Form 56 2007

What is the Form 56

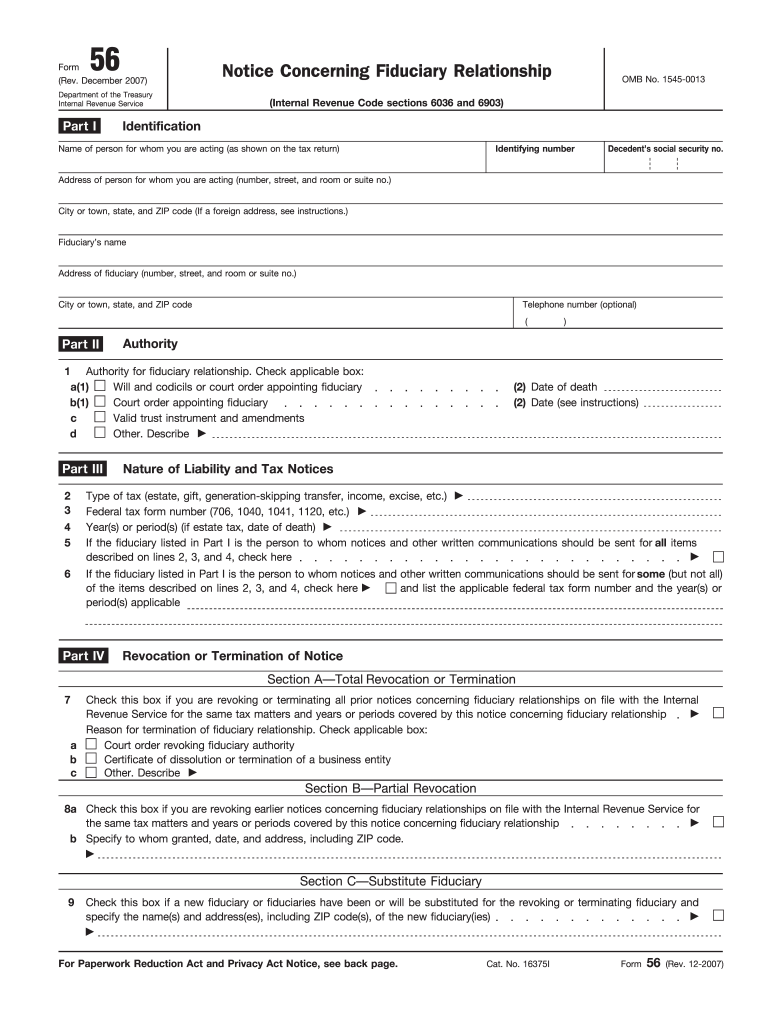

The Form 56 is a document used by taxpayers to notify the Internal Revenue Service (IRS) of the creation or termination of a fiduciary relationship. This form is essential for individuals or entities acting as fiduciaries, such as executors of estates or trustees of trusts, to ensure proper tax reporting and compliance. By filing Form 56, fiduciaries can inform the IRS about their authority and responsibilities regarding the tax obligations of the entities they manage.

How to use the Form 56

Using Form 56 involves several straightforward steps. First, obtain the form from the IRS website or through tax preparation software. Fill in the required information, including the name and address of the fiduciary, the type of fiduciary relationship, and the name of the entity for which the fiduciary is acting. Once completed, submit the form to the IRS. It is advisable to keep a copy for your records, as it serves as proof of notification to the IRS.

Steps to complete the Form 56

Completing the Form 56 requires careful attention to detail. Follow these steps:

- Download the Form 56 from the IRS website.

- Enter the name and address of the fiduciary.

- Specify the type of fiduciary relationship, such as executor or trustee.

- Provide the name of the entity involved.

- Sign and date the form.

After filling out the form, review all entries for accuracy before submitting it to the IRS.

Legal use of the Form 56

The legal use of Form 56 is crucial for maintaining compliance with IRS regulations. Filing this form establishes the fiduciary's authority to act on behalf of the entity, ensuring that tax obligations are met. It is important to file the form promptly to avoid any penalties or complications regarding tax filings for the estate or trust. The IRS requires that the form be submitted whenever there is a change in fiduciary status, such as the appointment of a new executor or trustee.

Filing Deadlines / Important Dates

Filing deadlines for Form 56 can vary based on the specific circumstances of the fiduciary relationship. Generally, it is recommended to file the form as soon as a fiduciary relationship is established or terminated. This proactive approach helps ensure compliance with IRS requirements. Additionally, if the fiduciary is managing an estate, be mindful of the deadlines associated with estate tax returns, which may influence the timing of filing Form 56.

Key elements of the Form 56

Understanding the key elements of Form 56 is essential for proper completion. The form includes sections for:

- Fiduciary's name and contact information.

- Type of fiduciary relationship.

- Name of the estate, trust, or entity.

- Signature of the fiduciary.

- Date of signing.

Each of these elements must be accurately filled out to ensure that the IRS recognizes the fiduciary's authority and responsibilities.

Quick guide on how to complete 2007 form 56

Prepare Form 56 seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents swiftly without delays. Manage Form 56 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

The easiest way to alter and eSign Form 56 with ease

- Locate Form 56 and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choice. Modify and eSign Form 56 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2007 form 56

Create this form in 5 minutes!

How to create an eSignature for the 2007 form 56

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is Form 56 and how can airSlate SignNow help me with it?

Form 56 is a notice of fiduciary relationship that is often required in various legal and financial contexts. airSlate SignNow simplifies the process of signing and sending Form 56 electronically, ensuring that you can complete your documentation efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for Form 56?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including features for managing Form 56. You can choose a plan that fits your budget while benefiting from seamless eSigning and document management.

-

Can I customize Form 56 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for Form 56, making it easy to tailor the document according to your specific requirements. This feature helps streamline your workflow and ensures consistency in your documents.

-

What are the benefits of using airSlate SignNow for Form 56?

Using airSlate SignNow for Form 56 offers numerous benefits, including faster document turnaround times, reduced paper usage, and enhanced security features. With our platform, you can track document status and ensure compliance with legal standards.

-

Does airSlate SignNow integrate with other software for managing Form 56?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems, enhancing your ability to manage Form 56 within your existing workflows. These integrations help streamline data transfer and improve overall efficiency.

-

How secure is my information when using airSlate SignNow for Form 56?

airSlate SignNow prioritizes your security by implementing advanced encryption protocols and compliance with industry standards. When using our platform for Form 56, you can rest assured that your sensitive information is protected.

-

Can I track the progress of my Form 56 once sent through airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents, including Form 56. You can easily monitor who has viewed the document, who has signed it, and if any actions are pending.

Get more for Form 56

- Texas equity form

- Frisco family ear nose and throatadult and pediatric form

- Prior authorizaton form addendum prior authorizaton form addendum

- Texas minor child power of attorney form

- Occupational therapy services cdn form

- Communication template form

- Medical release of information

- Moc part iv credit application form childrens health

Find out other Form 56

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy