Ct Purchase Form

What is the Ct Purchase

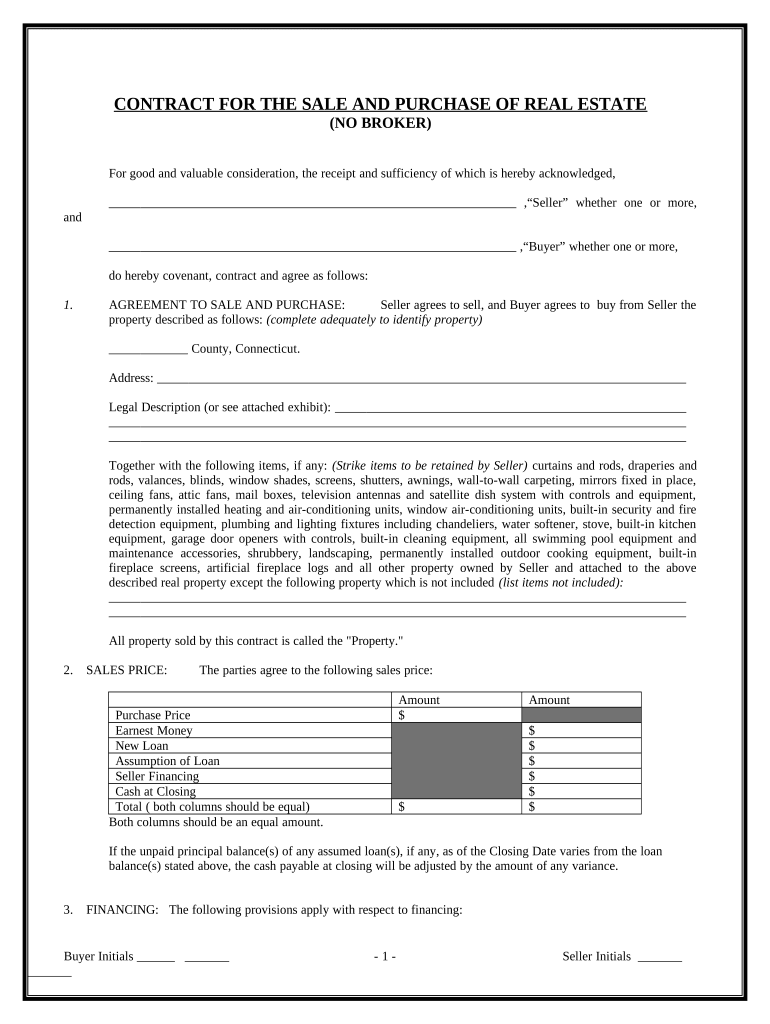

The ct purchase refers to a specific form used in various transactions, often related to real estate or property acquisition. This form serves as a legal document that outlines the terms and conditions of the purchase agreement between the buyer and the seller. It is essential for ensuring that both parties are aware of their rights and obligations throughout the transaction process. Understanding the details of the ct purchase is crucial for anyone involved in property transactions, as it helps to prevent misunderstandings and legal issues.

How to use the Ct Purchase

Using the ct purchase form involves several key steps to ensure that the document is completed accurately and effectively. First, gather all necessary information about the property and the parties involved. This includes details such as the property address, purchase price, and any contingencies that may apply. Next, fill out the form with precise information, ensuring that all sections are completed to avoid delays. Once the form is filled out, both parties should review it carefully before signing. This ensures that all terms are agreed upon and understood, promoting a smooth transaction.

Steps to complete the Ct Purchase

Completing the ct purchase form requires a systematic approach to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather necessary documentation, including identification and property details.

- Fill out the form with accurate information, paying close attention to all fields.

- Review the completed form for any errors or omissions.

- Ensure both parties sign the form, either electronically or in person.

- Keep a copy of the signed document for your records.

Legal use of the Ct Purchase

The ct purchase form must adhere to specific legal standards to be considered valid. In the United States, this includes compliance with local, state, and federal regulations governing property transactions. The form should be signed by both parties to create a legally binding agreement. Additionally, utilizing a reliable eSignature solution can enhance the legal validity of the document, ensuring that it meets the requirements set forth by laws such as ESIGN and UETA. This legal framework supports the use of electronic signatures, making the process more efficient while maintaining compliance.

Key elements of the Ct Purchase

Understanding the key elements of the ct purchase form is vital for effective use. Important components typically include:

- The names and contact information of the buyer and seller.

- A detailed description of the property being purchased.

- The agreed-upon purchase price and payment terms.

- Any contingencies that must be met before the sale is finalized.

- Signatures of both parties, indicating their agreement to the terms.

Who Issues the Form

The ct purchase form is typically issued by local government agencies or real estate organizations involved in property transactions. In many cases, real estate agents or brokers may provide the form as part of their services to clients. It is essential to ensure that the version of the form being used is the most current and compliant with local regulations. This helps to avoid any potential legal issues that could arise from using outdated or incorrect documentation.

Quick guide on how to complete ct purchase 497300912

Effortlessly Complete Ct Purchase on Any Device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Ct Purchase on any platform with airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

The easiest way to edit and eSign Ct Purchase with ease

- Locate Ct Purchase and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your preferred device. Modify and eSign Ct Purchase while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a ct purchase with airSlate SignNow?

A ct purchase refers to the process of acquiring a subscription plan for airSlate SignNow, which allows users to access essential eSigning features. By opting for a ct purchase, businesses can streamline their document workflow and improve overall efficiency.

-

How much does a ct purchase cost?

The pricing for a ct purchase with airSlate SignNow varies based on the plan selected. Our plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from our eSignature solutions without breaking the bank.

-

What features are included in the ct purchase plans?

When you make a ct purchase with airSlate SignNow, you'll gain access to features such as unlimited eSignatures, mobile compatibility, and customizable templates. These tools are designed to enhance productivity and facilitate seamless document management.

-

Are there any discounts available for bulk ct purchases?

Yes, airSlate SignNow offers discounts for bulk ct purchases. Businesses looking to subscribe multiple users can benefit from special pricing, making it more affordable to implement our eSigning solutions organization-wide.

-

Can I integrate airSlate SignNow with other software after a ct purchase?

Absolutely! After a ct purchase, airSlate SignNow can easily integrate with various popular software applications such as Google Drive, Dropbox, and CRM systems. These integrations help streamline your workflow and enhance productivity.

-

Is there a trial available before making a ct purchase?

Yes, airSlate SignNow offers a free trial that allows prospective customers to explore the platform before committing to a ct purchase. This enables users to experience the ease of eSigning and see how it can benefit their business.

-

What support is available after a ct purchase?

Once a ct purchase is completed, customers have access to comprehensive support through our dedicated help center. We provide resources such as tutorials, FAQs, and customer support representatives to assist with any questions or challenges.

Get more for Ct Purchase

- Staxi 2 questionnaire pdf form

- Online permission slip template form

- Vodafone direct debit mandate form

- Orphanage registration form

- Food bank application form

- Chamber of commerce registration form

- Secretary of state certificate of dissolution diss form

- Acknowledgment of risk and release of liability form

Find out other Ct Purchase

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself