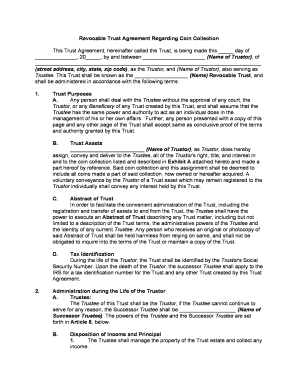

Revocable Trust Agreement Regarding Coin Collection Form

What is the Revocable Trust Agreement Regarding Coin Collection

A revocable trust agreement regarding a coin collection is a legal document that allows an individual, known as the grantor, to place their coin collection into a trust. This type of trust can be altered or revoked by the grantor at any time during their lifetime. The primary purpose of this agreement is to manage and protect the coin collection, ensuring that it is distributed according to the grantor's wishes upon their death. This agreement outlines the specific terms and conditions under which the collection will be held, managed, and distributed, providing clarity and security for both the grantor and the beneficiaries.

How to use the Revocable Trust Agreement Regarding Coin Collection

To effectively use a revocable trust agreement regarding a coin collection, the grantor must first detail their intentions for the collection. This includes identifying the coins included in the trust and specifying any particular instructions for their management. The grantor should then select a trustee, who will be responsible for administering the trust. Once the agreement is drafted, it must be signed and dated by the grantor and the trustee, ideally in the presence of witnesses or a notary public to enhance its legal standing. After execution, the grantor can manage the trust assets as they see fit, with the ability to modify the terms as needed.

Steps to complete the Revocable Trust Agreement Regarding Coin Collection

Completing a revocable trust agreement regarding a coin collection involves several key steps:

- Identify the assets: List all coins and related items to be included in the trust.

- Select a trustee: Choose a trustworthy individual or institution to manage the trust.

- Draft the agreement: Clearly outline the terms, including management and distribution instructions.

- Sign the document: The grantor and trustee should sign the agreement, ideally in front of witnesses.

- Fund the trust: Transfer ownership of the coin collection to the trust, ensuring proper documentation.

Legal use of the Revocable Trust Agreement Regarding Coin Collection

The legal use of a revocable trust agreement regarding a coin collection is crucial for ensuring that the grantor's wishes are honored after their passing. This document must comply with state laws governing trusts to be enforceable. It is important for the grantor to consult with a legal professional to ensure that all legal requirements are met, including proper execution and funding of the trust. The agreement should also address any tax implications related to the collection, as well as the rights of the beneficiaries.

Key elements of the Revocable Trust Agreement Regarding Coin Collection

Key elements of a revocable trust agreement regarding a coin collection include:

- Grantor's information: Name and contact details of the individual creating the trust.

- Trustee's information: Name and contact details of the appointed trustee.

- Asset description: Detailed inventory of the coin collection and any associated items.

- Distribution instructions: Clear directives on how the collection should be managed and distributed after the grantor's death.

- Revocation clause: A statement indicating that the grantor retains the right to modify or revoke the trust at any time.

State-specific rules for the Revocable Trust Agreement Regarding Coin Collection

State-specific rules can significantly impact the creation and management of a revocable trust agreement regarding a coin collection. Each state has its own laws governing trusts, including requirements for execution, funding, and tax implications. It is essential for grantors to familiarize themselves with their state's regulations to ensure compliance. Consulting with a legal expert who specializes in estate planning can provide valuable guidance tailored to the specific state laws that apply.

Quick guide on how to complete revocable trust agreement regarding coin collection

Effortlessly Prepare Revocable Trust Agreement Regarding Coin Collection on Any Device

Online document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Revocable Trust Agreement Regarding Coin Collection on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Revocable Trust Agreement Regarding Coin Collection Seamlessly

- Find Revocable Trust Agreement Regarding Coin Collection and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Revocable Trust Agreement Regarding Coin Collection and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Revocable Trust Agreement Regarding Coin Collection?

A Revocable Trust Agreement Regarding Coin Collection is a legal document that allows you to manage and protect your coin collection during your lifetime and dictate its distribution after your death. By setting up this agreement, you ensure that your valuable coins are handled according to your wishes.

-

How can airSlate SignNow help with creating a Revocable Trust Agreement Regarding Coin Collection?

airSlate SignNow provides an easy-to-use platform to draft, customize, and eSign your Revocable Trust Agreement Regarding Coin Collection. This solution allows you to create legally binding documents without needing extensive legal knowledge or assistance.

-

What are the benefits of using a Revocable Trust Agreement Regarding Coin Collection?

Using a Revocable Trust Agreement Regarding Coin Collection offers several benefits, such as avoiding probate, maintaining privacy regarding your assets, and flexibility in managing your coins. This trust ensures that your collection is distributed efficiently according to your preferences.

-

Is there a cost associated with using airSlate SignNow for my Revocable Trust Agreement Regarding Coin Collection?

airSlate SignNow offers various pricing plans that are cost-effective for individuals needing a Revocable Trust Agreement Regarding Coin Collection. You can choose a plan that best suits your needs, ensuring you have access to powerful document management features.

-

What features does airSlate SignNow offer for managing a Revocable Trust Agreement Regarding Coin Collection?

airSlate SignNow includes features such as document templates, secure eSigning, collaboration tools, and cloud storage, making it ideal for managing your Revocable Trust Agreement Regarding Coin Collection. These features streamline the process and enhance document security.

-

Can I customize my Revocable Trust Agreement Regarding Coin Collection using airSlate SignNow?

Yes, you can easily customize your Revocable Trust Agreement Regarding Coin Collection using airSlate SignNow's intuitive interface. You can add personalized clauses, modify terms, and ensure the document meets your specific needs.

-

Does airSlate SignNow integrate with other tools for my Revocable Trust Agreement Regarding Coin Collection?

airSlate SignNow integrates seamlessly with various applications to enhance the management of your Revocable Trust Agreement Regarding Coin Collection. Integrations with services like cloud storage and CRM systems improve workflow efficiency.

Get more for Revocable Trust Agreement Regarding Coin Collection

- Oklahoma oklahoma relative caretaker legal documents package form

- Oklahoma legal documents form

- Company policies procedures 481376076 form

- Oklahoma assignment of mortgage package form

- Oklahoma lease purchase agreements package form

- Oklahoma roofing contractor package form

- Oklahoma postnuptial form

- Oregon name change form

Find out other Revocable Trust Agreement Regarding Coin Collection

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online