North Dakota Installments Fixed Rate Promissory Note Secured by Residential Real Estate North Dakota Form

What is the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

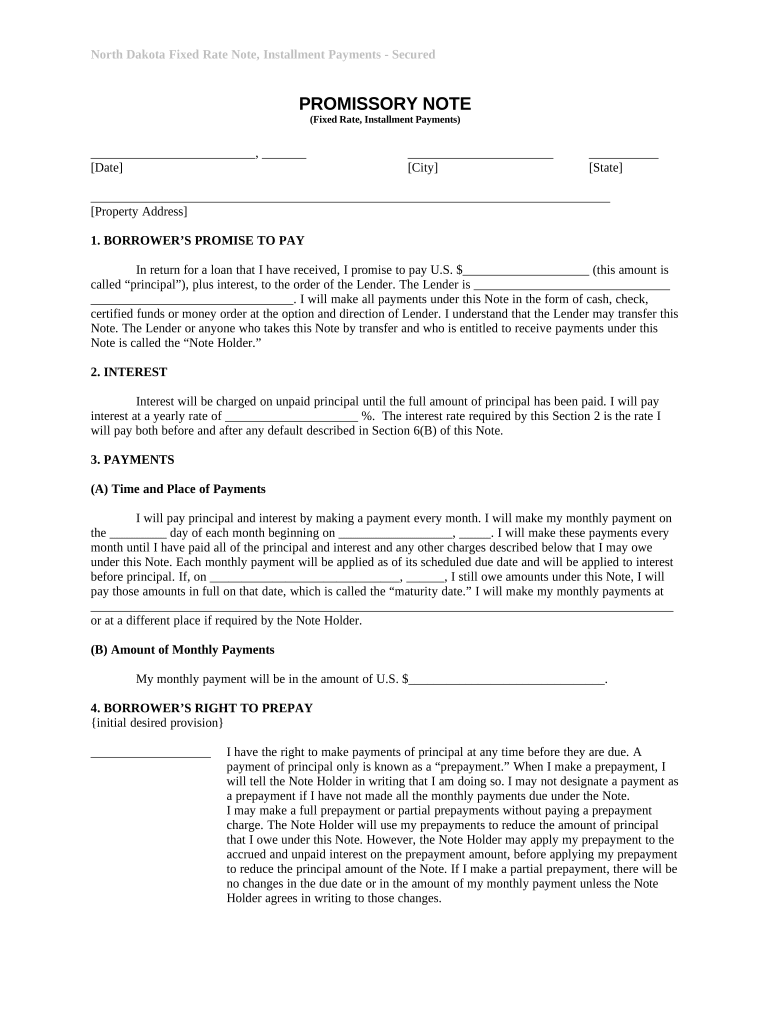

The North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan over a specified period. This note is secured by residential real estate, meaning that the property serves as collateral for the loan. If the borrower fails to make payments as agreed, the lender has the right to take possession of the property. This type of promissory note typically includes details such as the loan amount, interest rate, payment schedule, and any penalties for late payments.

How to use the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

To effectively use the North Dakota Installments Fixed Rate Promissory Note, both the borrower and lender must fill out the document accurately. The borrower should provide personal information, including their name, address, and details about the property being used as collateral. The lender must specify the loan amount, interest rate, and repayment terms. Once completed, both parties should sign the document, ensuring it meets all legal requirements for enforceability. Utilizing an electronic signature solution can streamline this process, making it easier to execute the note securely.

Steps to complete the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

Completing the North Dakota Installments Fixed Rate Promissory Note involves several key steps:

- Gather necessary information, including borrower and lender details, property information, and loan terms.

- Fill out the promissory note, ensuring all sections are completed accurately.

- Review the document for any errors or omissions.

- Both parties should sign the document, either physically or electronically, to validate the agreement.

- Make copies of the signed note for both the borrower and lender for their records.

Key elements of the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

Several key elements must be included in the North Dakota Installments Fixed Rate Promissory Note to ensure its effectiveness:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Payment Schedule: Specific dates and amounts for each installment payment.

- Collateral Description: Details about the residential real estate securing the loan.

- Default Terms: Conditions under which the lender may take action if payments are not made.

Legal use of the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

The legal use of the North Dakota Installments Fixed Rate Promissory Note is governed by state laws regarding secured transactions. This document is legally binding when executed properly, meaning that both parties must adhere to the terms outlined in the note. Compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA) is essential when using electronic signatures. Ensuring that the note is properly recorded with the appropriate county office can also enhance its enforceability.

State-specific rules for the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

North Dakota has specific regulations governing promissory notes and secured transactions. These rules dictate how the note must be structured, the necessary disclosures, and the rights of both parties involved. It is important for both borrowers and lenders to be aware of these state-specific laws to ensure compliance. For instance, North Dakota law may require certain disclosures regarding interest rates and fees, as well as the proper recording of the note to protect the lender's interest in the collateral.

Quick guide on how to complete north dakota installments fixed rate promissory note secured by residential real estate north dakota

Effortlessly Prepare North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Manage North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota with Ease

- Obtain North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota and select Get Form to commence.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional physical signature.

- Review all details and click on the Done button to save your changes.

- Decide how you wish to share your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

A North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota is a legal document that outlines the terms of a loan secured by a residential property. This type of note allows borrowers to repay their loan in fixed installments over a specified period. It provides both parties with clear terms, protecting the lender's investment while giving the borrower a structured repayment plan.

-

What are the benefits of using a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

Using a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota offers numerous benefits, including predictable payment schedules and lower interest rates over time. This documentation also ensures transparency in the loan terms, which helps build trust between the lender and borrower. Furthermore, securing the loan with residential real estate can enhance the lender's security and reduce risk.

-

How does the pricing work for a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

The pricing for a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota typically depends on the loan amount, interest rate, and term length. Most loan agreements will detail these costs, including any applicable fees. It's advisable for potential borrowers to compare offers to find the most competitive rates available.

-

What features are included with the North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

The North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota includes features like fixed monthly payment amounts, terms for default and late payments, and the legal framework for loan collection. Additionally, it is easy to modify as circumstances change, ensuring it remains relevant throughout the loan duration. Utilizing airSlate SignNow can enhance the signing process with seamless electronic signatures.

-

Can I customize my North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

Yes, you can customize your North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota to fit your specific needs and preferences. Customizable components may include payment schedules, interest rates, and additional clauses to enhance clarity and security. Using a flexible platform like airSlate SignNow can simplify this customization process.

-

What integrations are available for managing a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

airSlate SignNow offers integrations with various management and accounting tools, making it easier to track, manage, and store your North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota. These integrations can streamline the documentation process and ensure all records are easily accessible. This seamless approach aids in effective loan management without manual input.

-

How can I ensure compliance when creating a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota?

To ensure compliance when creating a North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate in North Dakota, consult a legal professional familiar with local laws. They can guide you through any statutory requirements and ensure that the document adheres to state regulations. airSlate SignNow also provides templates designed to meet compliance standards.

Get more for North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

Find out other North Dakota Installments Fixed Rate Promissory Note Secured By Residential Real Estate North Dakota

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation