Form 1040ME 2023

What is the Form 1040ME

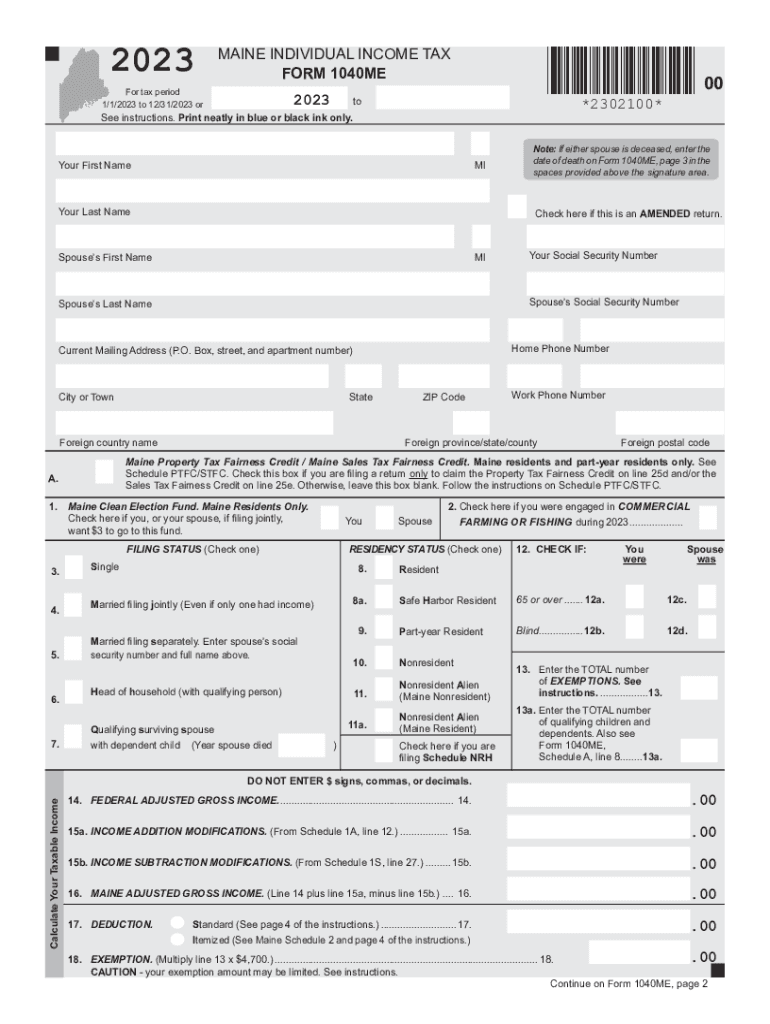

The Form 1040ME is the official Maine income tax return form used by residents to report their income and calculate their state tax liability. This form is specifically designed for individual taxpayers in Maine and is essential for ensuring compliance with state tax laws. The 1040ME allows taxpayers to report various sources of income, claim deductions, and determine their tax credits. It is crucial for residents to accurately complete this form to avoid potential penalties and ensure they pay the correct amount of taxes owed to the state.

How to obtain the Form 1040ME

Taxpayers can obtain the Form 1040ME from several sources. The most straightforward method is to visit the Maine Revenue Services website, where the form is available for download in PDF format. Additionally, taxpayers can request a physical copy of the form by contacting their local tax office or the Maine Revenue Services directly. It is important to ensure that you are using the correct version of the form for the applicable tax year, as forms may vary from year to year.

Steps to complete the Form 1040ME

Completing the Form 1040ME involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income by entering amounts from your income statements.

- Claim any deductions and credits applicable to your situation, such as the standard deduction or any specific Maine credits.

- Calculate your total tax liability and determine if you owe additional taxes or are due a refund.

- Sign and date the form before submitting it to ensure its validity.

Legal use of the Form 1040ME

The Form 1040ME is legally required for Maine residents who meet specific income thresholds. Filing this form is essential for compliance with state tax laws. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal action. It is important for taxpayers to understand their legal obligations regarding this form and to ensure that all information provided is accurate and complete.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines when filing the Form 1040ME. Generally, the due date for filing individual income tax returns in Maine is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file the form as early as possible to avoid last-minute issues and to ensure timely processing of any potential refunds.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting the Form 1040ME. The form can be filed electronically through approved tax software, which is often the fastest method for processing returns. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address provided by Maine Revenue Services. In-person submissions are also accepted at designated tax offices. Each method has its own advantages, and taxpayers should select the one that best suits their needs.

Quick guide on how to complete form 1040me

Effortlessly Prepare Form 1040ME on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form 1040ME on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign Form 1040ME with Ease

- Find Form 1040ME and click on Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form—via email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, and errors that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1040ME and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040me

Create this form in 5 minutes!

How to create an eSignature for the form 1040me

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow’s role in managing the 2014 Maine tax documents?

airSlate SignNow simplifies the process of managing your 2014 Maine tax documents by allowing you to eSign and send them securely. This solution helps ensure that all your documents are compliant and easily retrievable, reducing the hassle of traditional paperwork.

-

How does eSigning benefit my 2014 Maine tax filing process?

eSigning with airSlate SignNow streamlines your 2014 Maine tax filing process by eliminating the need for physical signatures. This not only saves time but also increases efficiency, allowing you to focus on more important aspects of your tax filing.

-

Is airSlate SignNow cost-effective for handling 2014 Maine tax documentation?

Yes, airSlate SignNow is a cost-effective solution for managing your 2014 Maine tax documentation. With flexible pricing plans, you can choose an option that suits your budget while ensuring that all your tax documents are handled with utmost care and professionalism.

-

What features of airSlate SignNow help with the 2014 Maine tax documentation?

airSlate SignNow offers features like document templates, automatic reminders, and secure cloud storage that are specifically beneficial for managing 2014 Maine tax documentation. These features enhance accuracy and help you stay organized during tax season.

-

Does airSlate SignNow integrate with accounting software for the 2014 Maine tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for efficient handling of your 2014 Maine tax filings. This integration ensures that your financial documents are linked and easily accessible for tax preparation.

-

Can I track the status of my 2014 Maine tax documents sent via airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 2014 Maine tax documents in real-time. This transparency helps you manage deadlines and ensures that you never miss an important date.

-

Is it easy to customize documents for the 2014 Maine tax with airSlate SignNow?

Definitely! airSlate SignNow allows users to easily customize their documents for 2014 Maine tax submissions. With user-friendly tools, you can tailor your documents to meet specific requirements, ensuring compliance and clarity.

Get more for Form 1040ME

- Fillable online case 509cv04134rdrkgs document 1 fax email form

- Non hearing motion for continuance declaration form

- Judiciarydistrict court forms for kauai fifth

- Free motion for reconsideration or new trial motion for r form

- Motion to set aside default judgment or dismissal declaration notice of motion certificate of service form

- E p m e form 5dc44 j de b t o r pe r s o n hav i n g kn o

- Judgment debtorss motion return release of wages form

- Fillable online engineering course of study swarthmore form

Find out other Form 1040ME

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document