South Dakota Fixed Rate Note, Installment Payments Secured by Personal Property Form

What is the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

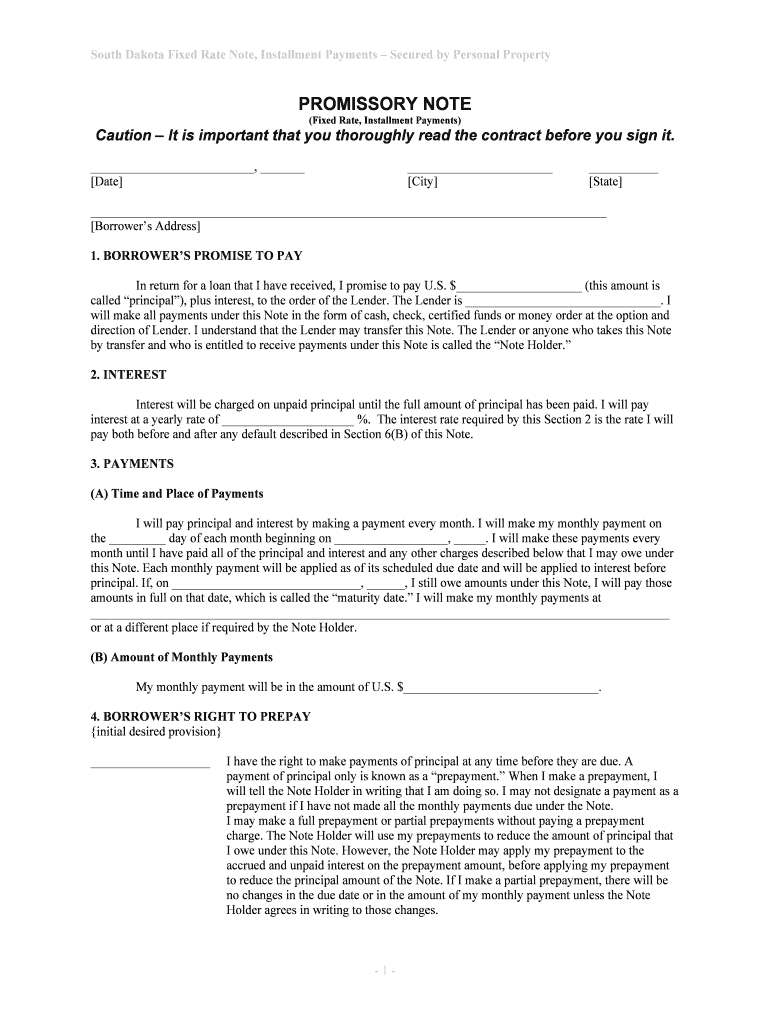

The South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document used in financial transactions where a borrower agrees to repay a loan in fixed installments over a specified period. This note is secured by personal property, meaning that the lender has a claim on the borrower's assets in case of default. The fixed rate ensures that the interest remains constant throughout the life of the loan, providing predictability in payment amounts. This type of note is commonly used for personal loans, vehicle financing, and other secured lending arrangements.

How to use the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

To use the South Dakota Fixed Rate Note, borrowers must first ensure that they understand the terms outlined in the document. The borrower and lender should fill in the required information, including loan amount, interest rate, payment schedule, and details about the secured personal property. Once completed, both parties must sign the document. It is advisable to keep a copy for personal records and provide one to the lender. Utilizing electronic signature tools can streamline this process, making it easier to execute and store the note securely.

Steps to complete the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

Completing the South Dakota Fixed Rate Note involves several key steps:

- Gather necessary information, including the loan amount, interest rate, and payment terms.

- Identify the personal property that will serve as security for the loan.

- Fill out the note, ensuring all fields are accurately completed.

- Both the borrower and lender should review the document for accuracy.

- Sign the note, either in person or using a secure electronic signature solution.

- Store copies of the signed note in a safe place for future reference.

Key elements of the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

Several key elements are essential in the South Dakota Fixed Rate Note:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The fixed rate applied to the loan.

- Payment Schedule: The frequency and amount of installment payments.

- Secured Property: Description of the personal property used as collateral.

- Default Terms: Conditions under which the lender can claim the secured property.

Legal use of the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

The South Dakota Fixed Rate Note is legally binding as long as it meets specific requirements. It must include clear terms regarding the loan, the obligations of both parties, and the consequences of default. The note should be signed by both the borrower and lender, and it is recommended to have it notarized to enhance its enforceability. Compliance with state laws regarding secured transactions is crucial to ensure that the note is valid and enforceable in court.

State-specific rules for the South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

In South Dakota, specific rules govern the use of fixed rate notes secured by personal property. These include requirements for the description of the secured property, the necessity of written agreements, and adherence to the Uniform Commercial Code (UCC) regulations. It is important for both borrowers and lenders to familiarize themselves with these rules to ensure compliance and protect their rights in the event of a dispute.

Quick guide on how to complete south dakota fixed rate note installment payments secured by personal property

Complete South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property effortlessly on any device

Web document management has become increasingly popular among businesses and individuals. It offers a seamless eco-friendly substitute to traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and eSign South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property with ease

- Obtain South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property?

A South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property is a financial agreement where the borrower agrees to repay a specific amount over time with a fixed interest rate, secured by personal assets. This type of note ensures lenders have a claim to property in case of default, making it a low-risk investment.

-

How do I create a South Dakota Fixed Rate Note?

Creating a South Dakota Fixed Rate Note can be easily done through airSlate SignNow. Our platform allows you to generate customizable templates that you can fill with your specific terms and conditions. The eSigning feature facilitates quick approval from all parties involved.

-

What are the benefits of using a South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property?

Using a South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property provides predictable repayment terms and security for lenders. It allows borrowers to maintain ownership of personal assets while obtaining necessary financing. Additionally, this structured agreement promotes trust between lenders and borrowers.

-

Is there a minimum loan amount for a South Dakota Fixed Rate Note?

The minimum loan amount for a South Dakota Fixed Rate Note typically depends on the lender's policies and the value of the secured personal property. While some lenders may have specific thresholds, airSlate SignNow can help you customize agreements to fit potential financing needs. Always consult with your lender for individual requirements.

-

What features does airSlate SignNow offer for processing South Dakota Fixed Rate Notes?

airSlate SignNow offers a user-friendly interface, customizable templates, and eSigning capabilities for South Dakota Fixed Rate Notes. Additionally, our document tracking and audit trail features ensure transparency and security throughout the process. These tools simplify managing the notes and enhance communication with all parties.

-

Are there integrations available for managing South Dakota Fixed Rate Notes with airSlate SignNow?

Yes, airSlate SignNow offers integrations with various third-party applications to streamline the management of South Dakota Fixed Rate Notes. These integrations can help synchronize your documents with CRM systems, accounting software, and more. This ensures seamless workflows and keeps all your financial documents organized.

-

How secure is my data when using airSlate SignNow for South Dakota Fixed Rate Notes?

Your data security is a top priority at airSlate SignNow. Our platform employs industry-leading encryption protocols to protect the information associated with South Dakota Fixed Rate Notes. This commitment to security ensures that your sensitive financial documents remain safe and confidential.

Get more for South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

Find out other South Dakota Fixed Rate Note, Installment Payments Secured By Personal Property

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online