Form 1099 INT Rev January Interest Income 2024-2026

What is the Form 1099-INT Interest Income

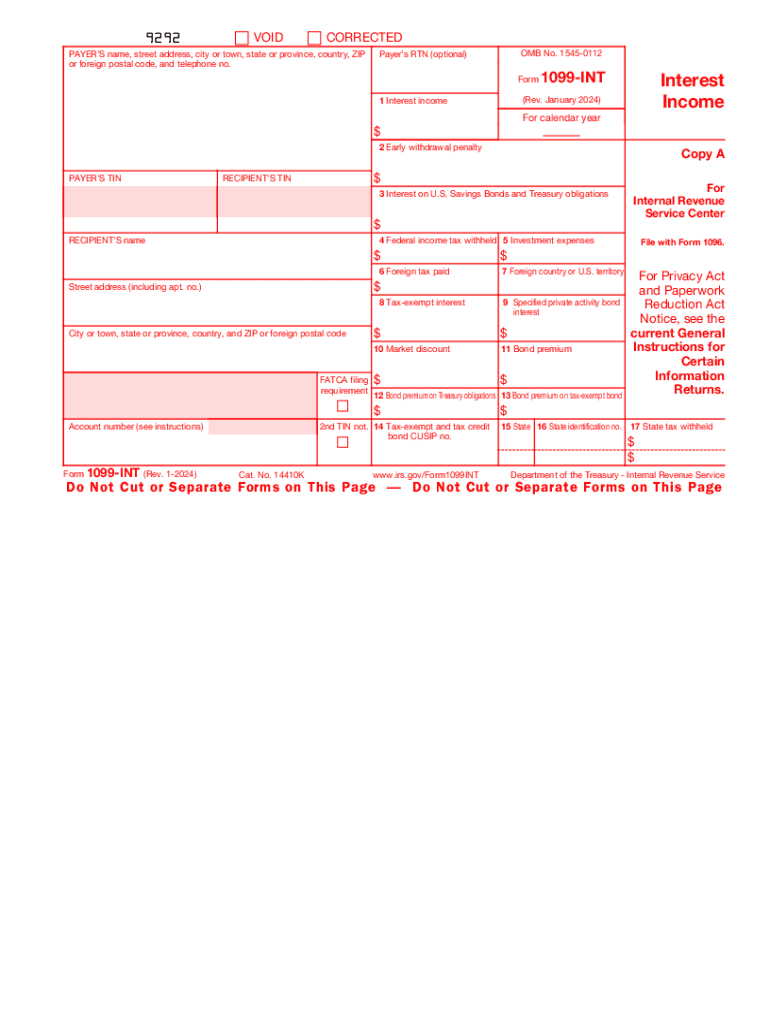

The Form 1099-INT is an Internal Revenue Service (IRS) document used to report interest income earned by taxpayers. This form is essential for individuals and businesses that receive interest payments from banks, financial institutions, or other entities. The IRS requires this form to ensure that all interest income is accurately reported and taxed accordingly. Taxpayers must include the amounts reported on the 1099-INT when filing their federal income tax returns.

How to Use the Form 1099-INT

To use the Form 1099-INT, taxpayers should first ensure they have received the form from the payer, such as a bank or credit union, by the end of January each year. The form will detail the total interest income earned during the previous year. Taxpayers must then report this income on their tax returns, typically on Schedule B of Form 1040. It is important to retain a copy of the form for personal records and to verify that the reported amounts match the taxpayer's records.

Steps to Complete the Form 1099-INT

Completing the Form 1099-INT involves several key steps:

- Gather all relevant information, including payer details and total interest earned.

- Fill out the payer's name, address, and taxpayer identification number (TIN).

- Enter the recipient's name, address, and TIN accurately.

- Report the total interest income in Box 1 of the form.

- If applicable, include any federal income tax withheld in Box 4.

- Submit the completed form to the IRS and provide a copy to the recipient.

IRS Guidelines for Form 1099-INT

The IRS provides specific guidelines regarding the issuance and reporting of the Form 1099-INT. Payers must issue this form to any recipient who earns $10 or more in interest during the tax year. The form must be filed with the IRS by the end of February if filed on paper or by March 31 if filed electronically. Failure to comply with these guidelines can result in penalties for the payer, making it crucial to adhere to the reporting requirements.

Penalties for Non-Compliance

Non-compliance with the IRS regulations regarding the Form 1099-INT can lead to significant penalties. Payers who fail to issue the form or report incorrect amounts may face fines. The penalties vary based on how late the form is submitted and the size of the business. It is essential for businesses to understand these penalties and ensure accurate and timely reporting to avoid unnecessary financial consequences.

Eligibility Criteria for Receiving Form 1099-INT

To be eligible to receive a Form 1099-INT, a taxpayer must have earned interest income of $10 or more from a single payer during the tax year. This includes interest from savings accounts, certificates of deposit, and other financial instruments. Taxpayers should also keep in mind that even if they do not receive a 1099-INT, they are still required to report all interest income on their tax returns.

Quick guide on how to complete form 1099 int rev january interest income

Effortlessly Prepare Form 1099 INT Rev January Interest Income on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form 1099 INT Rev January Interest Income on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Edit and Electronically Sign Form 1099 INT Rev January Interest Income

- Find Form 1099 INT Rev January Interest Income and click Get Form to begin.

- Utilize the tools at your disposal to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign feature, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review all details, then click the Done button to save your modifications.

- Choose your preferred method for sending your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you select. Edit and electronically sign Form 1099 INT Rev January Interest Income while ensuring smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 int rev january interest income

Create this form in 5 minutes!

How to create an eSignature for the form 1099 int rev january interest income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 1099 interest income form?

The IRS 1099 interest income form is a tax document used to report interest income earned by individuals or businesses. It is essential for accurately reporting income to the IRS, ensuring tax obligations are met. Using airSlate SignNow can streamline the process of managing and signing these forms electronically.

-

How can airSlate SignNow help with IRS 1099 interest income documents?

airSlate SignNow offers a user-friendly platform that enables businesses to send, sign, and manage IRS 1099 interest income documents seamlessly. With our electronic signature feature, you can expedite the signing process and ensure compliance with IRS regulations. This makes handling tax-related documents much more efficient.

-

Is airSlate SignNow compliant with IRS regulations regarding 1099 forms?

Yes, airSlate SignNow is designed to comply with all IRS regulations concerning the submission and signing of IRS 1099 interest income forms. We prioritize security and legal compliance, ensuring that your documents are handled in accordance with the law. This allows you to focus on your business while we take care of the documentation.

-

What pricing options does airSlate SignNow offer for managing IRS 1099 forms?

airSlate SignNow provides various pricing plans to accommodate different business needs, making it a cost-effective solution for managing IRS 1099 interest income forms. Whether you're a small business or a large enterprise, our plans are designed to offer flexibility and scalability. You can choose the plan that best fits your volume of document transactions.

-

Can airSlate SignNow integrate with other software for IRS 1099 interest income management?

Absolutely! airSlate SignNow offers integration capabilities with various accounting and financial software, making it easier to manage your IRS 1099 interest income documentation. This allows for seamless data transfer and enhances productivity, ensuring all your records are accurate and up-to-date without manual entry.

-

What are the benefits of using airSlate SignNow for IRS 1099 interest income forms?

Using airSlate SignNow for IRS 1099 interest income forms provides numerous benefits, including time savings, enhanced security, and improved document management. Our platform simplifies the eSigning process, making it faster and more efficient. Additionally, you can access your documents anytime, anywhere, optimizing your workflow.

-

Does airSlate SignNow offer templates for IRS 1099 interest income forms?

Yes, airSlate SignNow includes customizable templates for IRS 1099 interest income forms, allowing you to streamline your documentation process. These templates are designed to meet IRS standards, ensuring you don't miss any important elements. This feature saves you time and minimizes errors when preparing your tax documents.

Get more for Form 1099 INT Rev January Interest Income

- The legal environment today chapter 14 flashcardsquizlet form

- Secretary of state office application for amended 500 e form

- Secretary of state office application for reinstatement form

- Control number sd 01 77 form

- Control number sd 011 77 form

- Corporatioin to individual form

- Control number sd 013 77 form

- Control number sd 02 78 form

Find out other Form 1099 INT Rev January Interest Income

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online