eventual deposit into your proper account.

-

Does a NAFTA TN Management consultant in the U.S. still need to fill out an i-9 form even though they are an independent contractor?

Yes.You must still prove work authorization even though you are a contractor. You will fill out the I9 and indicate that you are an alien authorized to work, and provide the relevant details of your TN visa in support of your application.Hope this helps.

-

Which form do I have to fill out to get into LNCT Bhopal? I am from another state.

Dear candidatEngineering admission in lnct Bhopal is possible based on candidates marks in board exam and with jee mains rankFor more detailsContactNavnit singh(admission counselor for Bhopal and other engineering colleges)7065197100whatsapp no-7827599577

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Create this form in 5 minutes!

How to create an eSignature for the reportable incidents to state in tn form

How to generate an electronic signature for your Reportable Incidents To State In Tn Form in the online mode

How to create an eSignature for the Reportable Incidents To State In Tn Form in Google Chrome

How to make an electronic signature for putting it on the Reportable Incidents To State In Tn Form in Gmail

How to create an eSignature for the Reportable Incidents To State In Tn Form right from your mobile device

How to generate an eSignature for the Reportable Incidents To State In Tn Form on iOS

How to make an eSignature for the Reportable Incidents To State In Tn Form on Android devices

People also ask

-

How can airSlate SignNow help me tax calculate efficiently?

airSlate SignNow streamlines the document signing process, allowing you to quickly manage and send important tax documents. This efficiency helps ensure that you have the necessary documents ready for accurate tax calculation, saving you valuable time during tax season.

-

Is there a pricing option for small businesses using airSlate SignNow for tax calculation?

Yes, airSlate SignNow offers flexible pricing plans suitable for small businesses. These plans enable you to access tools that assist in managing invoices and tax documents, making it easier to tax calculate without breaking the bank.

-

What features does airSlate SignNow offer that assist with tax document management?

airSlate SignNow includes features like eSignature, document templates, and secure cloud storage that simplifies the management of tax documents. These functionalities contribute to a smoother process when you need to tax calculate and file your taxes.

-

Can I integrate airSlate SignNow with accounting software for optimal tax calculation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to tax calculate accurately. This integration ensures that all necessary data from your documents flows directly into your accounting system.

-

How does airSlate SignNow improve the security of my tax-related documents?

airSlate SignNow prioritizes document security by utilizing advanced encryption and security measures. This protects your sensitive tax documents, ensuring your data remains confidential while you prepare to tax calculate.

-

What support does airSlate SignNow provide for users needing help with tax calculation?

airSlate SignNow offers comprehensive customer support to assist users with any queries about the tax calculation process. Whether you need help navigating the platform or understanding document requirements, our support team is here to help you.

-

Can I use airSlate SignNow to create tax forms for electronic signature?

Yes, airSlate SignNow allows you to create customizable tax forms that can be easily sent out for electronic signature. This feature simplifies the process of obtaining necessary signatures for your documents, facilitating a smoother tax calculation.

Get more for Reportable Disease Form Tn

- Download ilovepdf for web apps free latest version form

- Leave application form biforst pdf download

- Fillable online gen reg fax email print pdffiller form

- Qualifying parentsand form

- Wwwpemapagovgrantshmgprealty transfer tax statement of value rev 183 form

- Arizona form individual amended income tax return 140x 20yy

- Azdorgovindividual estimated tax payment formindividual estimated tax payment formarizona department of

- 14 printable 2016 form 990 templates fillable samples in

Find out other Reportable Disease Form Tn

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself