MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine Gov 2020

What is the Maine Individual Income Tax Form 1040ME 2 0 1 4?

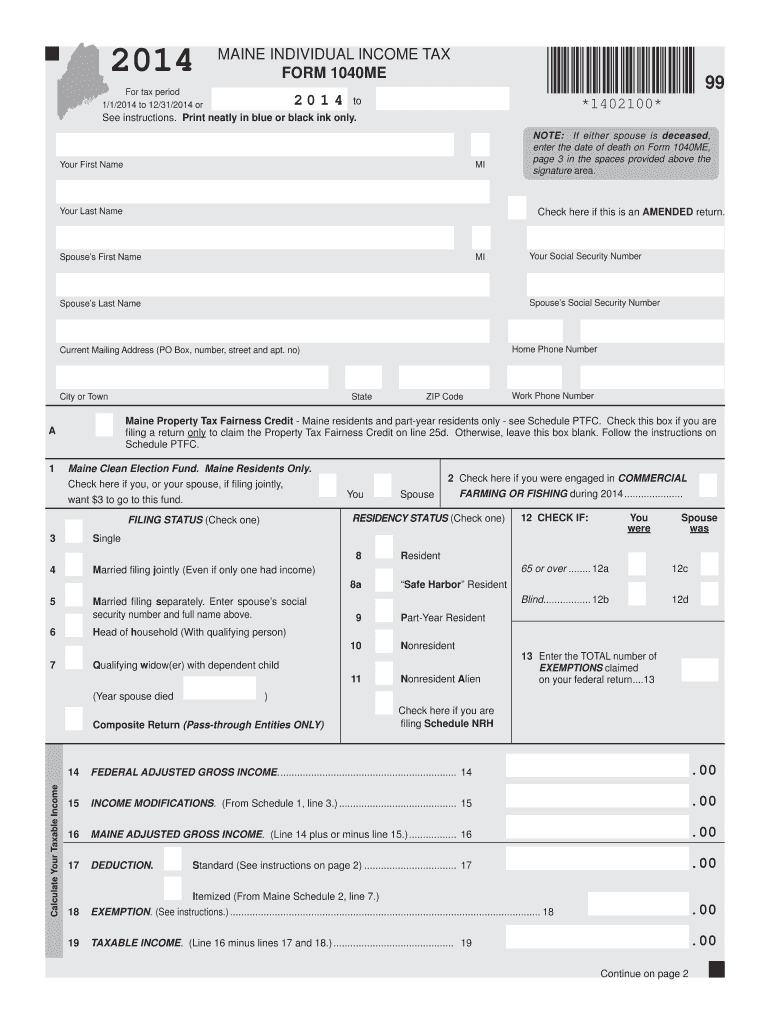

The Maine Individual Income Tax Form 1040ME 2 0 1 4 is a state-specific tax document used by residents of Maine to report their income and calculate their state tax liability for the tax year 2014. This form is essential for individuals who earn income in Maine and need to comply with state tax regulations. It provides a structured way to report various types of income, claim deductions, and calculate tax credits applicable to the taxpayer's situation.

How to Use the Maine Individual Income Tax Form 1040ME 2 0 1 4

Using the Maine Individual Income Tax Form 1040ME 2 0 1 4 involves several steps. Taxpayers should first gather all necessary financial documents, including W-2 forms, 1099s, and any other relevant income statements. Next, individuals should carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, taxpayers can submit it either online through the Maine Revenue Services website or by mailing a printed copy to the appropriate tax office. It is crucial to keep a copy of the completed form for personal records.

Steps to Complete the Maine Individual Income Tax Form 1040ME 2 0 1 4

Completing the Maine Individual Income Tax Form 1040ME 2 0 1 4 involves the following steps:

- Gather all necessary documents, including income statements and deduction records.

- Begin filling out the form by entering personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, interest, and dividends.

- Claim any applicable deductions and credits to reduce taxable income.

- Calculate the total tax owed or refund due based on the information provided.

- Review the completed form for accuracy before submission.

- Submit the form electronically or by mail, ensuring it is sent to the correct address.

Legal Use of the Maine Individual Income Tax Form 1040ME 2 0 1 4

The Maine Individual Income Tax Form 1040ME 2 0 1 4 is legally binding when completed and submitted according to state regulations. To ensure its validity, taxpayers must provide accurate information and sign the form. Electronic signatures are accepted, provided they comply with the legal standards set forth by the Electronic Signatures in Global and National Commerce (ESIGN) Act. This form serves as a formal declaration of income and tax obligations to the state of Maine.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Maine Individual Income Tax Form 1040ME 2 0 1 4. Typically, the deadline for filing individual income tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for taxpayers to stay informed about any changes to deadlines or extensions that may apply.

Required Documents

To accurately complete the Maine Individual Income Tax Form 1040ME 2 0 1 4, taxpayers should prepare the following documents:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of deductible expenses, such as medical bills or charitable contributions.

- Any relevant tax credit documentation.

Quick guide on how to complete maine individual income tax form 1040me 2 0 1 4 mainegov

Complete MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the correct format and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without delays. Manage MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov with ease

- Locate MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight essential parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct maine individual income tax form 1040me 2 0 1 4 mainegov

Create this form in 5 minutes!

How to create an eSignature for the maine individual income tax form 1040me 2 0 1 4 mainegov

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. used for?

The MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. is used by residents of Maine to file their individual income taxes for the year 2014. It helps taxpayers report their income, deductions, and credits to calculate the amount of tax owed or refund due. Filing this form is essential for complying with state tax regulations.

-

How can I obtain the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov.?

You can easily obtain the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. from the official Maine government website. Typically, forms are available for download in PDF format, allowing you to print them easily. Ensure you use the correct version for the appropriate tax year.

-

Is there a fee to file the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov.?

Filing the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. itself does not incur a filing fee; however, if you use a tax software or service to assist with your filing, there may be associated costs. Utilizing airSlate SignNow for eSigning documents may also include fees depending on the selected plan. Always check for any additional charges prior to filing.

-

What features does airSlate SignNow offer for handling the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov.?

airSlate SignNow provides features that simplify the process of completing and eSigning forms like the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. You can create templates, seal documents securely, and share them easily with others. This efficiency helps ensure your tax documents are filed on time.

-

Are there any benefits of using airSlate SignNow for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov.?

Using airSlate SignNow for your MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. offers benefits such as enhanced security for your personal information and greater convenience. You can sign documents electronically from anywhere, avoiding the hassle of printing and mailing. This solution saves time and reduces stress during tax season.

-

Can I track the status of my MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your documents, including the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. You can see when documents have been viewed, signed, or completed, providing peace of mind during the filing process. Keeping track of your submissions safeguards against potential delays.

-

Does airSlate SignNow support integrations with accounting software for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov.?

Absolutely! airSlate SignNow offers integrations with various accounting software which can enhance the filing process for the MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov. This allows for seamless data transfer and automates workflows, making tax preparation and filing much more efficient.

Get more for MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov

- Temporary form for hsp screening for clinics bsehatbbperkesob sehat perkeso gov

- Tulostettava valtakirja pohja form

- Checking account bank statements 1 answer key form

- Ultherapy consent form

- Restraining order instructions to the sheriff of the form

- Application for zoning board of adjustment city of lubbock form

- Form 1 florida commission on ethics

- American credit acceptance payoff phone number form

Find out other MAINE INDIVIDUAL INCOME TAX FORM 1040ME 2 0 1 4 Maine gov

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template