W 4p Form 2014

What is the W-4P Form

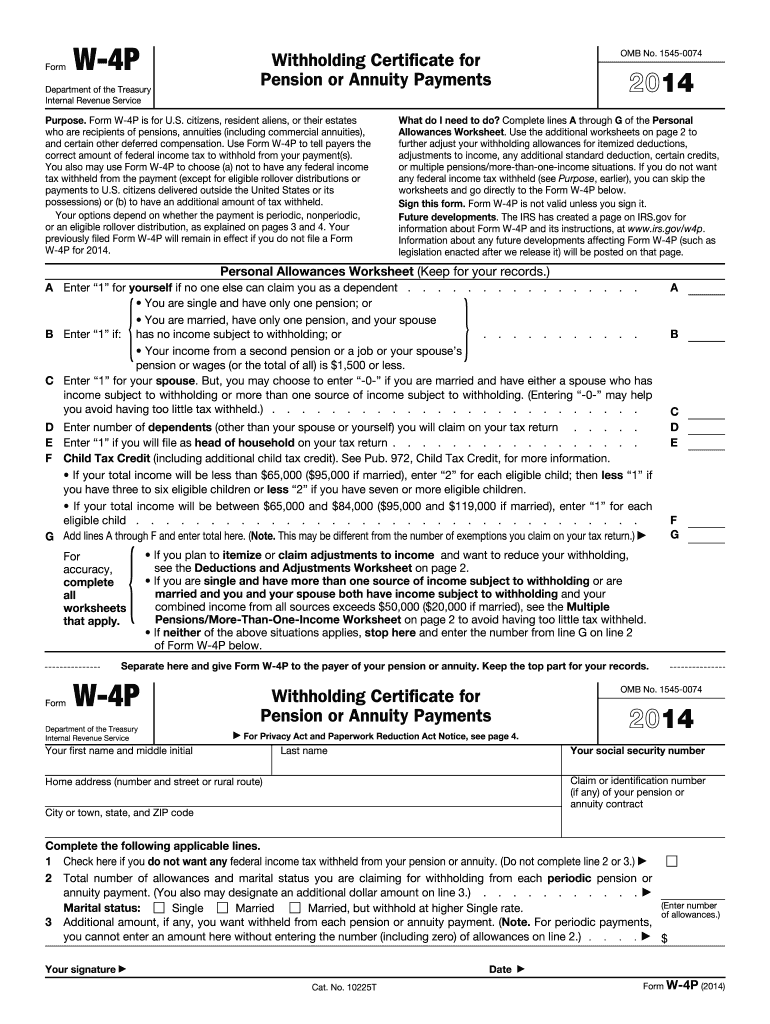

The W-4P Form, officially known as the Withholding Certificate for Pension or Annuity Payments, is a crucial document used by individuals receiving pension or annuity payments in the United States. This form allows recipients to instruct payers on the amount of federal income tax to withhold from their payments. It is particularly important for retirees or individuals receiving distributions from retirement accounts, as it helps ensure that the correct amount of taxes is withheld, preventing underpayment or overpayment of taxes during the tax year.

How to use the W-4P Form

To use the W-4P Form effectively, individuals should first obtain the form from the IRS website or their pension plan administrator. After filling out the form, recipients need to submit it to the payer of the pension or annuity. The form includes sections for personal information, such as name and address, as well as specific instructions on how much tax to withhold. It's essential to review the form annually or when there are significant changes in income or tax situation to ensure accurate withholding.

Steps to complete the W-4P Form

Completing the W-4P Form involves several straightforward steps:

- Download the W-4P Form from the IRS website.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate your filing status, such as single or married.

- Specify the amount of federal income tax you want withheld from your pension or annuity payments.

- Sign and date the form to certify that the information is accurate.

- Submit the completed form to your pension plan administrator or payer.

Legal use of the W-4P Form

The W-4P Form is legally recognized by the IRS as a valid method for individuals to communicate their withholding preferences. Proper completion and submission of this form ensure compliance with federal tax laws. It is important to note that failing to submit the W-4P Form may result in the payer withholding taxes at the highest rate, which could lead to over-withholding and potential financial strain during retirement.

Filing Deadlines / Important Dates

While there is no specific deadline for submitting the W-4P Form, it is advisable to complete it before the start of the tax year or when beginning to receive pension or annuity payments. Additionally, if there are changes in income or tax status, updating the form promptly is essential to avoid issues with tax withholding. Keeping track of any changes in tax laws or IRS guidelines is also beneficial for accurate tax planning.

Examples of using the W-4P Form

Individuals may use the W-4P Form in various scenarios, such as:

- A retiree receiving monthly pension payments from a former employer.

- An individual drawing annuity payments from a life insurance policy.

- Someone taking distributions from a retirement account, such as a 401(k) or IRA.

In each case, the form helps ensure that the correct amount of federal income tax is withheld, aligning with the individual's overall tax strategy.

Quick guide on how to complete 2014 w 4p form

Complete W 4p Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage W 4p Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest way to edit and eSign W 4p Form without hassle

- Obtain W 4p Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or erroneous documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign W 4p Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 w 4p form

Create this form in 5 minutes!

How to create an eSignature for the 2014 w 4p form

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the W 4p Form and why is it important?

The W 4p Form is a tax document used by employees to indicate their withholding preferences for federal income tax. This form is crucial for ensuring that the right amount of tax is withheld from your paycheck, preventing underpayment or overpayment of taxes. Using airSlate SignNow, you can easily eSign and submit your W 4p Form, streamlining the tax preparation process.

-

How can I fill out the W 4p Form using airSlate SignNow?

Filling out the W 4p Form with airSlate SignNow is simple and intuitive. You can upload the form directly to our platform, fill it out online, and then eSign it securely. This eliminates the need for printing and scanning, making the process both efficient and environmentally friendly.

-

Is there a cost associated with using airSlate SignNow for the W 4p Form?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business needs. While there is a subscription cost, the platform provides a cost-effective solution for managing documents, including the W 4p Form. Consider the savings in time and resources when evaluating the investment.

-

What features does airSlate SignNow offer for managing the W 4p Form?

airSlate SignNow provides a variety of features tailored for managing the W 4p Form, including customizable templates, secure eSigning, and document tracking. These features ensure that your forms are completed accurately and efficiently, giving you peace of mind during tax season. Plus, you can access your documents from anywhere, at any time.

-

Can I integrate airSlate SignNow with other tools for handling the W 4p Form?

Absolutely! airSlate SignNow seamlessly integrates with various business tools, such as Google Drive, Dropbox, and CRM systems. This integration allows you to easily manage the W 4p Form alongside your other documents and workflows, enhancing your overall productivity.

-

How secure is my information when using the W 4p Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. When you fill out and eSign the W 4p Form on our platform, your information is protected with industry-standard encryption and security protocols. We also comply with data protection regulations to ensure your personal and financial information remains confidential.

-

What are the benefits of using airSlate SignNow for the W 4p Form compared to traditional methods?

Using airSlate SignNow for the W 4p Form offers numerous benefits over traditional methods, such as reduced paperwork, faster processing times, and enhanced accessibility. You can fill out and eSign the form from any device, eliminating the hassle of printing and mailing. Additionally, our platform provides real-time updates, ensuring you're always informed about the status of your documents.

Get more for W 4p Form

- Internship application process guide child life council form

- Standard benefit for plan a plan f high deductible form

- Affadavit pregnancy form

- Milky way plate tectonics form

- Family39s bserious healthb condition certification of bhealthb bb slco form

- To serve you properly form

- I hereby acknowledge that it form

- Sublocade extended release form

Find out other W 4p Form

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed