Maine 1040 Form 2018

What is the Maine 1040 Form

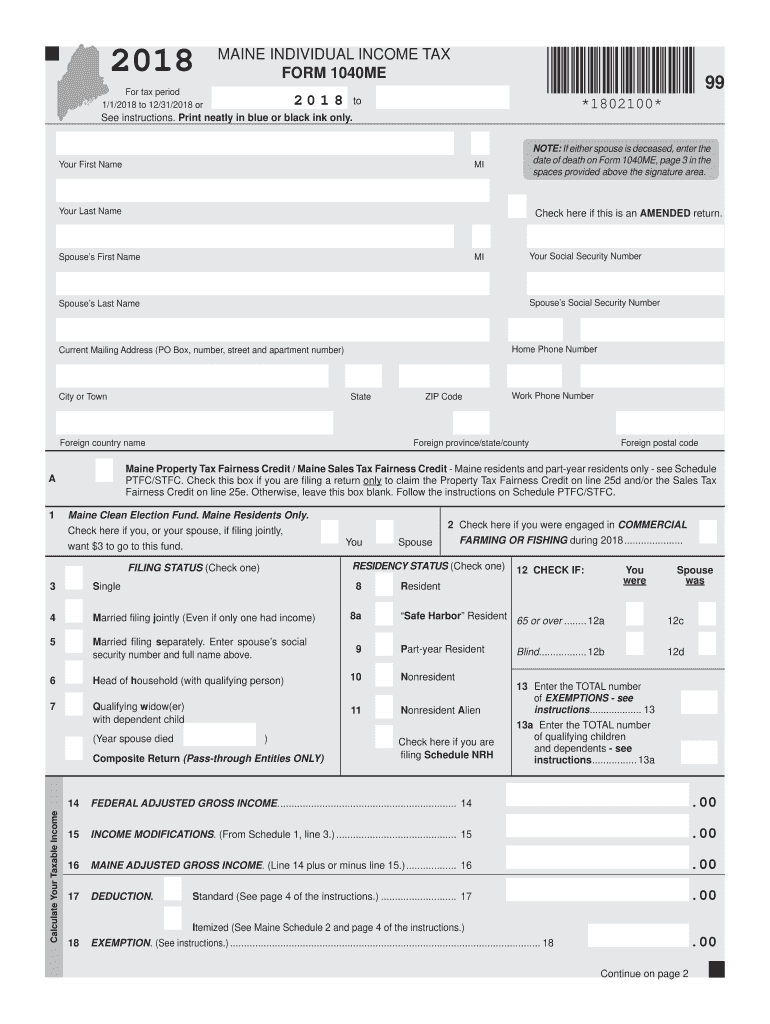

The Maine 1040 Form, officially known as the 1040ME, is the state income tax return form used by residents of Maine to report their income and calculate their state tax liability. This form is essential for individuals and families who earn income within the state, as it allows them to fulfill their legal obligation to report earnings and pay applicable taxes. The 1040ME is designed to accommodate various income sources, including wages, self-employment income, and investment earnings, ensuring that all taxpayers can accurately report their financial situation.

How to use the Maine 1040 Form

Using the Maine 1040 Form involves several key steps. Taxpayers must first gather all necessary documentation, including W-2s, 1099s, and any other income statements. Once all relevant information is collected, individuals can begin filling out the form. The 1040ME includes sections for personal information, income details, deductions, and credits. After completing the form, it is crucial to review all entries for accuracy before submission. Taxpayers can choose to file electronically or submit a paper version of the form, depending on their preference.

Steps to complete the Maine 1040 Form

Completing the Maine 1040 Form involves a systematic approach. Follow these steps for a smooth filing process:

- Gather all necessary documents, such as income statements and prior tax returns.

- Fill out the personal information section, including your name, address, and Social Security number.

- Report your total income in the appropriate section, ensuring all sources are accounted for.

- Apply any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability and any refund or amount owed.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or by mail, following the instructions provided.

Legal use of the Maine 1040 Form

The Maine 1040 Form is legally recognized as the official document for reporting state income taxes. It must be completed accurately and submitted by the designated filing deadline to avoid penalties. Failure to file or inaccuracies in reporting can lead to legal consequences, including fines or audits by the Maine Revenue Services. It is essential for taxpayers to understand their responsibilities and ensure compliance with state tax laws when using the 1040ME.

Filing Deadlines / Important Dates

Taxpayers should be aware of key deadlines associated with the Maine 1040 Form to ensure timely filing. Typically, the deadline for submitting the 1040ME is April fifteenth of each year, coinciding with the federal tax filing deadline. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers may request an extension to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Form Submission Methods (Online / Mail / In-Person)

The Maine 1040 Form can be submitted through various methods, providing flexibility for taxpayers. The options include:

- Online Submission: Taxpayers can file electronically using approved e-filing software, which streamlines the process and often includes built-in error checks.

- Mail Submission: Individuals may choose to print the completed form and mail it to the appropriate address provided in the filing instructions.

- In-Person Submission: Some taxpayers may opt to deliver their forms directly to local tax offices for assistance or confirmation of receipt.

Quick guide on how to complete maine form 1040me 2018 2019

Your assistance manual on how to prepare your Maine 1040 Form

If you're wondering how to generate and submit your Maine 1040 Form, here are some brief guidelines on how to make tax filing simpler.

First, you simply need to set up your airSlate SignNow account to change how you handle documents online. airSlate SignNow is a user-friendly and powerful document management solution that enables you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, check boxes, and eSignatures and revisit to amend responses as necessary. Streamline your tax organization with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finish your Maine 1040 Form in just a few minutes:

- Establish your account and start processing PDFs within minutes.

- Utilize our directory to obtain any IRS tax document; explore various versions and schedules.

- Click Get form to access your Maine 1040 Form in our editor.

- Complete the necessary fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally binding eSignature (if necessary).

- Review your document and correct any inaccuracies.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that paper filing can lead to additional errors and delays in refunds. As always, prior to e-filing your taxes, check the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct maine form 1040me 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

How do I fill out the JEE Main 2019 exam application form?

Steps to fill out the JEE Mains 2019 application form?How to Fill JEE Main 2019 Application FormJEE Main 2019 Registration Process to be followed on the NTA Website:Step 1: Visit the website of NTA or CLick here.Step 2: Click on NTA exams or on Joint Entrance Examination under the Engineering Section given on the same page.Step 3: You will see the registration button as shown in the image below. Read all the eligibility criteria and click on “Registration”Step 4: Candidates will be redirected to the JEE Main 2019 official website where they have to click on “Fill Application Form”.Step 5: Now, Click on “Apply for JEE Main 2019”. Read all instructions carefully and proceed to apply online by clicking on the button given at the end of the page.Step 6: Fill in all the details as asked. Submit the authentication form with correct details.Step 7: Upload the scanned images in correct specification given on the instructions page.Step 8: Pay the Application fee and take a print out of the filled up application form.Aadhar Card Required for JEE Main 2019 RegistrationFor the last two years, Aadhar card was made mandatory for each candidate to possess for the application form filling of JEE Main. However, since JEE Main 2019 is now to be conducted by NTA, they have asked the candidates to enter their Aadhar card number. The Aadhar card number is necessary for JEE Main 2019 Application form and candidates must be ready with their Aadhar card number to enter it in the application form.JEE main 2019 Application Form will be available twice, once in the month of September for the January 2019 exam and again in the month of February for the April exam. Thus, first, the candidates have to fill out the application form of January 2019 examination in the month of September 2018.

-

How will a student fill the JEE Main application form in 2018 if he has to give the improvement exam in 2019 in 2 subjects?

Now in the application form of JEE Main 2019, there will be an option to fill whether or not you are appearing in the improvement exam. This will be as follows:Whether appearing for improvement Examination of class 12th - select Yes or NO.If, yes, Roll Number of improvement Examination (if allotted) - if you have the roll number of improvement exam, enter it.Thus, you will be able to fill in the application form[1].Footnotes[1] How To Fill JEE Main 2019 Application Form - Step By Step Instructions | AglaSem

-

How do I fill out the JEE Main 2018 application form?

How to fill application form for JEE main 2018?Following is the Step By Step procedure for filling of Application Form.Before filling the form you must check the eligibility criteria for application.First of all, go to the official website of CBSE Joint Entrance Exam Main 2018. After that, click on the "Apply for JEE Main 2018" link.Then there will be some important guidelines on the page. Applicants must read those guidelines carefully before going further.In the next step, click on "Proceed to Apply Online" link.After that, fill all the asked details from you for authentication purpose and click Submit.Application Form is now visible to you.Fill all your personal and academic information.Then, Verify Your Full Details before you submit the application form.After that, the applicants have to Upload Scanned Images of their passport sized photograph and their signature.Then, click Browse and select the images which you have scanned for uploading.After Uploading the scanned images of your their passport sized photograph and their signature.At last, pay the application fee either through online transaction or offline mode according to your convenience.After submitting the fee payment, again go to the login page and enter your allotted Application Number and Password.Then, Print Acknowledgement Page.Besides this, the candidates must keep this hard copy of the application confirmation receipt safe for future reference.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

Create this form in 5 minutes!

How to create an eSignature for the maine form 1040me 2018 2019

How to create an electronic signature for your Maine Form 1040me 2018 2019 online

How to make an electronic signature for your Maine Form 1040me 2018 2019 in Chrome

How to make an electronic signature for putting it on the Maine Form 1040me 2018 2019 in Gmail

How to generate an electronic signature for the Maine Form 1040me 2018 2019 from your smartphone

How to create an eSignature for the Maine Form 1040me 2018 2019 on iOS

How to generate an eSignature for the Maine Form 1040me 2018 2019 on Android

People also ask

-

What is the Maine 1040 Form and why is it important?

The Maine 1040 Form is the state income tax return form used by residents of Maine to report their income and calculate their state tax obligations. Filing this form accurately is crucial to ensure compliance with state tax laws and to avoid potential penalties. Using tools like airSlate SignNow can simplify the signing and submission process for your Maine 1040 Form.

-

How can airSlate SignNow help me with my Maine 1040 Form?

airSlate SignNow provides a user-friendly platform that allows you to easily eSign and send your Maine 1040 Form securely. With our service, you can streamline the document management process, ensuring that your tax forms are completed and submitted on time. Plus, our solution helps maintain compliance with state regulations.

-

What features does airSlate SignNow offer for handling the Maine 1040 Form?

airSlate SignNow offers a range of features that enhance the management of your Maine 1040 Form, including customizable templates, secure eSigning, and document tracking. These features help you complete your tax filing efficiently while keeping your documents organized and accessible. Our platform ensures that you can manage your Maine 1040 Form effortlessly.

-

Is there a cost associated with using airSlate SignNow for my Maine 1040 Form?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective for businesses and individuals alike. The pricing varies based on the plan you choose, which provides access to a variety of features tailored for managing documents like the Maine 1040 Form. Investing in airSlate SignNow can save you time and reduce stress during tax season.

-

Can I integrate airSlate SignNow with other software for my Maine 1040 Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to connect your workflow when preparing your Maine 1040 Form. Whether you use accounting software or document management systems, our platform can enhance your productivity by integrating with tools you already use.

-

How secure is airSlate SignNow when handling my Maine 1040 Form?

Security is a top priority at airSlate SignNow. We employ advanced encryption and security protocols to protect your Maine 1040 Form and any other sensitive documents. Rest assured that your data is safe, allowing you to eSign and send documents with confidence.

-

Can I access my Maine 1040 Form from multiple devices using airSlate SignNow?

Yes, airSlate SignNow is accessible from any device with an internet connection, whether it's a desktop, tablet, or smartphone. This flexibility ensures that you can work on your Maine 1040 Form anytime and anywhere. Our platform is designed to provide convenience and accessibility for all users.

Get more for Maine 1040 Form

Find out other Maine 1040 Form

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation