Maine Form 1040me 2017

What is the Maine Form 1040me

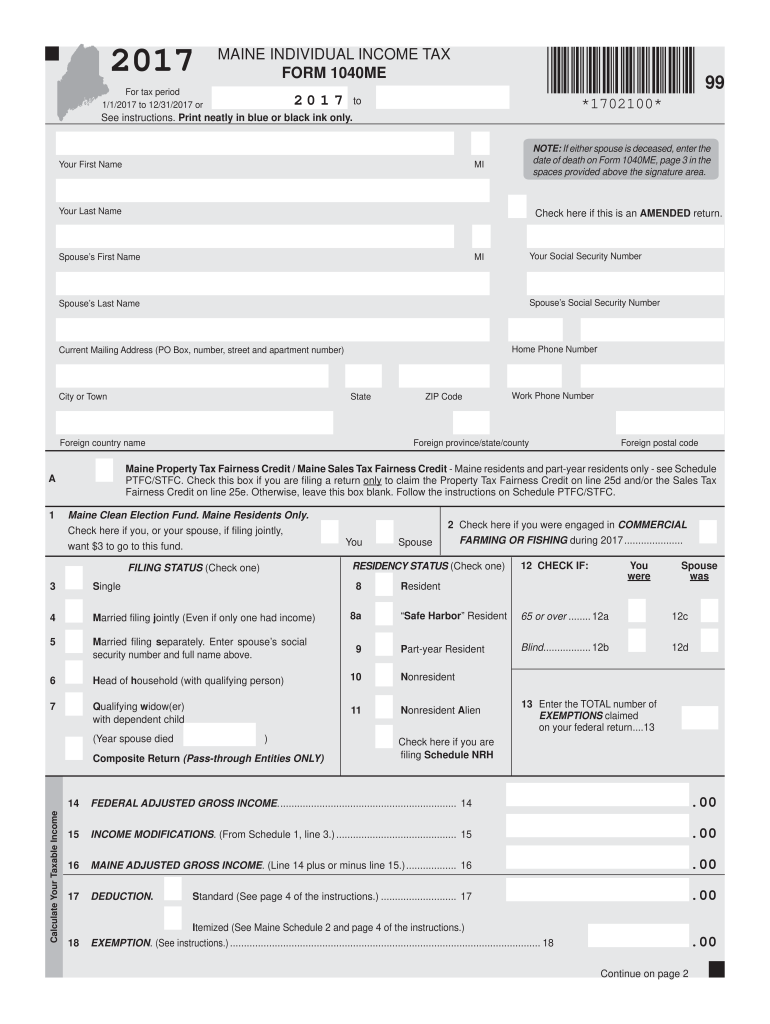

The Maine Form 1040me is the state's individual income tax return form. It is used by residents of Maine to report their income, calculate their tax liability, and claim any applicable credits or deductions. This form is essential for ensuring compliance with Maine tax laws and is typically filed annually. The 1040me allows taxpayers to provide detailed information about their income sources, including wages, dividends, and other earnings, as well as personal information such as filing status and dependents.

How to use the Maine Form 1040me

Using the Maine Form 1040me involves several steps. First, taxpayers should gather all necessary documentation, including W-2 forms, 1099 forms, and records of any other income. Next, individuals need to fill out the form accurately, entering their personal information and income details. After completing the form, it is important to review all entries for accuracy. Finally, taxpayers can submit the form either electronically or by mail, ensuring they meet the filing deadlines set by the state.

Steps to complete the Maine Form 1040me

Completing the Maine Form 1040me involves a systematic approach:

- Gather all required documents, such as income statements and previous tax returns.

- Fill out personal information, including name, address, and Social Security number.

- Report all sources of income, including wages, dividends, and other earnings.

- Calculate total income and determine any deductions or credits applicable.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via mail, ensuring it is sent to the correct address.

Legal use of the Maine Form 1040me

The Maine Form 1040me is legally recognized as the official document for reporting personal income to the state. It must be filled out in accordance with Maine tax laws and regulations. Taxpayers are responsible for providing accurate information, and any discrepancies may lead to penalties or audits. The form is designed to comply with both state and federal guidelines, ensuring that all reported income is properly accounted for.

Filing Deadlines / Important Dates

Filing deadlines for the Maine Form 1040me typically align with federal tax deadlines. Generally, the form must be submitted by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as natural disasters or state-specific announcements. Staying informed about these dates is crucial for avoiding late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Maine Form 1040me. The form can be filed electronically through approved e-filing services, which is often the fastest method. Alternatively, individuals can print the completed form and mail it to the designated state tax office. Some taxpayers may also choose to file in person at local tax offices, although this option may be less common. Each method has its own set of requirements and processing times, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete maine form 1040me 2017 2018

Your instructional manual on preparing your Maine Form 1040me

If you are curious about how to finalize and transmit your Maine Form 1040me, here are several concise recommendations to streamline tax processing.

To begin, simply establish your airSlate SignNow account to transform your approach to managing documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finish your income tax forms with ease. With its editor, you can toggle between text, check boxes, and eSignatures, and revisit to amend any information as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finalize your Maine Form 1040me in just a few minutes:

- Create your profile and start editing PDFs within minutes.

- Utilize our directory to obtain any IRS tax form; browse different versions and schedules.

- Click Get form to launch your Maine Form 1040me in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if needed).

- Review your document and rectify any mistakes.

- Save changes, print your copy, forward it to your recipient, and download it to your device.

Refer to this manual to electronically file your taxes using airSlate SignNow. Be aware that submitting on paper can lead to errors in return and delay refunds. Additionally, before e-filing your taxes, consult the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct maine form 1040me 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

Is it advantageous to fill out the JEE Mains 2018 form as soon as possible?

Yes. It is advantageous to fill out the JEE Mains 2018 form as soon as possible? Click here to know more about what are the advantage of filling JEE Main Application Form Earlier.

Create this form in 5 minutes!

How to create an eSignature for the maine form 1040me 2017 2018

How to generate an electronic signature for the Maine Form 1040me 2017 2018 in the online mode

How to create an electronic signature for your Maine Form 1040me 2017 2018 in Google Chrome

How to create an electronic signature for signing the Maine Form 1040me 2017 2018 in Gmail

How to make an electronic signature for the Maine Form 1040me 2017 2018 from your mobile device

How to create an eSignature for the Maine Form 1040me 2017 2018 on iOS devices

How to create an eSignature for the Maine Form 1040me 2017 2018 on Android

People also ask

-

What is the Maine Form 1040me and why is it important?

The Maine Form 1040me is the official state income tax form required for residents of Maine to report their income and calculate their tax liability. Filing this form accurately is crucial to ensure compliance with state tax laws and to avoid potential penalties. Utilizing airSlate SignNow can simplify the eSigning process for this form, making it quick and efficient.

-

How can airSlate SignNow assist with completing and filing the Maine Form 1040me?

airSlate SignNow offers an easy-to-use platform that allows users to electronically fill out and sign the Maine Form 1040me. This eliminates the need for physical paperwork and streamlines the process of filing taxes. By using our service, you can ensure that your form is submitted promptly and accurately.

-

Are there any fees associated with using airSlate SignNow for Maine Form 1040me?

airSlate SignNow provides a cost-effective solution for handling the Maine Form 1040me with a variety of pricing plans to suit different needs. We offer a free trial so you can experience our features before committing. The pricing structure is transparent, allowing you to choose the plan that best fits your business requirements.

-

What are the key features of airSlate SignNow for tax-related documents like the Maine Form 1040me?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking, which help streamline the completion of tax documents such as the Maine Form 1040me. Additionally, our platform ensures that all data is securely stored and compliant with legal standards, enhancing your peace of mind during the tax filing process.

-

Can I integrate airSlate SignNow with other software to manage my Maine Form 1040me?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications, allowing you to manage your Maine Form 1040me effectively within your existing workflow. Whether it's accounting software or document management systems, our platform enhances your capabilities and improves overall productivity.

-

What benefits does airSlate SignNow provide for businesses filing the Maine Form 1040me?

Using airSlate SignNow for filing the Maine Form 1040me provides numerous benefits, including time savings, reduced paperwork, and enhanced accuracy through automated features. Our platform allows for collaborative review, ensuring all parties are involved and informed. This efficiency leads to a simplified tax filing process that allows you to focus more on your core business operations.

-

Is airSlate SignNow user-friendly for someone unfamiliar with eSigning the Maine Form 1040me?

Absolutely! airSlate SignNow is designed with user experience in mind, making it intuitive even for those unfamiliar with electronic signing. Comprehensive support and quick tutorials are available to guide you through the eSigning process of the Maine Form 1040me. Our goal is to ensure that all users, regardless of technical expertise, can navigate the platform effectively.

Get more for Maine Form 1040me

Find out other Maine Form 1040me

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy