1040ez Tax Form 2009

What is the 1040ez Tax Form

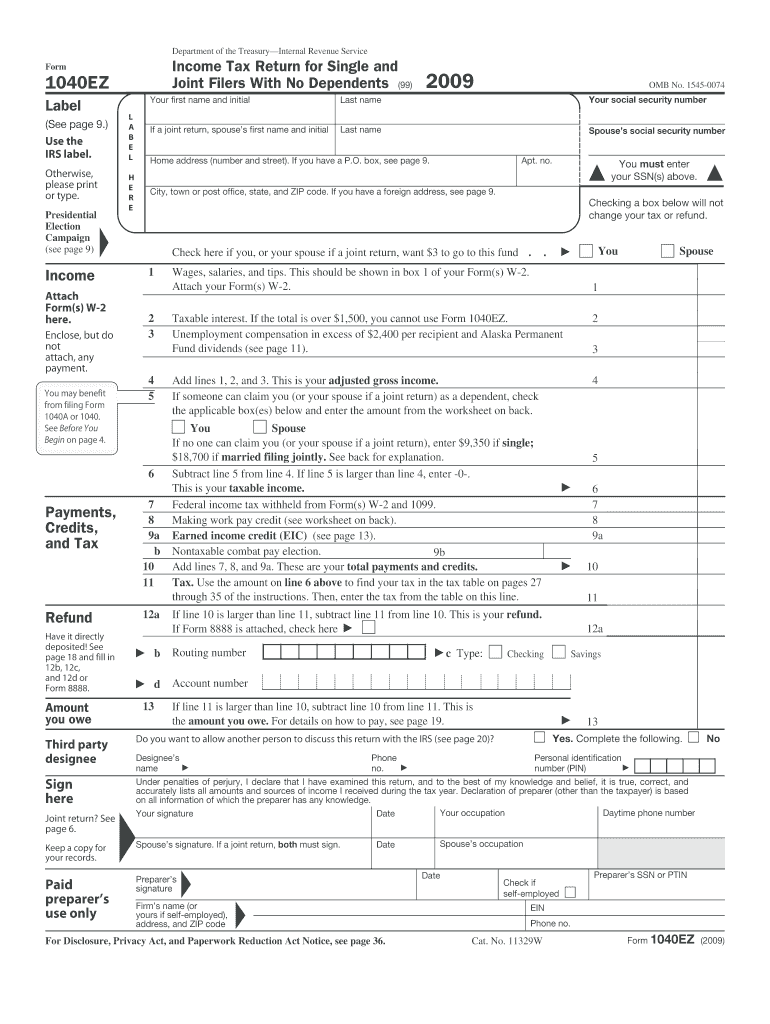

The 1040ez Tax Form is a simplified version of the standard IRS Form 1040, designed for individual taxpayers with straightforward financial situations. This form is ideal for those who meet specific eligibility criteria, allowing them to file their federal income tax returns quickly and efficiently. The 1040ez is primarily intended for single or married taxpayers filing jointly, who do not claim dependents and have taxable income below a certain threshold.

How to use the 1040ez Tax Form

Using the 1040ez Tax Form involves several straightforward steps. First, ensure that you meet the eligibility requirements, such as income limits and filing status. Next, gather all necessary information, including your Social Security number, income details, and any tax credits you may qualify for. Once you have this information, complete the form by entering your income, calculating your tax liability, and determining any refund or amount owed. Finally, submit the completed form to the IRS either electronically or by mail, depending on your preference.

Steps to complete the 1040ez Tax Form

Completing the 1040ez Tax Form requires a methodical approach. Follow these steps:

- Gather your financial documents, including W-2s and any other income statements.

- Fill in your personal information, such as name, address, and Social Security number.

- Report your total income from all sources, ensuring it does not exceed the limits set for the 1040ez.

- Calculate your tax using the provided tax tables or software.

- Determine if you are eligible for any tax credits, such as the Earned Income Tax Credit.

- Sign and date the form before submitting it to the IRS.

Eligibility Criteria

To file using the 1040ez Tax Form, taxpayers must meet specific eligibility criteria. These include:

- Filing status must be single or married filing jointly.

- Taxable income must be less than one hundred thousand dollars.

- No dependents can be claimed on the return.

- Taxpayers cannot claim certain credits, such as the Child and Dependent Care Credit.

Form Submission Methods

The 1040ez Tax Form can be submitted to the IRS through various methods. Taxpayers may choose to file electronically using tax preparation software or through a tax professional. This method often results in faster processing and quicker refunds. Alternatively, the form can be printed and mailed to the appropriate IRS address. Ensure that the form is sent well before the filing deadline to avoid penalties.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the 1040ez Tax Form. These guidelines detail the eligibility requirements, instructions for filling out the form, and information on filing deadlines. Taxpayers are encouraged to review these guidelines to ensure compliance and to maximize any potential refunds. Keeping abreast of any changes in tax laws or IRS procedures is also essential for accurate filing.

Quick guide on how to complete 2009 1040ez tax form

Manage 1040ez Tax Form easily on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, adjust, and electronically sign your documents swiftly and without issues. Handle 1040ez Tax Form on any platform using airSlate SignNow apps for Android or iOS and enhance any document-driven task today.

How to modify and electronically sign 1040ez Tax Form effortlessly

- Obtain 1040ez Tax Form and click on Get Form to begin.

- Use the tools we offer to submit your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from a device of your selection. Modify and electronically sign 1040ez Tax Form and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 1040ez tax form

Create this form in 5 minutes!

How to create an eSignature for the 2009 1040ez tax form

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

The best way to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 1040ez Tax Form and who can use it?

The 1040ez Tax Form is a simplified federal income tax return available for individuals with straightforward tax situations. It's ideal for single or married taxpayers filing jointly, who report income from wages, salaries, or tips without claimable deductions. Understanding how to use the 1040ez Tax Form can help streamline your filing process.

-

How can airSlate SignNow assist with signing the 1040ez Tax Form?

AirSlate SignNow provides an efficient platform for electronically signing the 1040ez Tax Form securely. Users can upload their documents, add e-signatures, and send them easily while ensuring compliance with legal standards. This tool saves time and enhances the overall filing experience.

-

Is there a cost associated with using airSlate SignNow for the 1040ez Tax Form?

AirSlate SignNow offers a competitive pricing model that allows you to choose a plan best suited for your needs, making it cost-effective for handling the 1040ez Tax Form. With a variety of subscription options, individuals and businesses can find a solution that fits their budget while enjoying robust features. Sign up today for a free trial to explore the benefits.

-

What features does airSlate SignNow offer for managing the 1040ez Tax Form?

AirSlate SignNow provides various features to facilitate handling the 1040ez Tax Form, including customizable templates, cloud storage, and tracking capabilities. The simplicity of the platform allows you to prepare, sign, and manage your forms all in one place. These features enhance efficiency and ensure your documents are always accessible.

-

Can I integrate airSlate SignNow with other software for the 1040ez Tax Form?

Yes, airSlate SignNow can be integrated seamlessly with various accounting and tax preparation software to streamline the process for the 1040ez Tax Form. This allows users to import data directly, making it easier to fill out and submit their tax returns accurately. Enhanced integration increases productivity and reduces the risk of errors.

-

What are the benefits of using airSlate SignNow for the 1040ez Tax Form?

Using airSlate SignNow for the 1040ez Tax Form offers several benefits, including improved efficiency and reduced turnaround times for document processing. The platform's user-friendly interface makes it accessible for all users, regardless of their tech-savviness. Furthermore, it ensures that your tax forms are handled securely and in compliance with regulations.

-

Is support available if I have questions about the 1040ez Tax Form?

Absolutely! AirSlate SignNow offers dedicated customer support to assist users with any questions or concerns regarding the 1040ez Tax Form. Whether you need assistance with e-signing, accessing features, or understanding tax requirements, help is just a click away. Our support team is committed to ensuring your experience is smooth and satisfactory.

Get more for 1040ez Tax Form

- Finance and treasury board form

- Wsib purchase certificate worksheet form

- Client intake form new perspectives counselling newperspectivescounselling

- Consent form for dental treatment

- Chem 2400 mun form

- Qsmm dr taher al jishi obgyn referral form 2016 10 31 qsmm dr taher al jishi obgyn referral form 2016 10 31

- Drinking water system number eastgwillimbury form

- Psac grievance form

Find out other 1040ez Tax Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation