Individual Vehicle Mileage and Fuel Record Form

What is the Individual Vehicle Mileage and Fuel Record

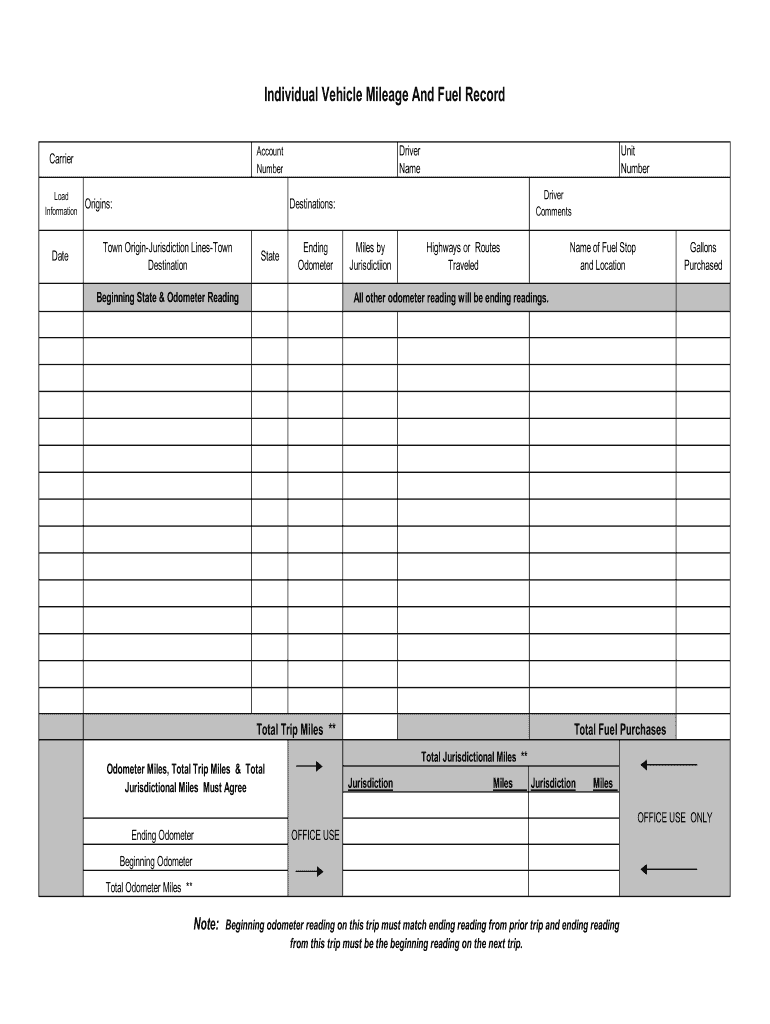

The Individual Vehicle Mileage and Fuel Record is a detailed document that tracks the fuel consumption and mileage of a specific vehicle. This record is essential for individuals and businesses that need to monitor their fuel expenses for tax purposes, reimbursement, or budgeting. It typically includes information such as the date of each trip, the starting and ending odometer readings, the amount of fuel purchased, and the cost of that fuel. Maintaining an accurate mileage and fuel record can help ensure compliance with tax regulations and provide valuable insights into vehicle usage.

How to Use the Individual Vehicle Mileage and Fuel Record

Using the Individual Vehicle Mileage and Fuel Record involves regularly updating the document with relevant trip details. Users should record the date, purpose of the trip, starting and ending odometer readings, and fuel expenses each time they refuel. This systematic approach helps in creating a comprehensive log that can be easily referenced when needed. Additionally, digital tools can simplify this process by allowing users to input data directly into an electronic format, ensuring that the information is organized and easily accessible.

Steps to Complete the Individual Vehicle Mileage and Fuel Record

To complete the Individual Vehicle Mileage and Fuel Record effectively, follow these steps:

- Gather necessary information, including vehicle details and personal identification.

- Record the date of each trip.

- Note the starting odometer reading before beginning the trip.

- Document the ending odometer reading upon completion of the trip.

- Log the amount of fuel purchased and the total cost.

- Include the purpose of the trip for future reference.

- Review the completed record regularly to ensure accuracy and completeness.

Legal Use of the Individual Vehicle Mileage and Fuel Record

The Individual Vehicle Mileage and Fuel Record holds legal significance, especially for tax deductions and reimbursements. Accurate records can substantiate claims made on tax returns, ensuring compliance with IRS guidelines. It is crucial to maintain detailed and truthful entries, as discrepancies can lead to audits or penalties. Users should familiarize themselves with state-specific regulations regarding mileage documentation to ensure their records meet all legal requirements.

Key Elements of the Individual Vehicle Mileage and Fuel Record

Key elements of the Individual Vehicle Mileage and Fuel Record include:

- Date of each trip

- Starting and ending odometer readings

- Total miles driven

- Amount of fuel purchased

- Cost of fuel

- Purpose of the trip

These elements collectively provide a comprehensive view of vehicle usage and expenses, making it easier to analyze fuel efficiency and track costs over time.

Examples of Using the Individual Vehicle Mileage and Fuel Record

Examples of using the Individual Vehicle Mileage and Fuel Record include:

- A self-employed individual tracking mileage for business trips to claim deductions on their tax return.

- A company monitoring fuel expenses for its fleet vehicles to manage budgets effectively.

- A commuter keeping a record for reimbursement from their employer for travel expenses.

These examples illustrate the versatility of the record in various contexts, highlighting its importance for both personal and professional use.

Quick guide on how to complete individual vehicle mileage and fuel record form modot

Simplify your existence by signNowing Individual Vehicle Mileage And Fuel Record form with airSlate SignNow

Whether you need to title a new automobile, register to obtain a driver’s license, transfer ownership, or carry out any other task related to vehicles, managing such RMV forms as Individual Vehicle Mileage And Fuel Record is an unavoidable task.

There are several ways to access them: by mail, at the RMV service center, or by obtaining them online via your local RMV website and printing them. Each of these methods is time-consuming. If you’re seeking a faster option to fill them out and signNow them with a legally-recognized eSignature, airSlate SignNow is the optimal choice.

How to complete Individual Vehicle Mileage And Fuel Record effortlessly

- Click on Show details to read a brief overview of the form in which you are interested.

- Select Get form to begin and open the form.

- Follow the green label pointing at the required fields if applicable.

- Utilize the top toolbar and explore our advanced functionalities to modify, annotate, and enhance your form's professionalism.

- Insert text, your initials, shapes, images, and other elements.

- Press Sign in in the same toolbar to generate a legally-binding eSignature.

- Examine the form content to ensure it contains no errors or discrepancies.

- Click on Done to complete the form submission.

Using our platform to fill out your Individual Vehicle Mileage And Fuel Record and similar forms will save you considerable time and effort. Streamline your RMV form completion process from the beginning!

Create this form in 5 minutes or less

FAQs

-

A driver of a high mileage vehicle recommended Seafoam additive to clean out an engine and fuel system. Have you used Seafoam, and does it work?

Youtube has some good videos on this. The guy runs a camera down the sparkplug hole before and after the Seafoam. There was no meaningful difference.Myself? I keep my cars forever and the only thing I’ve ever used is a can of Techron every now and again. BTW there are two versions of Techron; get the expensive one.-Thomas-

-

How can humans survive the Van Allen radiation belts?

Yes! At least 9 missions crossed two times the Van Allen Belts safely: Apollo 8, Apollo 10, Apollo 11, Apollo 12, Apollo 13, Apollo 14, Apollo 15, Apolo 16 and Apollo 17. The first on in December 1968 and the last one n December 1972.Before and after these missions, all missions happened in Low Earth Oribt.The Apollo missions are controversial only between the ignoramus. For example, the ignoramus that thinks that the Van Allen belt kills instantly.Most scientists and space engineers knows how to deal with the Van Allen belts in a safe way.Phil Plait's Bad Astronomy: Bad TVBad: A big staple of the HBs is the claim that radiation in the van Allen Belts and in deep space would have killed the astronauts in minutes. They interview a Russian cosmonaut involved in the USSR Moon program, who says that they were worried about going in to the unknowns of space, and suspected that radiation would have penetrated the hull of the spacecraft.Good: Kaysing's exact words in the program are ``Any human being traveling through the van Allen belt would have been rendered either extremely ill or actually killed by the radiation within a short time thereof.''This is complete and utter nonsense. The van Allen belts are regions above the Earth's surface where the Earth's magnetic field has trapped particles of the solar wind. An unprotected man would indeed get a lethal dose of radiation, if he stayed there long enough. Actually, the spaceship traveled through the belts pretty quickly, getting past them in an hour or so. There simply wasn't enough time to get a lethal dose, and, as a matter of fact, the metal hull of the spaceship did indeed block most of the radiation. For a detailed explanation of all this, my fellow Mad Scientist William Wheaton has a page with the technical data about the doses received by the astronauts. Another excellent page about this, that also gives a history of NASA radiation testing, is from the Biomedical Results of Apollo site. An interesting read!It was also disingenuous of the program to quote the Russian cosmonaut as well. Of course they were worried about radiation before men had gone into the van Allen belts! But tests done by NASA showed that it was possible to not only survive such a passage, but to not even get harmed much by it. It looks to me like another case of convenient editing by the producers of the program.Moon landing conspiracy theories1. The astronauts could not have survived the trip because of exposure to radiation from the Van Allen radiation belt and galactic ambient radiation (see radiation poisoning and health threat from cosmic rays). Some conspiracists have suggested that Starfish Prime (a high-altitude nuclear test in 1962) was a failed attempt to disrupt the Van Allen belts.There are two main Van Allen belts - the inner belt and the outer belt - and a transient third belt.[106] The inner belt is the more dangerous one, containing energetic protons. The outer one has less-dangerous low-energy electrons (Beta particles).[107][108] The Apollo spacecraft passed through the inner belt in a matter of minutes and the outer belt in about 1 1⁄2 hours.[108] The astronauts were shielded from the ionizing radiation by the aluminum hulls of the spacecraft.[108][109] Furthermore, the orbital transfer trajectory from Earth to the Moon through the belts was chosen to lessen radiation exposure.[109] Even Dr. James Van Allen, the discoverer of the Van Allen radiation belts, rebutted the claims that radiation levels were too harmful for the Apollo missions.[110]Plait cited an average dose of less than 1 rem (10 mSv), which is equivalent to the ambient radiation received by living at sea level for three years.[111] The spacecraft passed through the intense inner belt and the low-energy outer belt. The total radiation received on the trip was about the same as allowed for workers in the nuclear energy field for a year[108][112] and not much more than what Space Shuttle astronauts received.[107]

-

How does a Trinidadian fill out part II and part III of an W-8BEN form when opening an individual account?

For Part II you write in where you reside on Line 9 and on Line 10 the withholding rate from 0 to 30% depending on which article of the US/Trinidad tax treaty applies to you. Then write in the type of income and the treaty article that applies to your income. The most common are Article 9 for business profits or Article 11 for personal services, but not knowing your particular circumstance I can't say if one of those is correct for you.Part III only requires your signature and the date signed. You are attesting that the statements in Part III are true.

-

Which ITR form should I fill for payments received from the USA to a salaried individual in India for freelancing work, and how should I declare this in ITR? There is no TDS record of this payment as it is outside India.

You can use ITR-1 to show it as Income from Other SOurcesIf you want to claim expense against this income, then you are better off showing it in ITR-2 again as Income from Other Sources. In this case dont claim too many expenses against Income from Other Sources because that usually triggers a scrutinyIf this is going to be regular, then you will need to fill ITR-3 and show this as Income from Business/Profession. The negative of this ITR is that it is quite voluminous and you will have to prepare a Balance Sheet and Profit and loss account even if your income from this source exceeds an amount as low as Rs. 1,20,000/-.

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

Create this form in 5 minutes!

How to create an eSignature for the individual vehicle mileage and fuel record form modot

How to create an electronic signature for your Individual Vehicle Mileage And Fuel Record Form Modot online

How to make an eSignature for the Individual Vehicle Mileage And Fuel Record Form Modot in Google Chrome

How to make an eSignature for putting it on the Individual Vehicle Mileage And Fuel Record Form Modot in Gmail

How to generate an eSignature for the Individual Vehicle Mileage And Fuel Record Form Modot straight from your smartphone

How to create an eSignature for the Individual Vehicle Mileage And Fuel Record Form Modot on iOS devices

How to make an eSignature for the Individual Vehicle Mileage And Fuel Record Form Modot on Android

People also ask

-

What is an individual vehicle mileage and fuel record?

An individual vehicle mileage and fuel record is a detailed log that tracks the distance traveled and fuel consumption for a specific vehicle. This record helps owners and businesses monitor fuel efficiency and vehicle usage, making it essential for tax deductions and expense tracking.

-

How does airSlate SignNow help with maintaining individual vehicle mileage and fuel records?

airSlate SignNow offers a streamlined platform to collect, manage, and eSign documents related to individual vehicle mileage and fuel records. By using customizable templates, users can easily capture and organize mileage and fuel data efficiently, saving time and improving accuracy.

-

Are there any costs associated with using airSlate SignNow for vehicle records?

Yes, airSlate SignNow provides various pricing plans tailored to different business needs. These plans are designed to be cost-effective while offering essential features, including those for managing individual vehicle mileage and fuel records.

-

What features are included in airSlate SignNow for tracking individual vehicle mileage and fuel records?

Key features of airSlate SignNow for tracking individual vehicle mileage and fuel records include easy eSigning, customizable templates, and automated reporting. This functionality ensures that all records are kept up to date and easily accessible for review and audit purposes.

-

Can airSlate SignNow integrate with other software for enhanced vehicle record management?

Yes, airSlate SignNow offers seamless integrations with various accounting and fleet management systems. This ensures that your individual vehicle mileage and fuel records can easily sync with your existing tools, enhancing overall efficiency.

-

How can using airSlate SignNow benefit my business for mileage and fuel record keeping?

Using airSlate SignNow can signNowly boost your business's efficiency by automating the tracking and management of individual vehicle mileage and fuel records. This not only saves time but also reduces the risk of errors, leading to more accurate reporting and potential tax benefits.

-

Is it easy to get started with airSlate SignNow for managing vehicle records?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it straightforward to start managing your individual vehicle mileage and fuel records. You can easily set up your account, create templates, and begin eSigning documents in minutes.

Get more for Individual Vehicle Mileage And Fuel Record

- Writing an unable to pay debt letter sample letters form

- County of civil case no plaintiffstakeholder v form

- History of greene county missouri pdf free download form

- Yandex nv form

- Tax deeds on form

- Contract between a waste management company and the owner form

- Ex parte application for earnings assignment form

- Form of trademark assignment secgov

Find out other Individual Vehicle Mileage And Fuel Record

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word