CLEAR ALL 2022

Understanding Maine Income Tax

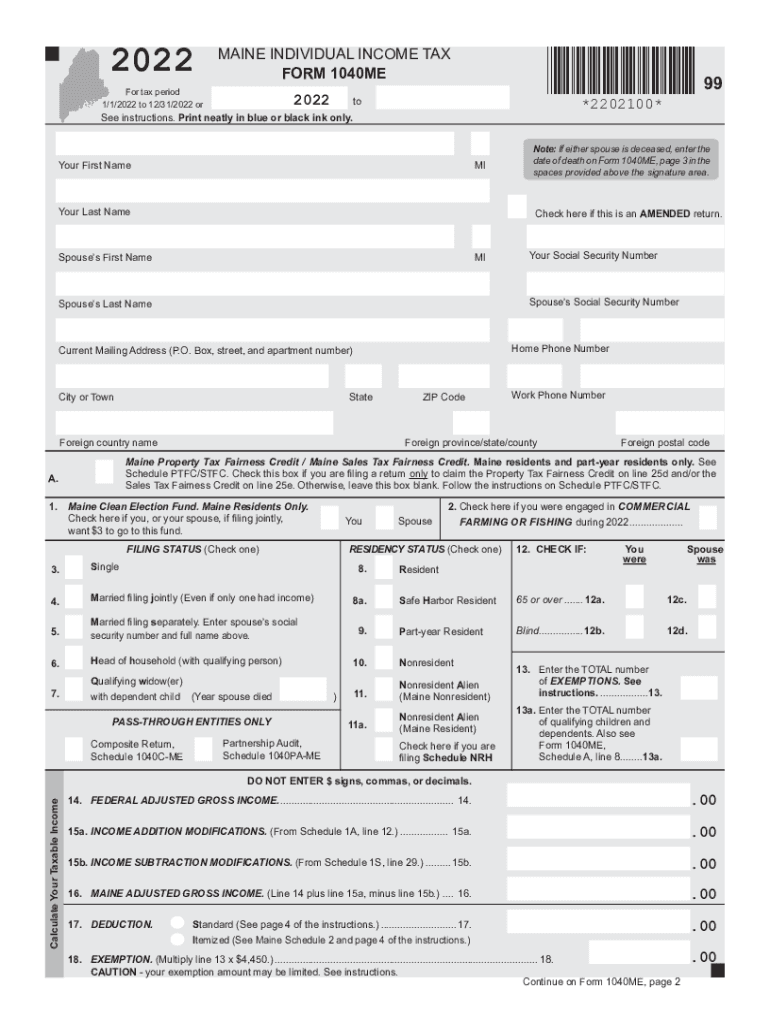

Maine income tax is a state-level tax imposed on the income of residents and non-residents earning income within the state. The tax rate varies based on income levels, with a progressive structure that increases as income rises. Understanding the nuances of the Maine tax system is essential for accurate filing and compliance.

Filing Deadlines and Important Dates

For the 2022 tax year, the deadline to file Maine income tax returns is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of estimated tax payment deadlines, which are usually due quarterly. Keeping track of these dates helps avoid penalties and ensures timely compliance.

Required Documents for Filing

When filing Maine income tax, certain documents are necessary to ensure accurate reporting. Taxpayers should gather their W-2 forms from employers, 1099 forms for other income sources, and any relevant deductions or credits documentation. Additionally, if claiming certain deductions, such as medical expenses or property taxes, supporting documentation will be required to substantiate these claims.

Form Submission Methods

Maine income tax forms can be submitted through various methods, including online filing, mail, and in-person submissions. The online option is often the most efficient, allowing for quicker processing and confirmation of receipt. For those who prefer traditional methods, forms can be printed and mailed to the appropriate state tax office. In-person submissions are also accepted at designated locations.

Penalties for Non-Compliance

Failing to file Maine income tax returns or pay owed taxes can result in significant penalties. These may include late filing fees, interest on unpaid taxes, and potential legal action for severe non-compliance. It's crucial for taxpayers to understand these risks and ensure they meet all filing requirements to avoid unnecessary financial burdens.

IRS Guidelines for Maine Income Tax

While Maine has its own tax regulations, it is essential to align with IRS guidelines as well. Taxpayers must ensure that their federal tax returns are accurately reflected in their state filings. This includes reporting all income and deductions consistently. Understanding the relationship between state and federal tax obligations can help streamline the filing process.

Examples of Taxpayer Scenarios

Different taxpayer scenarios can affect how Maine income tax is calculated. For instance, self-employed individuals may have different deductions available compared to traditional employees. Additionally, retirees and students may also face unique tax situations based on their income sources and residency status. Recognizing these scenarios can help taxpayers prepare more effectively for filing.

Quick guide on how to complete clear all

Easily prepare CLEAR ALL on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents promptly without delays. Manage CLEAR ALL on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to edit and eSign CLEAR ALL effortlessly

- Obtain CLEAR ALL and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you would like to share your form, whether by email, text (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Edit and eSign CLEAR ALL and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct clear all

Create this form in 5 minutes!

How to create an eSignature for the clear all

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Maine income tax?

airSlate SignNow is a digital signing solution that allows businesses to send and eSign documents. For those managing Maine income tax documents, it provides an efficient way to get documents signed quickly and securely, reducing the hassles of paperwork and ensuring compliance.

-

How can airSlate SignNow help with Maine income tax filing?

By using airSlate SignNow, you can streamline the process of collecting signatures needed for Maine income tax filings. This platform ensures that all necessary documents are signed without delay, helping you meet important tax deadlines effortlessly.

-

What are the pricing options for airSlate SignNow when managing Maine income tax documents?

airSlate SignNow offers several pricing plans that cater to different business needs, from individual users to large enterprises. Each plan provides essential features for managing documents related to Maine income tax, allowing businesses to choose an option that fits their budget.

-

Can airSlate SignNow integrate with accounting software for Maine income tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enhancing its utility for Maine income tax preparation. This integration allows you to easily send tax-related documents for eSignature without disrupting your existing workflow.

-

What features does airSlate SignNow offer to simplify Maine income tax processing?

airSlate SignNow includes features such as templates, automatic reminders, and comprehensive tracking to simplify the processing of Maine income tax documents. These tools help ensure that all signatures are obtained on time, facilitating a smoother tax filing experience.

-

Is airSlate SignNow secure for managing sensitive Maine income tax documents?

Absolutely, airSlate SignNow employs top-tier security measures, including encryption and secure cloud storage, to protect your sensitive Maine income tax documents. You can trust that your data is safeguarded throughout the signing process.

-

What are the benefits of using airSlate SignNow for Maine income tax paperwork?

The benefits of using airSlate SignNow for Maine income tax paperwork include increased efficiency, reduced turnaround times, and enhanced compliance. Businesses can minimize the paperwork load while ensuring that all necessary documents are easily accessible and securely signed.

Get more for CLEAR ALL

- Unconditional waiver and release of claim of lien upon progress payment south carolina form

- Quitclaim deed from husband and wife to llc south carolina form

- Warranty deed from husband and wife to llc south carolina form

- Sc judgment form

- Conditional waiver and release of claim of lien upon final payment south carolina form

- Landlord notice premises form

- South carolina notice 497325636 form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497325637 form

Find out other CLEAR ALL

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself