241040mebookresident Indd 2024-2026

Understanding the Maine Form 1040ME 2024

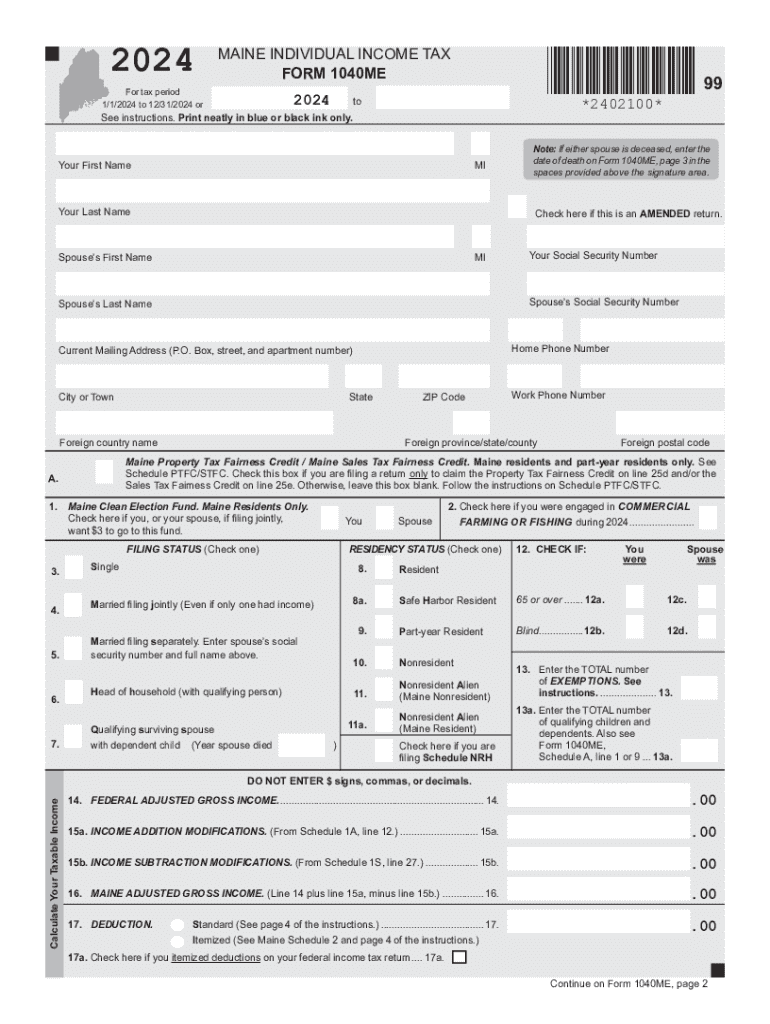

The Maine Form 1040ME 2024 is the state income tax return form used by residents of Maine to report their income and calculate their state tax liability. This form is essential for individuals who earn income within the state and need to comply with Maine tax regulations. It includes sections for reporting various types of income, deductions, and credits specific to Maine taxpayers.

Steps to Complete the Maine Form 1040ME 2024

Completing the Maine Form 1040ME 2024 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, interest, dividends, and any other sources of income.

- Claim applicable deductions and credits to reduce your taxable income.

- Calculate your total tax liability and any payments made throughout the year.

- Sign and date the form before submitting it to the appropriate state tax authority.

Filing Deadlines for Maine Form 1040ME 2024

It is crucial to be aware of the filing deadlines for the Maine Form 1040ME 2024 to avoid penalties. Typically, the deadline for filing your state tax return is April 15 of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions they may need to file their returns.

Required Documents for Filing

When preparing to file the Maine Form 1040ME 2024, ensure you have the following documents ready:

- W-2 forms from all employers.

- 1099 forms for any freelance or contract work.

- Documentation for any other income sources.

- Records of deductible expenses, such as medical expenses or educational costs.

- Previous year’s tax return for reference.

Form Submission Methods

The Maine Form 1040ME 2024 can be submitted through various methods. Taxpayers have the option to file online using approved e-filing services, which can streamline the process and ensure quicker processing times. Alternatively, individuals may choose to print the completed form and mail it to the appropriate state tax office. In-person submissions are also accepted at designated tax offices.

Penalties for Non-Compliance

Failing to file the Maine Form 1040ME 2024 by the deadline can result in penalties. The state may impose fines based on the amount of tax owed and the length of the delay. Additionally, interest may accrue on any unpaid taxes. It is important for taxpayers to file on time and ensure all information is accurate to avoid these consequences.

Eligibility Criteria for Filing

To file the Maine Form 1040ME 2024, individuals must meet specific eligibility criteria. Generally, residents who earn income in Maine and have a filing requirement based on their income level must complete this form. This includes individuals who are employed, self-employed, or receive other forms of income. Additionally, certain exemptions may apply based on age, disability, or income level.

Create this form in 5 minutes or less

Find and fill out the correct 241040mebookresident indd

Create this form in 5 minutes!

How to create an eSignature for the 241040mebookresident indd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maine Form 1040ME 2024?

The Maine Form 1040ME 2024 is the state income tax return form that residents of Maine must use to report their income and calculate their tax liability for the year 2024. It includes various sections for income, deductions, and credits specific to Maine taxpayers. Understanding this form is crucial for accurate tax filing and compliance.

-

How can airSlate SignNow help with the Maine Form 1040ME 2024?

airSlate SignNow provides an efficient platform for electronically signing and sending the Maine Form 1040ME 2024. With its user-friendly interface, you can easily prepare your tax documents, ensuring they are signed and submitted on time. This streamlines the tax filing process, making it less stressful.

-

What are the pricing options for using airSlate SignNow for the Maine Form 1040ME 2024?

airSlate SignNow offers various pricing plans to suit different needs, starting with a free trial for new users. Paid plans provide additional features such as advanced integrations and enhanced security, making it a cost-effective solution for managing the Maine Form 1040ME 2024 and other documents. You can choose a plan that best fits your business requirements.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features like customizable templates, automated workflows, and secure cloud storage, which are essential for managing tax documents like the Maine Form 1040ME 2024. These features help ensure that your documents are organized, easily accessible, and compliant with state regulations. Additionally, the platform supports real-time collaboration among team members.

-

Is airSlate SignNow compliant with Maine tax regulations?

Yes, airSlate SignNow is designed to comply with various state regulations, including those related to the Maine Form 1040ME 2024. The platform ensures that all electronic signatures and document submissions meet legal standards, providing peace of mind for users. This compliance is crucial for avoiding potential issues with tax authorities.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular tax preparation software, allowing you to seamlessly manage the Maine Form 1040ME 2024 alongside your other financial documents. This integration enhances productivity by reducing the need for manual data entry and ensuring that all information is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for the Maine Form 1040ME 2024?

Using airSlate SignNow for the Maine Form 1040ME 2024 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your sensitive tax information. The platform's ease of use allows you to focus on your tax strategy rather than the logistics of document management. Additionally, the ability to track document status in real-time adds to the convenience.

Get more for 241040mebookresident indd

- Fillable online gro adoption certificate application form

- Adoption certificate uk form

- Veterinary referral form template

- My space housing application form

- Title taste of the islands do you see what i see form

- Forms district of massachusetts united states bankruptcy court

- Declaration of pro se party district of north dakota form

- Sample notice of guardianship proceeding nycourts form

Find out other 241040mebookresident indd

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile