Oregon Chapter 13 Form

What is the Oregon Chapter 13

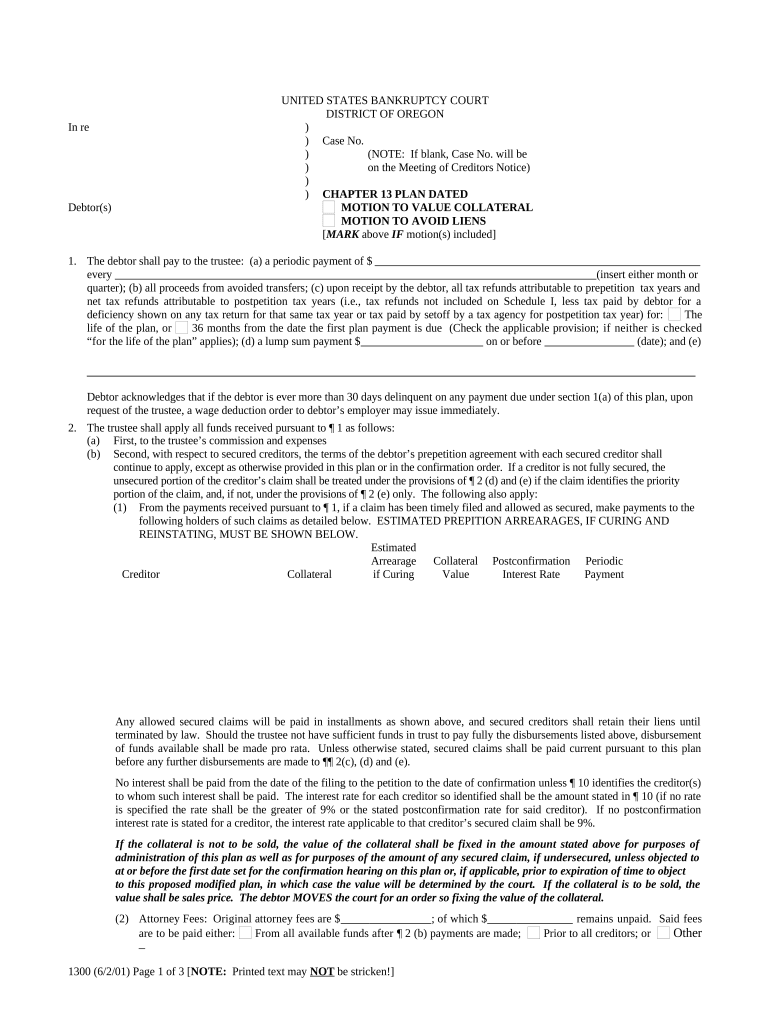

The Oregon Chapter 13 is a legal framework under the U.S. Bankruptcy Code that allows individuals with a regular income to develop a plan to repay all or part of their debts. This form is specifically designed for those who wish to reorganize their debts while retaining their assets. It provides a structured way for debtors to manage their financial obligations over a three to five-year period, making it a viable option for many facing financial difficulties.

Steps to complete the Oregon Chapter 13

Completing the Oregon Chapter 13 involves several important steps to ensure compliance with legal requirements. The process generally includes the following:

- Gather financial documents, including income statements, tax returns, and a list of debts.

- Complete the Chapter 13 bankruptcy petition and the accompanying schedules.

- Submit the petition to the bankruptcy court in your jurisdiction.

- Attend the meeting of creditors, where you will answer questions about your financial situation.

- Work with the court to finalize your repayment plan, which must be approved by the judge.

Key elements of the Oregon Chapter 13

Understanding the key elements of the Oregon Chapter 13 is crucial for successful navigation through the process. Important components include:

- The repayment plan, which outlines how debts will be repaid over time.

- Eligibility criteria, including income limits and types of debts that can be included.

- Duration of the repayment plan, typically ranging from three to five years.

- Protection from creditors during the repayment period, preventing collection actions.

Required Documents

To file for the Oregon Chapter 13, specific documents are required to support your application. These typically include:

- Proof of income, such as pay stubs or tax returns.

- A list of all debts, including secured and unsecured obligations.

- Details of monthly expenses to demonstrate your financial situation.

- Any relevant legal documents, such as prior bankruptcy filings.

Eligibility Criteria

Eligibility for filing the Oregon Chapter 13 depends on several factors. To qualify, an individual must:

- Have a regular income that can support a repayment plan.

- Meet the debt limits set by the bankruptcy code, which are adjusted periodically.

- Not have had a previous bankruptcy case dismissed for failure to comply with court orders.

Legal use of the Oregon Chapter 13

The legal use of the Oregon Chapter 13 is essential for ensuring that the process adheres to federal and state laws. It allows individuals to reorganize their debts in a manner that is legally recognized, providing protections against creditor actions. Proper legal representation can help navigate the complexities of the process and ensure compliance with all necessary regulations.

Quick guide on how to complete oregon chapter 13

Complete Oregon Chapter 13 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Oregon Chapter 13 on any platform using airSlate SignNow's Android or iOS applications and streamline your document-based operations today.

The easiest way to modify and eSign Oregon Chapter 13 with ease

- Obtain Oregon Chapter 13 and click on Get Form to begin.

- Make use of the tools available to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Oregon Chapter 13 while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Oregon Chapter 13 and how does it work?

Oregon Chapter 13 is a bankruptcy filing option that allows individuals to reorganize their debts while keeping their assets. It enables debtors to create a repayment plan over three to five years, allowing them to pay off their creditors at a manageable pace. With airSlate SignNow, you can easily send and eSign necessary documents for the Oregon Chapter 13 process securely and efficiently.

-

How much does it cost to file an Oregon Chapter 13?

The cost of filing an Oregon Chapter 13 varies based on court fees and attorney fees, which can range from a few hundred to several thousand dollars. However, using airSlate SignNow can save you time and money by streamlining the documentation process, making it easier to handle your budget. Our solution provides a cost-effective way to manage your bankruptcy paperwork without unnecessary expenses.

-

What features does airSlate SignNow offer for Oregon Chapter 13 filings?

AirSlate SignNow offers a variety of features for Oregon Chapter 13 filings, including customizable templates, document tracking, and secure eSigning capabilities. Our user-friendly interface allows you to manage your bankruptcy documents efficiently, ensuring you meet all legal requirements. Additionally, you can collaborate easily with your attorney, making the process smoother.

-

What are the benefits of using airSlate SignNow in my Oregon Chapter 13 case?

Using airSlate SignNow in your Oregon Chapter 13 case offers several benefits, including faster processing times and reduced paperwork hassles. With eSigning, you can sign documents from anywhere, thus eliminating the need for in-person meetings. Our platform also ensures that your documents are securely stored and easily accessible whenever needed.

-

Can I integrate airSlate SignNow with other software for Oregon Chapter 13?

Yes, airSlate SignNow can be integrated with various software solutions that may assist in your Oregon Chapter 13 filings. Whether you use case management software or accounting tools, our integration capabilities ensure seamless document management. This flexibility helps streamline your bankruptcy process and improves your overall efficiency.

-

Is airSlate SignNow compliant with Oregon Chapter 13 legal requirements?

Absolutely! AirSlate SignNow complies with all legal requirements for document management, including those specific to Oregon Chapter 13 filings. Our platform ensures that your documents meet all necessary compliance standards, so you can focus on your financial recovery without worrying about paperwork pitfalls.

-

How does eSigning work for Oregon Chapter 13 documents?

eSigning for Oregon Chapter 13 documents through airSlate SignNow is simple and quick. You upload your documents, and then invite signers to eSign them electronically. This method is legally binding in Oregon and ensures that all parties can complete the paperwork efficiently, facilitating smoother bankruptcy proceedings.

Get more for Oregon Chapter 13

- Chula vista wisconsin dells vacation classic form

- New patient forms

- Goodwill application print out form

- App gp99 nwf metropolitan life insurance company one form

- Registered nurse renewal fee timely140 form

- Application for state of illinois non resident dealers liquor license form

- Blank backflow test forms 250764808

- Change of income packet instructions form

Find out other Oregon Chapter 13

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy