Quitclaim Deed from Individual to LLC Illinois Form

What is the Quitclaim Deed From Individual To LLC Illinois

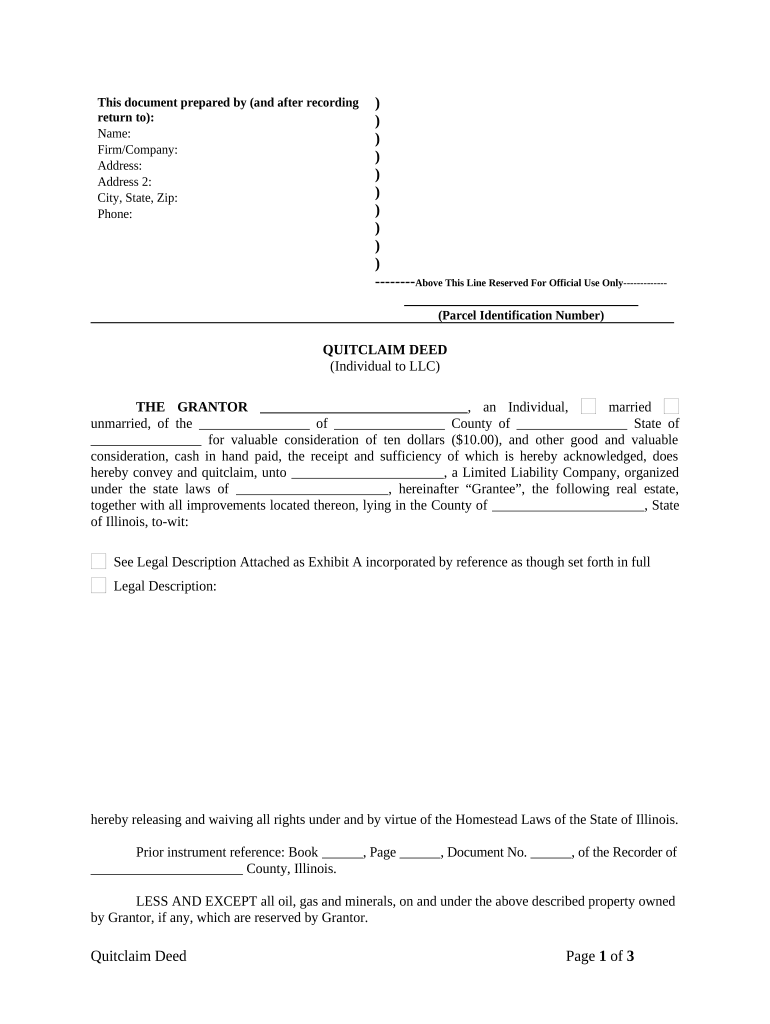

A quitclaim deed from an individual to an LLC in Illinois is a legal document that transfers ownership of property from a person to a limited liability company (LLC). Unlike warranty deeds, quitclaim deeds do not guarantee that the title is clear or free of liens. This type of deed is often used in situations where the transferor and transferee know each other, such as family members or business partners. The quitclaim deed effectively relinquishes any claim the individual has to the property, allowing the LLC to assume ownership.

Steps to Complete the Quitclaim Deed From Individual To LLC Illinois

Completing a quitclaim deed in Illinois involves several important steps:

- Gather necessary information about the property, including the legal description and the names of the parties involved.

- Obtain a blank quitclaim deed form, which can typically be found online or at a local legal office.

- Fill out the form accurately, ensuring all details are correct, including the grantor's and grantee's names.

- Sign the document in the presence of a notary public to ensure its legal validity.

- File the completed quitclaim deed with the appropriate county recorder's office to make the transfer official.

Legal Use of the Quitclaim Deed From Individual To LLC Illinois

The quitclaim deed is legally recognized in Illinois and can be used for various purposes, such as transferring property into an LLC for asset protection or estate planning. It is essential to ensure that the deed complies with state laws to avoid any potential disputes regarding ownership. While a quitclaim deed may not provide the same level of protection as a warranty deed, it is a straightforward method for transferring property rights.

State-Specific Rules for the Quitclaim Deed From Individual To LLC Illinois

In Illinois, specific rules govern the execution and filing of quitclaim deeds. The deed must include a legal description of the property, the names of the parties involved, and the signature of the grantor. Additionally, the document must be notarized. It is also important to note that Illinois requires the payment of a transfer tax when filing the deed, which varies by county. Understanding these state-specific requirements is crucial to ensure a valid transfer of property.

Required Documents

To complete a quitclaim deed from an individual to an LLC in Illinois, several documents are typically required:

- The completed quitclaim deed form.

- A valid identification for the grantor.

- The legal description of the property being transferred.

- Payment for any applicable transfer taxes.

Examples of Using the Quitclaim Deed From Individual To LLC Illinois

There are various scenarios in which an individual might use a quitclaim deed to transfer property to an LLC. For instance:

- A property owner may transfer their personal residence to an LLC to protect personal assets from business liabilities.

- Business partners may use a quitclaim deed to transfer ownership of a shared property to the LLC they formed together.

- An individual may wish to simplify estate planning by transferring property to an LLC that can manage the property after their passing.

Quick guide on how to complete quitclaim deed from individual to llc illinois

Effortlessly manage Quitclaim Deed From Individual To LLC Illinois on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate template and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Quitclaim Deed From Individual To LLC Illinois on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to alter and eSign Quitclaim Deed From Individual To LLC Illinois effortlessly

- Locate Quitclaim Deed From Individual To LLC Illinois and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and then click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your preferred device. Modify and eSign Quitclaim Deed From Individual To LLC Illinois and guarantee exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Individual To LLC in Illinois?

A Quitclaim Deed From Individual To LLC in Illinois is a legal document used to transfer property ownership from an individual to a limited liability company. This type of deed is commonly used because it allows for a quick transfer without the need for warranties or guarantees regarding the property's title. It is essential to ensure that the deed is properly filled out and recorded in the county where the property is located.

-

How do I create a Quitclaim Deed From Individual To LLC in Illinois?

Creating a Quitclaim Deed From Individual To LLC in Illinois involves filling out a standard form that includes details about the property, the individual transferring ownership, and the LLC receiving the property. It is advisable to seek assistance from a legal professional to ensure that all requirements are met. Once completed, the deed must be signed before a notary and recorded with the appropriate county office.

-

What are the costs associated with a Quitclaim Deed From Individual To LLC in Illinois?

The costs for a Quitclaim Deed From Individual To LLC in Illinois can vary based on several factors, including filing fees and any legal assistance you may require. Typically, you should expect to pay a nominal fee for the recording of the deed at the county clerk's office. Additionally, if you use services like airSlate SignNow, you can leverage convenience at a competitive price.

-

What are the benefits of using airSlate SignNow for my Quitclaim Deed From Individual To LLC in Illinois?

Using airSlate SignNow for your Quitclaim Deed From Individual To LLC in Illinois provides an easy-to-use interface for eSigning and sending documents securely online. This streamlines the process, saves time, and minimizes the potential for errors. Additionally, you’ll have access to legal templates and can track the signing process in real time.

-

Is it necessary to signNow a Quitclaim Deed From Individual To LLC in Illinois?

Yes, notarization is a crucial step for the Quitclaim Deed From Individual To LLC in Illinois as it validates the authenticity of the signatures on the document. Without notarization, the deed may not be enforced in court or may face challenges in the future. Always ensure your deed is signNowd before recording it to avoid any legal hassles.

-

Can I edit a Quitclaim Deed From Individual To LLC in Illinois after it has been signed?

Once a Quitclaim Deed From Individual To LLC in Illinois has been signed and recorded, it cannot be unilaterally edited or altered. If changes are necessary, a new deed must be prepared and executed. Using eSigning platforms like airSlate SignNow helps keep track of document versions and ensures all parties are aware of changes.

-

Are there any limitations on transferring property using a Quitclaim Deed From Individual To LLC in Illinois?

While a Quitclaim Deed From Individual To LLC in Illinois can facilitate property transfer, certain limitations may exist based on local laws and the type of property being transferred. It's essential to verify that there are no liens, violations, or restrictions on the property beforehand. Consulting with a real estate attorney can provide clarity on specific property issues.

Get more for Quitclaim Deed From Individual To LLC Illinois

Find out other Quitclaim Deed From Individual To LLC Illinois

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure