SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME for Form 1040ME 2021

Understanding the Schedule 2 Itemized Deductions Form 1040ME

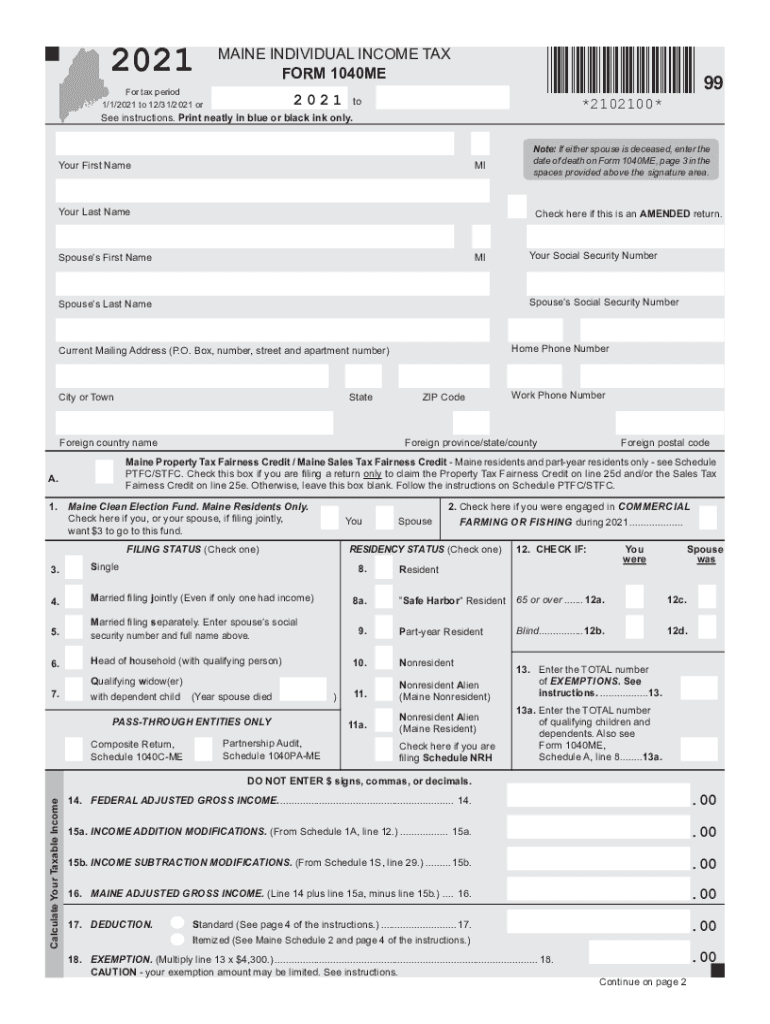

The Schedule 2 Itemized Deductions Form 1040ME is a crucial document for taxpayers in Maine who wish to itemize their deductions on their state income tax return. This form allows individuals to list specific expenses that can reduce their taxable income, potentially leading to a lower tax liability. Common deductions include medical expenses, mortgage interest, and charitable contributions. Understanding how to use this form effectively can help taxpayers maximize their deductions and ensure compliance with state tax regulations.

Steps to Complete the Schedule 2 Itemized Deductions Form 1040ME

Completing the Schedule 2 Itemized Deductions Form 1040ME involves several steps:

- Gather all necessary documentation, including receipts and statements for deductible expenses.

- Begin filling out the form by entering your personal information, including your name and Social Security number.

- List each deductible expense in the appropriate sections of the form, ensuring you provide accurate amounts.

- Calculate the total of your itemized deductions and transfer this amount to your main Form 1040ME.

- Review the completed form for accuracy before submitting it with your tax return.

How to Obtain the Schedule 2 Itemized Deductions Form 1040ME

Taxpayers can obtain the Schedule 2 Itemized Deductions Form 1040ME through various means. The form is available for download from the Maine Revenue Services website. Additionally, physical copies can often be found at local tax offices or public libraries. It's important to ensure that you are using the most current version of the form to comply with any recent changes in tax laws.

Legal Use of the Schedule 2 Itemized Deductions Form 1040ME

The Schedule 2 Itemized Deductions Form 1040ME must be used in accordance with Maine tax laws. To be legally valid, all information provided must be accurate and truthful. Misrepresentation or fraudulent claims can lead to penalties or legal repercussions. Taxpayers should keep all supporting documents for their deductions, as these may be required in case of an audit by the Maine Revenue Services.

Filing Deadlines for the Schedule 2 Itemized Deductions Form 1040ME

It is essential to be aware of the filing deadlines for the Schedule 2 Itemized Deductions Form 1040ME. Typically, Maine state income tax returns, including all associated forms, are due on April 15th of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers are encouraged to file early to avoid last-minute issues and ensure they have ample time to gather necessary documentation.

Examples of Using the Schedule 2 Itemized Deductions Form 1040ME

There are various scenarios in which taxpayers might find the Schedule 2 Itemized Deductions Form 1040ME beneficial. For instance, a homeowner who pays mortgage interest can deduct this amount on their state tax return. Similarly, individuals who have incurred significant medical expenses that exceed a certain percentage of their income may benefit from itemizing these costs. Charitable contributions made to qualified organizations can also be included, providing further tax relief.

Quick guide on how to complete schedule 2 itemized deductions form 1040me for form 1040me

Finish SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest method to modify and electronically sign SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME effortlessly

- Obtain SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule 2 itemized deductions form 1040me for form 1040me

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 itemized deductions form 1040me for form 1040me

How to make an e-signature for a PDF document in the online mode

How to make an e-signature for a PDF document in Chrome

The way to generate an e-signature for putting it on PDFs in Gmail

How to create an electronic signature right from your mobile device

The best way to make an e-signature for a PDF document on iOS devices

How to create an electronic signature for a PDF on Android devices

People also ask

-

What are the main features of airSlate SignNow for Maine tax forms?

airSlate SignNow offers a variety of features specifically tailored for handling Maine tax forms, including customizable templates, real-time collaboration, and the ability to securely eSign documents. This ensures that you can manage your tax filings efficiently and with minimal hassle. The platform also allows you to track document statuses so you can stay updated on your Maine tax forms.

-

How can airSlate SignNow help me complete my Maine tax forms?

Using airSlate SignNow simplifies the process of completing your Maine tax forms by providing easy-to-use templates and guided workflows. You can fill out forms online, save your progress, and securely send them for eSignature. This makes it easier to meet filing deadlines without the stress of manual paperwork.

-

Is airSlate SignNow affordable for small businesses managing Maine tax forms?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their Maine tax forms. With a variety of pricing plans, you can choose one that fits your budget while still enjoying powerful tools for document management and eSignature. The investment in airSlate SignNow can ultimately save you time and reduce errors in your tax processes.

-

Does airSlate SignNow integrate with other software useful for Maine tax forms?

Absolutely! airSlate SignNow offers integrations with popular accounting and financial software that are commonly used for managing Maine tax forms. This seamless integration allows you to streamline your workflow, ensuring that all relevant data is automatically synced and reducing the likelihood of errors.

-

What benefits does airSlate SignNow provide for electronic signatures on Maine tax forms?

The primary benefit of using airSlate SignNow for eSigning Maine tax forms is the increased efficiency and security it offers. Electronic signatures are legally recognized and ensure that your documents are signed quickly and securely. This means you can finalize your tax forms without the delays associated with traditional paper signatures.

-

How does airSlate SignNow ensure the security of my Maine tax forms?

airSlate SignNow takes the security of your Maine tax forms seriously, utilizing advanced encryption and security measures to protect your data. Your documents are stored securely, and access is restricted to authorized users only. This commitment to security helps you maintain compliance and peace of mind when handling sensitive tax information.

-

Can I access my Maine tax forms from multiple devices using airSlate SignNow?

Yes, airSlate SignNow is designed for accessibility, allowing you to manage your Maine tax forms from any device with internet access. This means you can work on your documents from your computer, tablet, or smartphone, providing flexibility and convenience as you handle your tax paperwork.

Get more for SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME

- Mn 20 1 form

- Change name m online form

- Assignment of mortgage by business entity ucbc form 2032 minnesota

- Mn satisfaction form

- Satisfaction of mortgage by business entity with change of name or identity minn stat 507411 ucbc form 2053 minnesota

- Partial release mortgage form 497312087

- Partial release of mortgage by business entity with change of name or identity minn stat 507411 ucbc form 2063 minnesota

- Mn discharge form

Find out other SCHEDULE 2 ITEMIZED DEDUCTIONS FORM 1040ME For Form 1040ME

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple