Colorado Income Tax Form

What is the Colorado Income Tax

The Colorado income tax is a state-level tax imposed on the income earned by individuals and businesses within Colorado. This tax is calculated based on the taxpayer's total income, which includes wages, salaries, dividends, and other forms of income. The state employs a flat tax rate, meaning all taxpayers pay the same percentage of their income, regardless of their income level. Understanding the structure and requirements of the Colorado income tax is essential for compliance and effective financial planning.

Steps to Complete the Colorado Income Tax

Completing the Colorado income tax involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, determine your filing status, which can affect your tax rate and deductions. After calculating your total income, apply any applicable deductions and credits to arrive at your taxable income. Finally, complete the required forms, such as the Colorado Individual Income Tax Return (Form 104), and submit them either online or by mail.

Required Documents

To file your Colorado income tax, certain documents are essential. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of other income sources, such as rental income or interest

- Receipts for deductible expenses, such as medical costs or educational expenses

- Any prior year tax returns for reference

Having these documents ready will streamline the filing process and help ensure that all income is accurately reported.

Form Submission Methods

Taxpayers in Colorado have several options for submitting their income tax forms. The most common methods include:

- Online submission through the Colorado Department of Revenue's website, which offers a secure and efficient way to file.

- Mailing paper forms to the appropriate address, ensuring that they are postmarked by the filing deadline.

- In-person submissions at designated tax offices, which may provide additional assistance for complex cases.

Choosing the right method can depend on personal preference, the complexity of the tax situation, and the resources available.

Penalties for Non-Compliance

Failing to comply with Colorado income tax regulations can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time if the return is not submitted by the deadline.

- Interest charges on unpaid taxes, which are assessed from the due date until the tax is paid in full.

- Potential legal action for severe cases of tax evasion or fraud, which can lead to fines or imprisonment.

Understanding these penalties emphasizes the importance of timely and accurate tax filing.

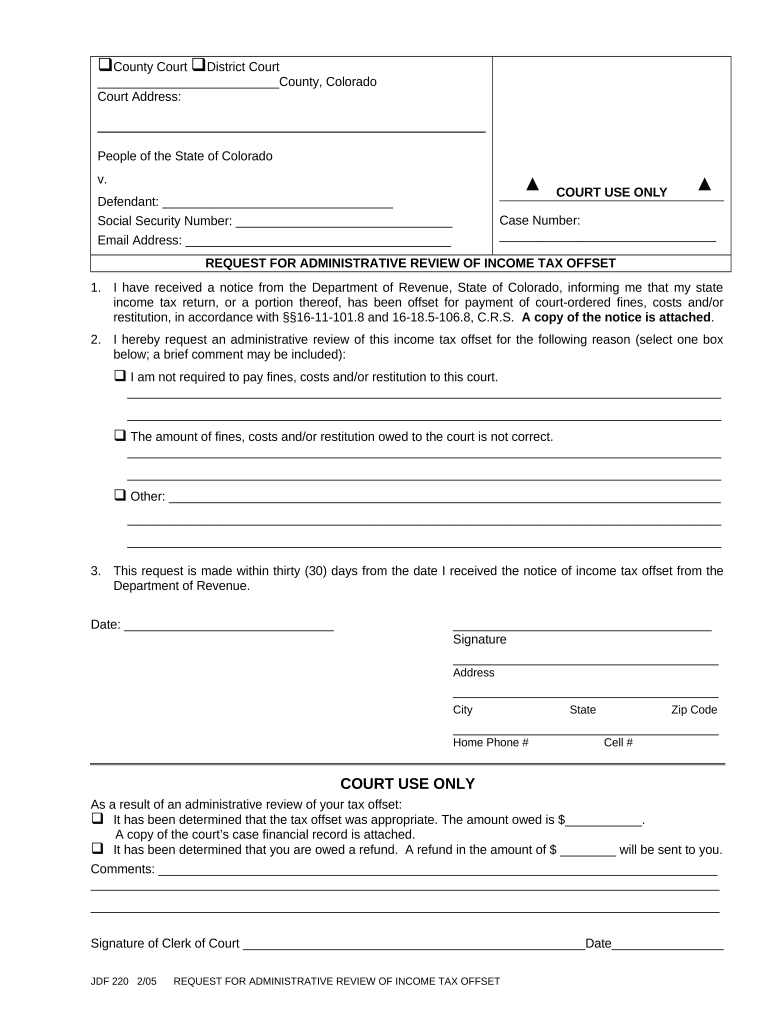

Quick guide on how to complete colorado income tax

Manage Colorado Income Tax effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Colorado Income Tax on any platform via airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Colorado Income Tax with ease

- Locate Colorado Income Tax and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Select key parts of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that require reprinting. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and electronically sign Colorado Income Tax to ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is administrative review in the context of airSlate SignNow?

Administrative review refers to the process of evaluating documents and signatures within the airSlate SignNow platform. It ensures that all legal and compliance aspects are met before finalizing documents. This feature helps businesses maintain accurate records and streamline their documentation process.

-

How does airSlate SignNow support administrative review for businesses?

airSlate SignNow offers a comprehensive administrative review system that allows easy tracking and management of eSigned documents. Users can set up workflows that require specific approvals, ensuring a thorough review process. This capability helps organizations maintain transparency and accountability in document handling.

-

Is there a cost associated with the administrative review feature in airSlate SignNow?

While airSlate SignNow's pricing may vary based on subscription tiers, the administrative review feature is included in higher plans at a competitive rate. Businesses can access powerful tools tailored for efficient document management without incurring additional costs for administrative review. Explore our pricing page to find the best option for your needs.

-

What are the benefits of using airSlate SignNow for administrative review?

Using airSlate SignNow for administrative review streamlines the workflow, enhancing collaboration among team members. It minimizes errors in document handling and ensures compliance with industry regulations. The user-friendly interface can signNowly reduce the time spent on administrative tasks, allowing teams to focus on core business operations.

-

Which integrations does airSlate SignNow offer for enhancing administrative review?

airSlate SignNow seamlessly integrates with various applications, including CRM systems and document management tools, to enhance the administrative review process. These integrations help consolidate workflows and enable real-time collaboration across platforms. This feature is particularly valuable for teams looking to optimize their document handling practices.

-

Can I customize the administrative review workflow in airSlate SignNow?

Yes, airSlate SignNow allows users to customize their administrative review workflows according to their business needs. You can set specific approval steps, assign reviewers, and manage timelines, ensuring that every document goes through the necessary checks. This level of customization helps enhance efficiency and compliance in your document processes.

-

How does airSlate SignNow ensure the security of documents during administrative review?

airSlate SignNow prioritizes document security during the administrative review with advanced encryption protocols and secure cloud storage. Access controls can be set up to limit who can view and edit documents, safeguarding sensitive information. The platform’s commitment to security ensures that your documents are protected throughout the review process.

Get more for Colorado Income Tax

- Vfs consent form indonesia

- Circle the adjectives and underline the nouns with answers form

- Sanc past exam papers pdf form

- Century 21 accounting textbook 11e pdf form

- English file intermediate third edition grammar bank answer key form

- Vocabulary workshop level a answer key pdf form

- Wilson student notebook pdf form

- To download the pdf extra watch form

Find out other Colorado Income Tax

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF