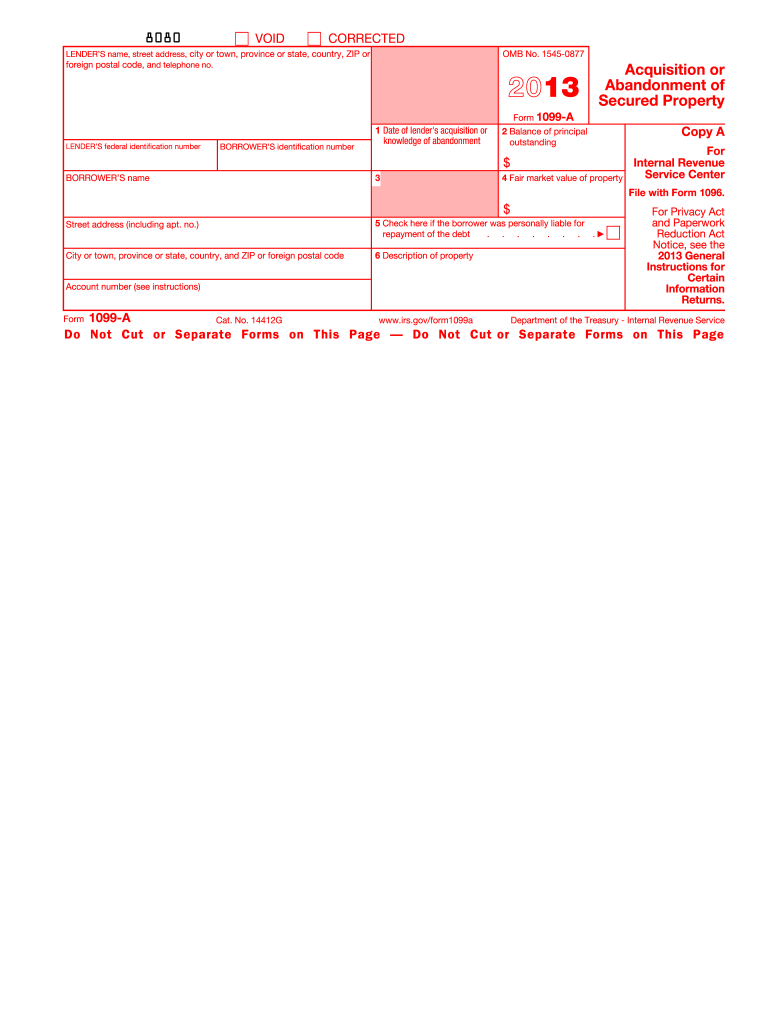

1099a Form 2013

What is the 1099a Form

The 1099a Form, officially known as the Acquisition or Abandonment of Secured Property, is a tax document used in the United States. It is primarily utilized by lenders to report the acquisition of secured property or the abandonment of such property by a borrower. This form is essential for accurately reflecting the financial transactions related to secured loans, particularly in cases of foreclosure or repossession. By providing detailed information about the property and the loan, the 1099a Form helps ensure that both the lender and the borrower are compliant with IRS regulations.

How to obtain the 1099a Form

To obtain the 1099a Form, individuals or businesses can access it directly from the IRS website. The form is available for download in PDF format, allowing users to print it for completion. Additionally, financial institutions that issue loans may provide the form to borrowers when necessary, particularly in cases involving secured property. It is important to ensure that the correct tax year’s form is being used, as the IRS may update the form periodically to reflect changes in tax law.

Steps to complete the 1099a Form

Completing the 1099a Form involves several key steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary information, including details about the secured property and the loan. Then, follow these steps:

- Enter the lender's information, including name, address, and taxpayer identification number.

- Provide the borrower's details, ensuring that the name and address are accurate.

- Fill in the property description, including the address and type of property.

- Indicate the date of acquisition or abandonment of the property.

- Report the fair market value of the property at the time of acquisition or abandonment.

After completing the form, review it for accuracy before submission to ensure compliance with IRS regulations.

Legal use of the 1099a Form

The legal use of the 1099a Form is crucial for both lenders and borrowers. For lenders, it serves as a formal record of the acquisition or abandonment of secured property, which can be necessary for tax reporting purposes. Borrowers may also need this form to accurately report their financial situation on their tax returns. It is essential that the form is completed correctly and submitted on time to avoid potential penalties. Compliance with IRS guidelines regarding the use of the 1099a Form helps protect all parties involved in the transaction.

Key elements of the 1099a Form

The 1099a Form contains several key elements that are critical for accurate reporting. These include:

- Lender's Information: Name, address, and taxpayer identification number of the lender.

- Borrower's Information: Name and address of the borrower.

- Property Description: Details about the secured property, including its address and type.

- Date of Acquisition or Abandonment: The specific date when the property was acquired or abandoned.

- Fair Market Value: The value of the property at the time of the transaction.

Each of these elements must be accurately reported to ensure compliance with tax regulations and to provide a clear record of the transaction.

Filing Deadlines / Important Dates

Filing deadlines for the 1099a Form are crucial for compliance with IRS regulations. Typically, the form must be submitted to the IRS by the end of February if filing by paper, or by the end of March if filing electronically. Additionally, borrowers should receive their copy of the 1099a Form by January 31 of the following tax year. Being aware of these deadlines helps ensure that all parties involved can meet their reporting obligations and avoid potential penalties for late submissions.

Quick guide on how to complete 1099a 2013 form

Easily Prepare 1099a Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage 1099a Form on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign 1099a Form Effortlessly

- Find 1099a Form and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all information carefully and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that force you to print new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign 1099a Form while ensuring excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1099a 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1099a 2013 form

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a 1099A Form and when should I use it?

The 1099A Form, officially known as the Acquisition or Abandonment of Secured Property, is used to report the acquisition or abandonment of property. This form is particularly useful for taxpayers who have taken ownership of a property through various means, such as foreclosure. You should consider using the 1099A Form when dealing with secured property transactions to ensure proper reporting to the IRS.

-

How can airSlate SignNow help me manage my 1099A Forms?

airSlate SignNow offers a streamlined solution for creating, sending, and eSigning 1099A Forms. With our user-friendly interface, you can easily manage your documents, ensuring they are signed and returned promptly. This feature simplifies the filing process, saving you time and reducing the chance of errors.

-

Is there a specific pricing plan for using airSlate SignNow for 1099A Forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Whether you need basic functionality or advanced features for handling 1099A Forms, our pricing is designed to be cost-effective for all types of businesses. You can choose the plan that best fits your requirements and budget.

-

What are the benefits of using airSlate SignNow for 1099A Forms?

Using airSlate SignNow for 1099A Forms provides several benefits, including enhanced security, faster processing times, and ease of use. With our platform, you can ensure that all sensitive information is encrypted and compliant with regulations. Additionally, the automated reminders help you track pending forms, making the eSigning process smooth and efficient.

-

Can I integrate airSlate SignNow with my accounting software when handling 1099A Forms?

Absolutely! airSlate SignNow seamlessly integrates with a variety of accounting software, which allows for efficient management of your 1099A Forms. This integration ensures that all financial documents are synchronized and easily accessible, reducing the risk of data discrepancies and improving your workflow.

-

What documents do I need to prepare before filling out a 1099A Form?

Before filling out a 1099A Form, you should gather relevant documents such as the property's acquisition details, transaction records, and any other financial documentation related to the property. Collecting this information in advance will streamline the process and ensure accuracy. Having everything organized upfront makes it easier to input the required data into the form.

-

How does airSlate SignNow ensure the security of my 1099A Forms?

airSlate SignNow prioritizes the security of your 1099A Forms by implementing advanced encryption technologies and strict access controls. Your documents are stored securely, and our platform complies with industry standards for data protection. This commitment to security helps you confidently manage and share sensitive tax documents.

Get more for 1099a Form

- 2020 instructions for form 1041 and schedules a b g j and k 1 instructions for form 1041 and schedules a b g j and k 1 us

- Chicago north secretary of state facility form

- Doh application form for renewal of license to operate 2021

- Form 6765 rev december 2020 credit for increasing research activities

- Instructions for form 8283 rev december 2020 instructions for form 8283 noncash charitable contributions

- I whose signature appears form

- Get a temporary work visa for new zealandnew zealand now form

- Yemen application form for entry visa fillable form

Find out other 1099a Form

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online