Sample Letter Tax Form

Understanding the Sample Letter Tax

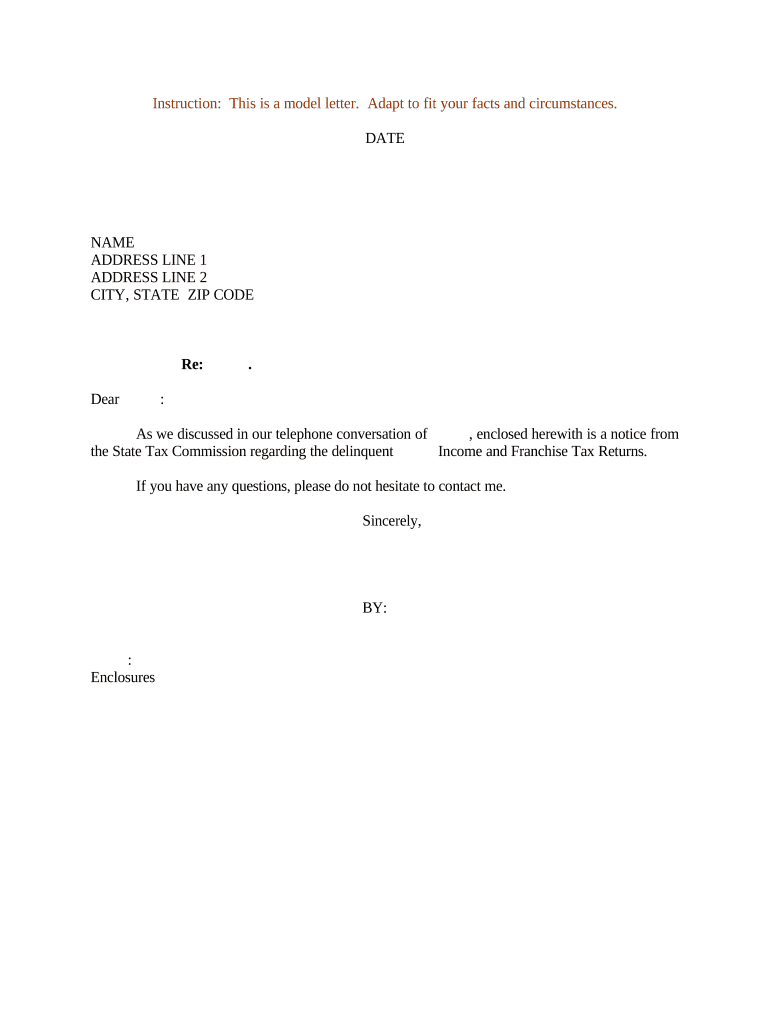

The sample letter tax is a specific document used to communicate important tax-related information, particularly in legal or financial contexts. This letter often serves as a formal request or notification regarding tax obligations, compliance, or other relevant issues. It is essential for individuals and businesses to understand the implications of this letter, as it can influence their tax status and obligations.

Key Elements of the Sample Letter Tax

When drafting or reviewing a sample letter tax, several key elements should be included to ensure clarity and compliance:

- Sender Information: Clearly state the name, address, and contact information of the sender.

- Recipient Information: Include the name and address of the individual or organization receiving the letter.

- Date: The date on which the letter is sent should be prominently displayed.

- Subject Line: A concise subject line indicating the purpose of the letter.

- Body: A detailed explanation of the tax issue, request, or notification.

- Closing: A polite closing statement, along with the sender's signature.

Steps to Complete the Sample Letter Tax

Completing a sample letter tax involves several straightforward steps:

- Gather all necessary information, including tax identification numbers and relevant documents.

- Draft the letter, ensuring all key elements are included as outlined above.

- Review the letter for accuracy and clarity, making any necessary revisions.

- Sign the letter, either digitally or physically, depending on the submission method.

- Send the letter using the appropriate method, whether online, by mail, or in person.

Legal Use of the Sample Letter Tax

The sample letter tax must adhere to legal standards to ensure its validity. It is crucial to comply with IRS guidelines and any state-specific regulations. This compliance guarantees that the letter is recognized as a legitimate document in tax matters. Failure to follow legal requirements may result in penalties or complications regarding tax obligations.

IRS Guidelines for the Sample Letter Tax

When preparing a sample letter tax, it is important to consult IRS guidelines to ensure that all necessary information is included. The IRS provides specific instructions on how to format and submit tax-related correspondence. Adhering to these guidelines helps to avoid delays in processing and ensures that the letter is taken seriously by tax authorities.

Examples of Using the Sample Letter Tax

There are various scenarios in which a sample letter tax may be utilized:

- Requesting an extension for tax filing deadlines.

- Notifying the IRS of a change in address or business structure.

- Responding to a tax notice or inquiry from the IRS.

- Providing documentation to support a tax deduction or credit claim.

Quick guide on how to complete sample letter tax 497330403

Create Sample Letter Tax effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Sample Letter Tax on any platform using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and electronically sign Sample Letter Tax with ease

- Locate Sample Letter Tax and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Adjust and electronically sign Sample Letter Tax and ensure effective communication at every stage of your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter commission and how can airSlate SignNow help?

A letter commission is a formal document used to authorize or appoint someone to act on behalf of another in a certain capacity. airSlate SignNow simplifies the process of creating, sending, and eSigning letter commission documents, ensuring compliance and efficiency in your workflows.

-

What are the pricing options for using airSlate SignNow for letter commission?

airSlate SignNow offers competitive pricing plans to meet the needs of businesses of all sizes. Our pricing options are designed to accommodate your usage of letter commission documents, providing access to essential features at a cost-effective rate.

-

Can airSlate SignNow integrate with other tools for managing letter commission documents?

Yes, airSlate SignNow seamlessly integrates with a variety of applications, including Google Drive and Salesforce, to streamline the management of letter commission documents. These integrations enhance your efficiency and help you keep all your important data in one place.

-

What features make airSlate SignNow ideal for handling letter commission documents?

airSlate SignNow includes features like document templates, automated workflows, and real-time tracking, making it ideal for handling letter commission documents. These functionalities help reduce processing times and increase the accuracy of your documents.

-

How secure is airSlate SignNow when eSigning letter commission documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance with industry standards to ensure that your letter commission documents are safely signed and stored, giving you peace of mind during the eSigning process.

-

Can multiple signers be included in a letter commission with airSlate SignNow?

Absolutely! airSlate SignNow allows you to add multiple signers to your letter commission documents, enabling collaboration and ensuring all necessary parties can review and sign efficiently. This feature enhances communication and expedites the signing process.

-

Is there a mobile app for airSlate SignNow to manage letter commission documents on the go?

Yes, airSlate SignNow offers a mobile app that lets you manage your letter commission documents from anywhere. This mobile accessibility ensures that you can send, sign, and track your documents in real time, even while you are on the go.

Get more for Sample Letter Tax

Find out other Sample Letter Tax

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template